Southern Dongying regional market morning report 20240604 | Japan implements its largest-ever forex intervention; Aramco's stock demand eases market difficulties

Market News

[Japan] Japan acknowledges the implementation of forex intervention.

• Financial Minister Toshimitsu Suzuki of Japan stated that the government intervened in the currency market over a month ago to address excessive currency fluctuations driven by speculative trading. This is the first official admission after government data released on Friday showed expenditures of 9.8 trillion yen (about 62.7 billion U.S. dollars) to support the yen.

· On May 31, the Japanese Ministry of Finance announced the actual foreign exchange intervention situation from April 26 to May 29. The total intervention amount was 9.7885 trillion yen. This reflects the suspected intervention measures of buying yen and selling dollars implemented on April 29 and May 2, marking the second intervention since October 2022. Compared to past interventions under the situation of yen depreciation, the scale of this intervention set a historic new record. This was a secret intervention that was not immediately announced following the intervention.

【Japan】Japan 1~3 industry-wide regular profit growth 15.1%profit continuously increased for 5 quarters, achieving positive growth 1~3 Historical high for the monthly data. The service industry benefits from the recovery of foot traffic. Progress has also been made in shifting the company's costs.

[Saudi Arabia] Analyst: The selling pressure in the Saudi Arabian stock market may mainly be due to geopolitical tensions and oil price fluctuations.

AlJazira Capital's research director stated that although the profits of companies listed on Tadawul (excluding Aramco) increased significantly by about 8% in the first quarter of 2024, achieving year-on-year growth for the first time after five consecutive quarters of decline, the recent pressure faced by Tadawul may not only come from news about the secondary listing of Saudi Aramco. Recent geopolitical tensions and oil price fluctuations in the region, their impact on oil revenue, and their impact on the economy and local growth prospects may be considered as one of the recent key pressure factors.

Company News

[Saudi Arabia] Analyst: Aramco Company (ARAMCO.US) The demand for the stock issuance has eased the market's difficulties.

Many analysts believe that the selling pressure in May is normal due to the secondary offering of Alibaba and ongoing high inflation and interest rates.

They also point out that the demand for the Saudi Aramco's secondary offering is a positive factor to offset the negative impact and restore liquidity to normal levels.

【japan】Sony (6758.JT) plans to invest about 6500 billion yen (approximately41.4billion U.S. dollars) in capital. Sony plans to achieve up to 2027in the chip business starting this fiscal year, reaching as high as 20%ROI (ROIC)。

[Japan] Nikkei Asia: Japanese electronic group Sharp (6753.JT) and telecommunications partners KDDI(9433.JT) will convert a factory in Japan into a datacenter supported by Nvidia's advanced chips (such as the Blackwell series) Blackwell series)

Citi research analyst on Southeast Asia Alicia Yap Indicates,Grab (GRAB.US) may further reduce costs in the coming quarters.

o Grab is using generative AI to improve operational efficiency and manage variable cost structures, while expanding business, marketing, and benefiting from cloud cost savings.

o Grab focuses on cost management and prudence in its fintech business, with management believing its digital bank business can achieve profitability within three years.

o Citi maintains a buy rating on the stock, with a target price of $5.00. Grab ADR closed at $3.67 yesterday.

【China】The Wall Street Journal: Sources say that semiconductor manufacturer Semiconductor Manufacturing International Corporation in China (0981.HK) is gradually commercializing chip production and cutting back on production lines using American tools.

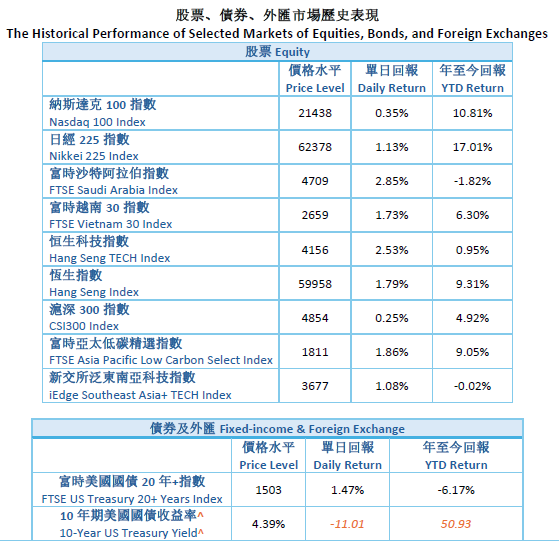

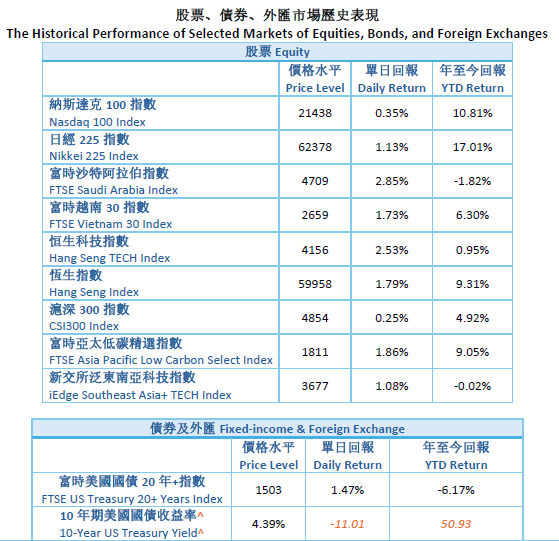

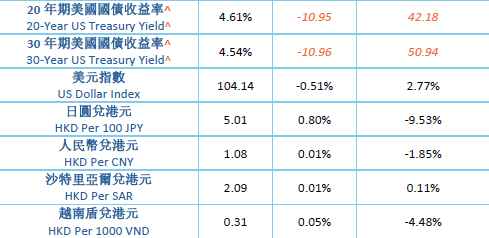

Market Performance

Data source: Bloomberg, Southern Fund, as of 6/3/2024. All indices are net total return.

^Orange represents basis point changes in bond yields.

Disclaimer

This document is for general reference only. This document is provided to the recipient and shall not be further distributed. In no circumstances shall this document be construed as a forecast, research, or investment advice for future events, nor shall it be construed as an opinion, offer, solicitation, invitation, advertisement, inducement, recommendation, suggestion, persuasion, statement, or commitment to purchase, sell or distribute any securities, funds or financial products or to engage in any type of investment or transaction. Southern Eastern Asset Management Limited and Southern Eastern Asset Management Private Limited ("Southern Eastern") believe that the data sources obtained when creating this document are accurate, complete, and appropriate, but Southern Eastern does not make any representations or warranties as to the accuracy, reliability, timeliness, completeness, or reasonableness of the contents of this document. Southern Eastern and its affiliates shall not be liable for any loss, damage or expense incurred directly or indirectly by any recipient and/or its controlling shareholders as a result of using and/or relying on this document. This document may contain "forward-looking" information that is not purely historical. Such information may include forecasts, estimates of earnings or returns, and possible portfolio composition. The opinions expressed in this document reflect the judgment of Southern Eastern as of the date of preparation of the material and are subject to change at any time without notice. Southern Eastern has no obligation to ensure the timeliness of such information. Any contents of this document do not constitute financial, professional, investment, legal, or any other opinions or advice. For investment advice, please consult your professional legal, tax, and financial advisors. This document is not intended for distribution to any individual or entity in any jurisdiction or country/region where such distribution or use would violate any laws or regulations, or where Southern Eastern would be subjected to any registration requirements in such jurisdiction or country/region.

Investment involves risks. Future performance and capital value are not guaranteed. Past performance data does not indicate future performance. Investors should not rely solely on this document to make investment decisions. Investors should determine the suitability of any investment, securities, or strategies based on their personal financial situation, and if necessary, seek professional advice.

This document is not intended for distribution in jurisdictions where prohibited. This document is prepared by Southern Eastern Asset Management and has not been reviewed by the Securities and Futures Commission of Hong Kong ("SFC") or the Monetary Authority of Singapore. All copyrights, patents, and other intellectual property rights related to the information contained in this document are owned by Southern Eastern. This document does not grant the recipient any copyright or intellectual property rights to use the information contained (whether direct, indirect, or implied). Without the written consent of Southern Eastern, no part of the information in this document may be copied, distributed, or reproduced.

Issuer: Southern Eastern Asset Management Limited and Southern Eastern Asset Management Private Limited

Index provider disclaimer

For the disclaimer from the index provider, please refer to the offering documents and product key facts of the relevant fund.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment