Splitting Shares, Winning Moves: Top Options Strategies for NVIDIA Post-Split

Welcome to the first week post-NVIDIA's exciting stock split!

If you're feeling uncertain about NVIDIA's next moves and wondering how to trade now, you're not alone. ![]()

Today, I’m here to share some savvy options strategies tailored for this new chapter.

The stock split comes with fantastic perks—it’s now easier and more affordable to buy shares and dive into options trading. ![]()

For NVIDIA fans, this means lower option prices, making it the perfect time for beginners to get started with options trading.

Below, I’ll introduce two options selling strategies ideal for scenarios where NVIDIA's stock isn't expected to skyrocket but where the risks remain manageable.

Ⅰ. Seek to acquire the underlying stock at a lower price

With the rapid growth of the AI industry, some investors believe that NVIDIA's stock price might correct without new growth catalysts.

If this indeed happens, a pullback might present a great entry opportunity.

For options traders, selling put options (Short Put) is a proactive strategy that lets you wait for the right moment while potentially profiting from the market's movements.

Practical Scenarios

Suppose NVIDIA's current stock price is $120, and you anticipate a slight pullback in the coming months. You hope to buy in at a lower price during a potential pullback.

Consequently, you set up a strategy to sell put options (Short Put).

By doing this, you earn the option premium when the stock price rises; when the stock price falls, you can purchase NVIDIA shares at your desired price level.

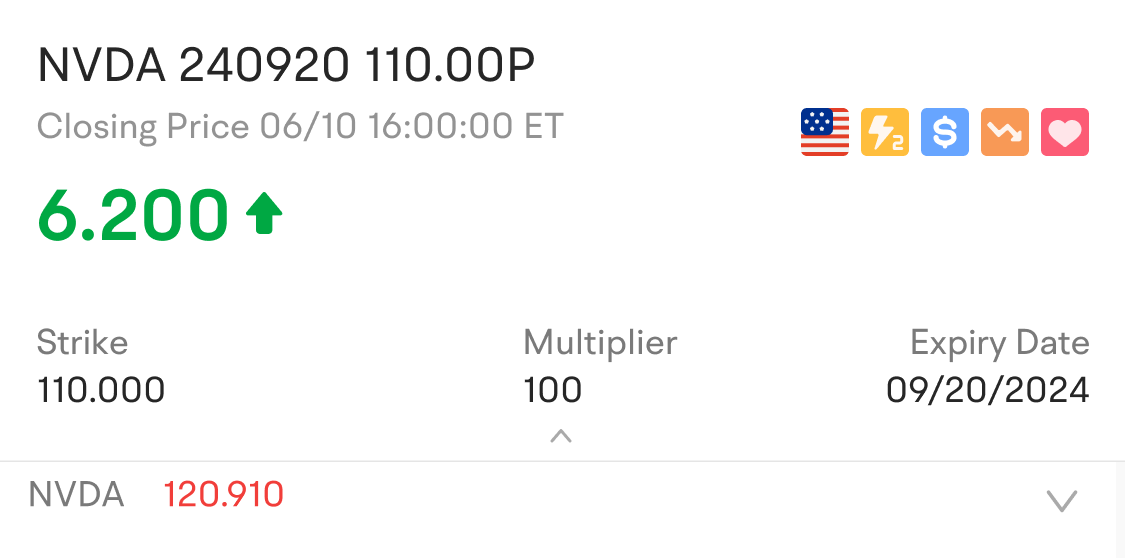

Sell to Open:

Let's say you have a target buy price of $110. You decide to sell a put option with a $100 strike price, expiring in three months.

By doing this, you receive an option premium of $6.20 per share, totaling $620 in net premium income.

Note:

A. Expiry Date: Longer expiry dates typically yield higher option premiums. Choose an expiry date that aligns with your market outlook.

B. Strike Price: Technical analysis can be used to determine an appropriate strike price. Click here to learn more: How to Use Drawing Tools

C. Risk Disclaimer: The data provided is for illustrative purposes only, hypothetical in nature, and does not reflect actual market conditions.

By selling a Put, you can:

Collect an option premium of $620 when you sell the option. Once you successfully sell the Put, the premium is immediately credited to your account. You can check this by clicking on 'Accounts'- 'More'-'Funds Records'.

If the option is exercised, you not only collect the $620 premium but also get to buy NVIDIA shares at your desired price of $110.

Other Considerations:

Practice risk management

In theory, the risk for an option seller is unlimited, while the profit is limited. If you are not prepared to take delivery of the shares, be cautious when selling Puts.

Ensure sufficient funds (cash) in your account

Always ensure you have enough margin in your account to cover your positions. This helps avoid the risk of a forced liquidation.

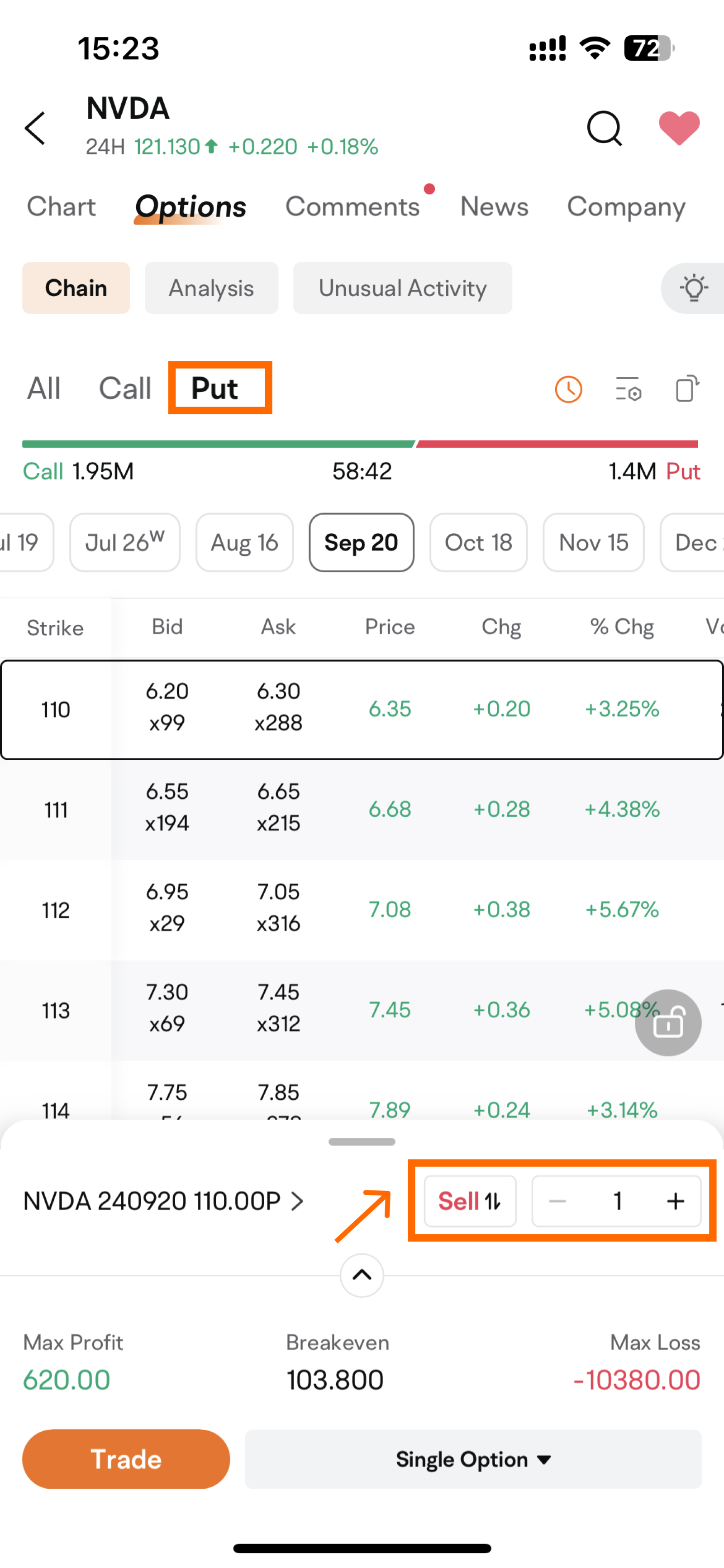

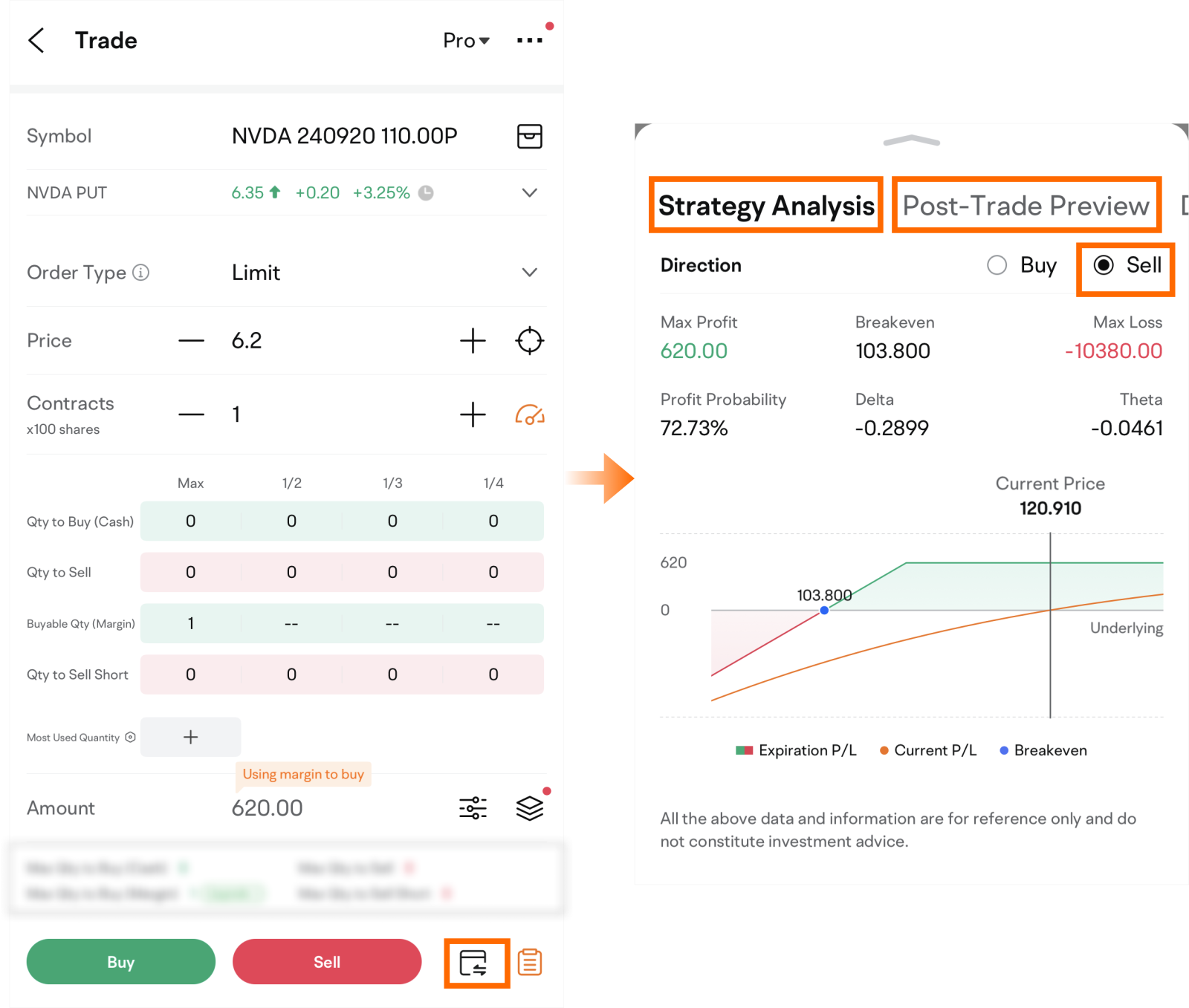

When you're ready to trade, click on Options> Chain> Trade> Enter Price and Contracts. Tap on the icon next to the Sell button to view Strategy Analysis and the necessary Post-Trade Preview.

P/L Analysis

Scenario 1: If, by the expiration date, NVIDIA's stock price is more than $110, the buyer will not exercise the option.

In this case, you are not required to fulfill the obligation to buy the stock, and you keep the option premium, resulting in a net profit of $620.

Scenario 2: If, by the expiration date, NVIDIA's stock price is lower than $110, the buyer exercises the option.

In this scenario, you not only keep the $620 option premium but also get to buy 100 shares of NVDA stock at the anticipated price, perfectly aligning with your expectations.

It's worth mentioning that before the split, NVIDIA's stock price was as high as $1100. If you were to use this strategy then, you might have needed to prepare up to $120,000 in funds to take delivery, which could be a significant challenge for many individual investors.

Now, after the split, NVIDIA's share price has adjusted to $110 per share, so the cost to take delivery when selling a Put option is $11,000, which is considerably lower than before.

Ⅱ. Reducing cost basis with Covered Call strategy

I previously mentioned that after a stock split, not only does it lower the threshold for trading options, but it also increases flexibility when executing options strategies.

For example, if you want to use a covered call strategy to earn additional income, a stock split increases the number of shares you hold.

This allows you to flexibly allocate your holdings: you can use some shares to execute covered calls and others for different strategies, achieving a diversified income approach.

Additionally, when building multi-leg options on moomoo, you can enjoy margin reduction benefits. You can again go to Post-Trade Preview by clicking on the icon next to the Sell button.

Practical Scenarios

Suppose you hold NVIDIA shares and are optimistic about NVIDIA's long-term prospects. However, you believe that without new growth drivers, the stock price may struggle to rise significantly in the short term.

At the same time, as a rational investor, you are aware of the time cost of holding stocks and hope to earn additional income through certain strategies.

For this situation, you set up a covered call strategy, which involves selling a call option (Call) while holding NVIDIA shares, thus using the stocks as collateral for selling the Call. This strategy hedges risk while earning extra income.

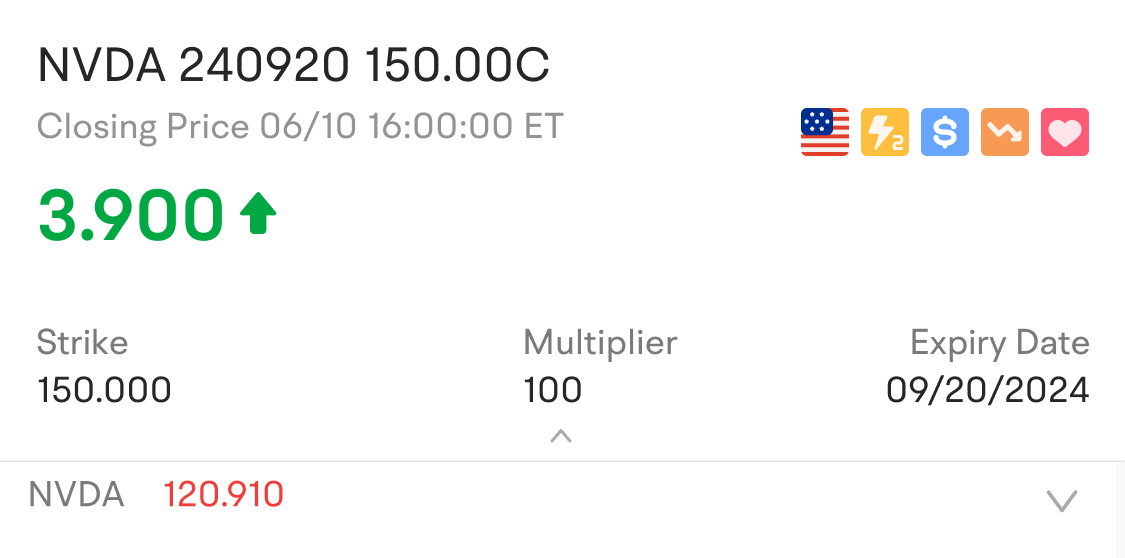

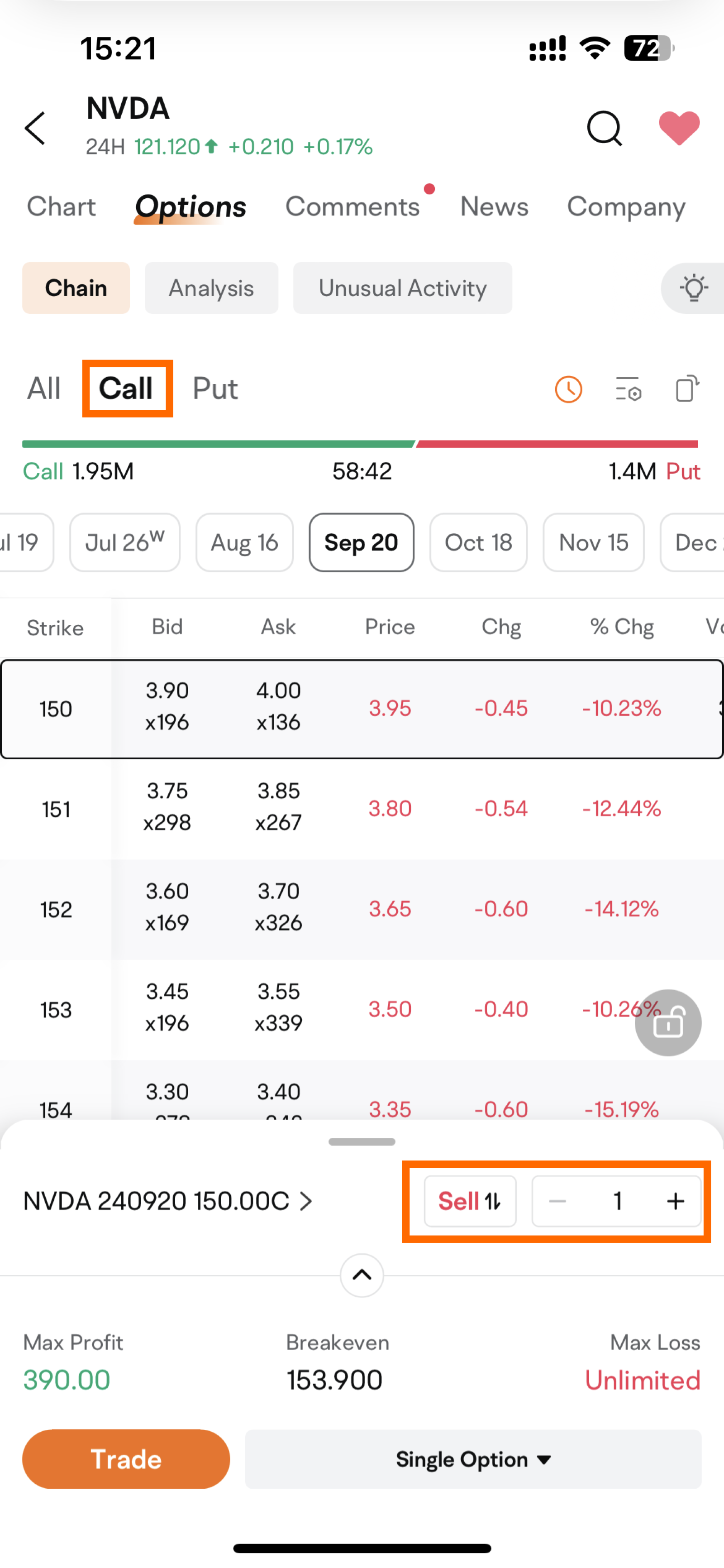

Sell to Open:

Assuming you think NVIDIA won't rise above $150 in the next three months, you sell a call option that expires in three months with a strike price of $150.

You receive an option premium of $3.9 per share, totaling a net premium of $390.

Note:

A. Expiration date

All else being equal, the closer an option is to its expiration date, the faster its time value decays. Time decay works for the option seller.

In addition, options with closer expiration dates tend to have lower premiums.

It is important for investors to choose a suitable expiration date based on their own judgment and strategies.

B. Strike price

Experienced investors may set the target sell price as the strike price of the call in a Covered Call strategy.

In this case, even if the call is exercised in the end, they can sell the underlying stock at the expected price and earn the premium.

C. Risk Disclaimer: The data mentioned above is for illustrative purposes only, hypothetical in nature, and does not reflect actual market conditions.

Placing orders can be divided into two scenarios:

Scenario 1: If you already hold NVIDIA shares, you can directly sell a Call to construct a Covered Call strategy.

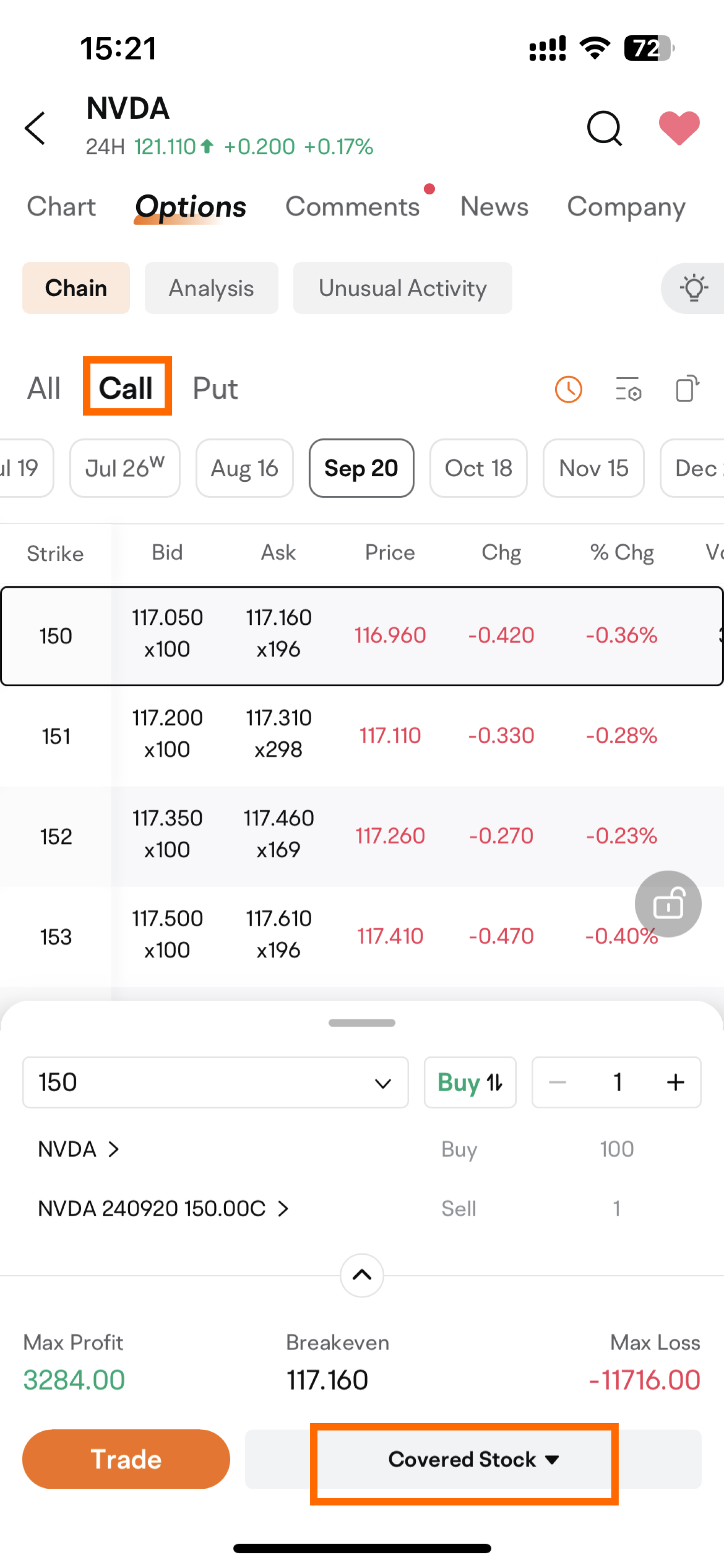

Scenario 2: If you do not hold NVIDIA shares, you can construct a Covered Call by clicking on Options > Chain > Covered Stock.

The system will automatically help you buy 100 shares of NVIDIA stock and sell a Call.

Note: The number of underlying shares held must be equal to the number of shares represented by the short Call.

Essentially, you are using the shares you hold to provide collateral for the potential exercise of the option. If they are not equal, the risk can increase significantly.

Let's break down this two-part strategy.

On the one hand, buy the shares. This trade suggests investors are bullish on the stock.

On the other hand, sell the call options. This trade alone suggests investors are not that confident the stock will go up.

Hence, the covered call strategy can be considered when one investor believes the stock will go up in the long term, but doesn't think it will rise substantially in the near term.

P/L Analysis

Scenario 1: If, by the expiration date, NVIDIA's stock price is lower than $150, the option becomes out-of-the-money.

In this case, the buyer will not exercise the option. You collect the $390 premium and are obligated to sell NVIDIA shares.

Your return = premium earned from selling the Call + paper profit from your NVIDIA holding.

If the stock price falls below your cost basis for holding the shares, the loss will be reduced due to the income from selling the Call, compared to just holding the shares;

If the stock price does not fall below your cost basis, then you will gain the profit from selling the Call plus the potential capital gains from holding the shares.

Scenario 2: If, by the expiration date, NVIDIA's stock price is above $150, the option becomes in-the-money.

At this time, the buyer will exercise the option. You collect the $390 premium and are obligated to sell 100 shares of NVIDIA stock at $150.

Your return = profit from selling the Call + capital gains from buying and then selling 100 shares of NVIDIA stock.

Features of the strategy

In a covered call, the primary position is the long stock position and the short call is the secondary position. Still, the overall gain and loss is largely determined by the stock's price changes.

Here are some features of the strategy:

① Generate potential extra income and hedge some of the risk of stock price decline

If investors use a covered call, they earn a premium from selling the call option. Compared with holding the stock alone, the overall cost could be lowered.

If the stock price drops, the premium investors receive after selling the call may partially hedge their stock position.

② Limit the potential profits from stock price jump

The strategy's maximum gain is determined by the call's strike price.

If the stock price reaches the strike price, covered call traders will be obligated to sell the stock, if assigned.

Therefore, they can only benefit from the potential upside between the stock purchase price and the strike price.

Experienced investors usually set the strike price of the call as their target sell price of the underlying stock.

If the stock price reaches the target sell price, investors can sell the stock as they expected and also profit from selling the call.

If the stock price fails to reach the target price, investors can earn the premium and do not need to fulfill their obligation.

(Note: The covered call strategy essentially sacrifices some upside potential of the underlying in exchange for less potential loss.Therefore, Covered Call is considered a relatively conservative strategy. Theoretically, the loss of this strategy is limited, and the maximum loss is achieved if the price of the underlying stock falls to $0.

The potential profit of this strategy is also limited, and the maximum gain is achieved if the price of the underlying stock rises above the strike price.)

Alright, that wraps up today's sharing.

The two strategies discussed are best suited for scenarios where you expect NVIDIA's stock price to remain relatively stable.

A word of caution: options trading involves risks, particularly for sellers. If you're not prepared to buy the underlying stock at a lower price, be cautious about selling Puts. Similarly, if you don't hold the underlying shares, be cautious about selling Calls.

Options are versatile tools, and your strategy should align with your market outlook. If you anticipate a substantial rise in NVIDIA's stock price, consider buying call options or using a bull spread strategy.

For more strategies, click here to learn:Making Options Trading Work for You: A Real-Life Case Study

Stay tuned for next week, as we’ll dive into strategies designed for significant market uptrends.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

James Prichett : 200+

webguybob : I think they'll keep flying high, especially with a soft landing being anticipated for the recession.

7566697(ggallen) :