$Snowflake (SNOW.US)$ SBC is obviously an issue, and it need...

$Snowflake (SNOW.US)$ SBC is obviously an issue, and it needs to be addressed, but the stock isn't declining because of SBC

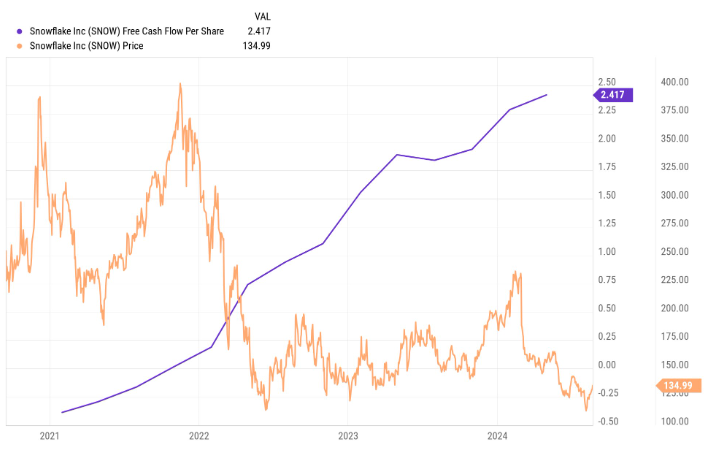

It's declining because it's been overvalued relative to its free cash flow per share generation for years now

That's it. That's the extent of it. It had a great quarter. It's a phenomenal business.

SBC does drag on fcf/share growth by expanding the denominator in the equation while sales growth pulls up on the numerator, but that's not the stock's issue.

SBC isn't negating SNOW's fcf growth, which has been phenomenal, to any thesis destroying degree.

The stock's issue is that it's a risky equity that's been trading at 50x+ fcf while going through a year of transition for its leadership and business model

Which is something all companies experience at some point, which is why it's important to buy with some margin of safety (and this can be interpreted in different ways, and I discuss it often).

Some will say valuations don't matter and to just keep adding, but SNOW illustrates that, despite being arguably the best software company of the last 10 years, buying with no margin of safety can create terrible, terrible investment outcomes

All this said, remember to follow free cash flow per share and focus on the four points of equity value.

That's the distilled truth of a business:

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

joejoejoejoejoe : so based on your opinion, it is a buy or not for now?

DouGiee joejoejoejoejoe : better not