SoftBank-owned Arm to Launch IPO: How's the Performance of Masayoshi Son-Backed Stocks?

ARM, the chip design company highly favored by Masayoshi Son, is expected to be listed on the Nasdaq on September 13th with a target valuation of more than $52 billion.

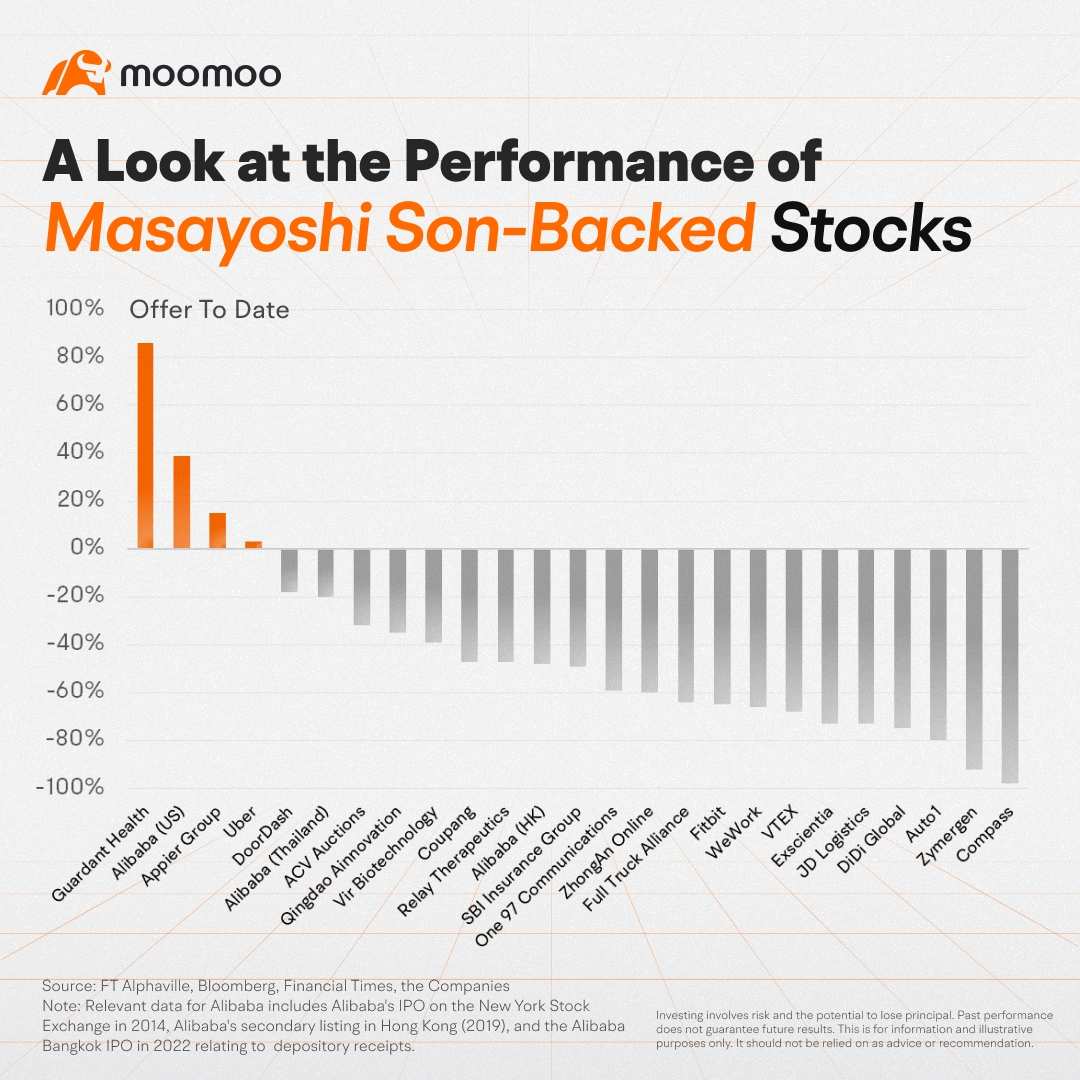

As the largest IPO of the year, ARM has already gained significant market attention. Meanwhile, the seller of the IPO, SoftBank, is once again in the spotlight for its historical investment performance, which has been less than stellar. Statistics showed that, out of the SoftBank-backed companies still trading, only four IPOs are currently trading above their issue price, while 21 are underwater. The average IPO return across the portfolio is -46%.

Here's a closer look at SoftBank's past IPO involvement.

Note: The relevant data for Alibaba in the image, chronologically, includes Alibaba's IPO on the New York Stock Exchange in 2014, the Alibaba Bangkok IPO in 2022 relating to depository receipts, and Alibaba's secondary listing in Hong Kong (2019).

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment