$Snowflake (SNOW.US)$ put up a mixed quarter (beat street bu...

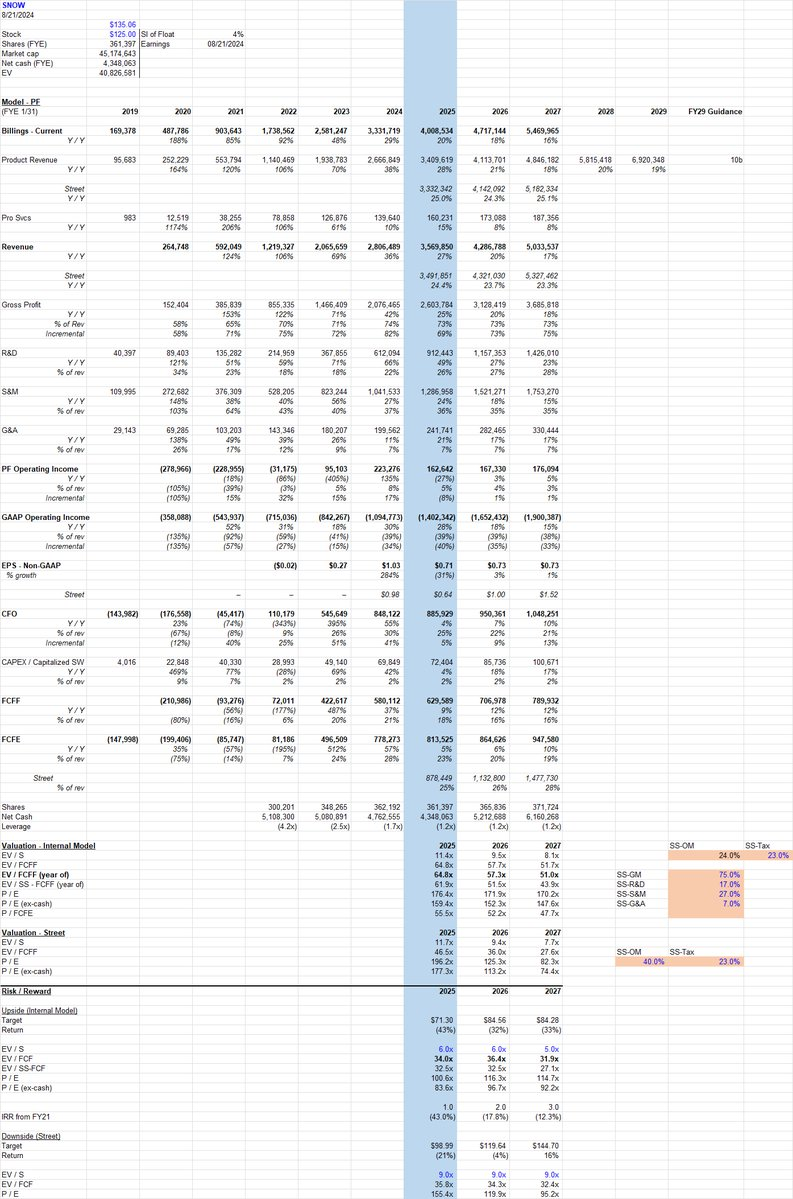

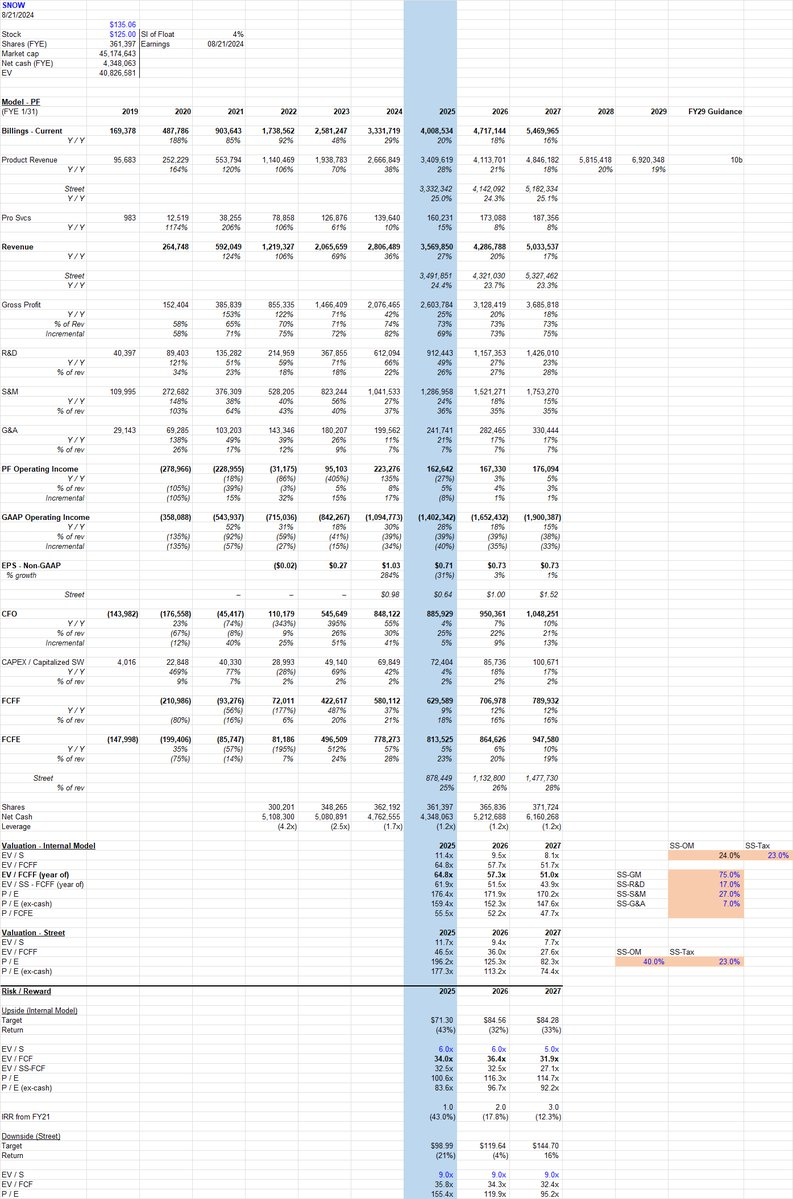

$Snowflake (SNOW.US)$ put up a mixed quarter (beat street but showing continued decel / margin pressure). Story is getting worse and numbers for next year likely need to move lower.

Risk / reward is unattractive.

Downside of -32% to 6x my below street CY25 revs / 38x FCF. -33% to 5x my CY26 revs / 33x FCF. (Worth noting broken infra companies trade well below these multiples if that ends up being the outcome.)

Upside of -4% to 9x street CY25 revs / 34x FCF. 16% upside to street CY26.

The Quarter

Product rev of 829m grew 29.5% yy > street at 808m but a beat of only 2.7% which was narrowest Q2 beat ever. Rev delta adjusted for leap year was 48m down from 50m last Q2 and 72m the Q2 before that.

For reference, GAAP S&M spend has increased 51% from 2 years ago and they are adding far less product revenue. Not a good sign and signals continued steep deceleration may continue to be the norm. Slowdown also seen across all geos.

cRPO is not a great indicator but it grew 2% qq / 29% yy w/ net delta of 56m down from 75m last Q2 and 165m the Q2 before that. Also indicates growth is getting tougher.

RPO is a misleading metric here – big customers sign big, multi-year deals to lock-in price. That’s great but don’t confuse stronger growth in RPO vs the slowing growth in actual usage of the platform.

Customer metrics were decent:

-Total customer base of 10.2k up 20% yy w/ net adds of 427 up from 370 last Q2 but down from 486 the Q2 before that.

-Customers worth >$1m were 510 up 27% yy w/ net adds of 25 down from 29 last Q2 and down from 40 the Q2 before that.

-G2K customers grew 37% yy w/ net adds of 27 down from 49 last Q2 but up from 12 the Q2 before that.

-Total customer base of 10.2k up 20% yy w/ net adds of 427 up from 370 last Q2 but down from 486 the Q2 before that.

-Customers worth >$1m were 510 up 27% yy w/ net adds of 25 down from 29 last Q2 and down from 40 the Q2 before that.

-G2K customers grew 37% yy w/ net adds of 27 down from 49 last Q2 but up from 12 the Q2 before that.

Subscription GM of 76.4% continues to trend lower due to AI investments / pricing pressure (GM was 76.9% last qtr and 77.9% last Q2).

PF OM of 5% was down from 8% last Q2 and narrowly beat guidance by 2% (used to beat margin guidance by 5-6% routinely). SBC remains completely out of control at 48% of revs so GAAP OM of -41% slightly improved from -42% last Q2.

They now have a buyback in place to help offset massive dilution which adds insult to injury since they are doing it when company is not doing well and valuation very high.

Weak balance sheet metrics / cash flow :

-Current deferred shrank -4.5% qq and only grew 21.4% yy. This prepayment by customers should continue to face headwinds as 80% of the customer base prepays annually but are gradually moving to paying monthly in arrears as they do w/ most other cloud infra providers. This will be a material headwind to FCF for the company.

-Current deferred shrank -4.5% qq and only grew 21.4% yy. This prepayment by customers should continue to face headwinds as 80% of the customer base prepays annually but are gradually moving to paying monthly in arrears as they do w/ most other cloud infra providers. This will be a material headwind to FCF for the company.

-Accounts payable shot up to 42 days in Q2 up from 21 in Q1 and 17 last Q2. This provided a benefit of 70m to cash flow from ops which was the entire reason the company generated positive cash flow from ops in the quarter (cash flow from ops was only 70m down from 83m last Q2).

Other Highlights

-400 customers using Iceberg (standardized external data structure) up from 300 last qtr. Seeing customers use this to store even more data [but the data is now stored outside $SNOW although then potentially analyzed using $SNOW compute]

-400 customers using Iceberg (standardized external data structure) up from 300 last qtr. Seeing customers use this to store even more data [but the data is now stored outside $SNOW although then potentially analyzed using $SNOW compute]

-Not much commentary on new products other than soft metrics on traction. CFO used to tout “Guidance doesn’t include new products…” but now seems like new products not outperforming expectations.

-SNOW was not to blame at all for the hack. Customers should have setup multi-factor authentication. No impact to consumption in the qtr.

-DBNR of 127% continues to contract from 128% last qtr and 142% last Q2

Guidance

Guidance for Q3 is 850-855m in revs = street at 851m; assuming a 2.7% beat implies a slowdown to 25.4% yy growth.

Guidance for Q3 is 850-855m in revs = street at 851m; assuming a 2.7% beat implies a slowdown to 25.4% yy growth.

Last Q3 had extra days in the qtr which negatively impacts growth (not sure if that is also the case this year), and customer renewal including Iceberg will pressure growth (move storage out of $SNOW to standardized structure).

Regardless, bigger stepdown in growth coming up and implies net rev delta of 46m in Q3 down from 58m last Q3 and down from 56m the Q3 before that.

PF OM guided to 3% so we also are now in investment-catch-up mode.

CFO said they are contemplating accelerating hiring in the back half of this year which may set up margin headwinds next year.

Bull case

-Leading solution for structured data warehouses w/ long runway for continued growth in new accounts and expansions

-Leading solution for structured data warehouses w/ long runway for continued growth in new accounts and expansions

-Company will catch-up in unstructured data / AI via Snowpark

-New products are late but will be GA in 2H of this year and help SNOW more meaningfully participate in adjacent markets next year

-Company entering investment cycle but will emerge w/ better growth rates and improving margins

-AI theme lifts all boats

-Valuation doesn’t matter

-CEO maybe can put in a phone call to sell this to $Amazon (AMZN.US)$ , $Microsoft (MSFT.US)$ , $Alphabet-A (GOOGL.US)$ [price obviously unclear as would be FTC approval]

Bear case

-New CEO is no Slootman.

-New CEO is no Slootman.

-SNOW’s product lead is eroding relative to competition

-SNOW has no real product for unstructured data / AI where Databricks has a decided lead and MSFT has a platform advantage / partnership advantage (Open.AI). Databricks is accelerating while Snowflake is decelerating.

-Market has already moved to making AI the force function decision and MSFT, AMZN, GOOG, Databricks all advantaged here.

-Large customers are mature and slowing, sales territories are over-congested and productivity is falling

-Field work suggests all new products are flimsy and will not move the needle for SNOW (largest “success” is Snowpark which receives poor reviews, and still will only be 3% of revs this year).

-Even though company probably beats sandbagged guidance this year, revenue still decelerating meaningfully w/ revenue growth exiting this year in the low to mid 20s, likely be in the low 20s next year, and slowing growth will drive a de-rating of a very expensive SaaS stock.

-FCF margins likely peaked due to 1) need to invest in AI to catch-up, and 2) the working capital headwinds from customers moving to monthly arrears payment terms.

-FCF also nonsense given level of SBC here. FCF-SBC is deeply negative.

-Company probably grows 20% next year so street numbers need to move lower. FCF margin likely peaked last year and contracts from here (street estimates way too high).

-No valuation support. Commodity infra companies that are unprofitable can trade down to 4x sales.

-No acquirors. All the big competitors already have their own offerings, and ~50b is a big market cap.

What am I missing?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment