Spotlight back on economic data as key reports roll in tonight

US Market Key Charts (S&P, US Dollar, Gold)

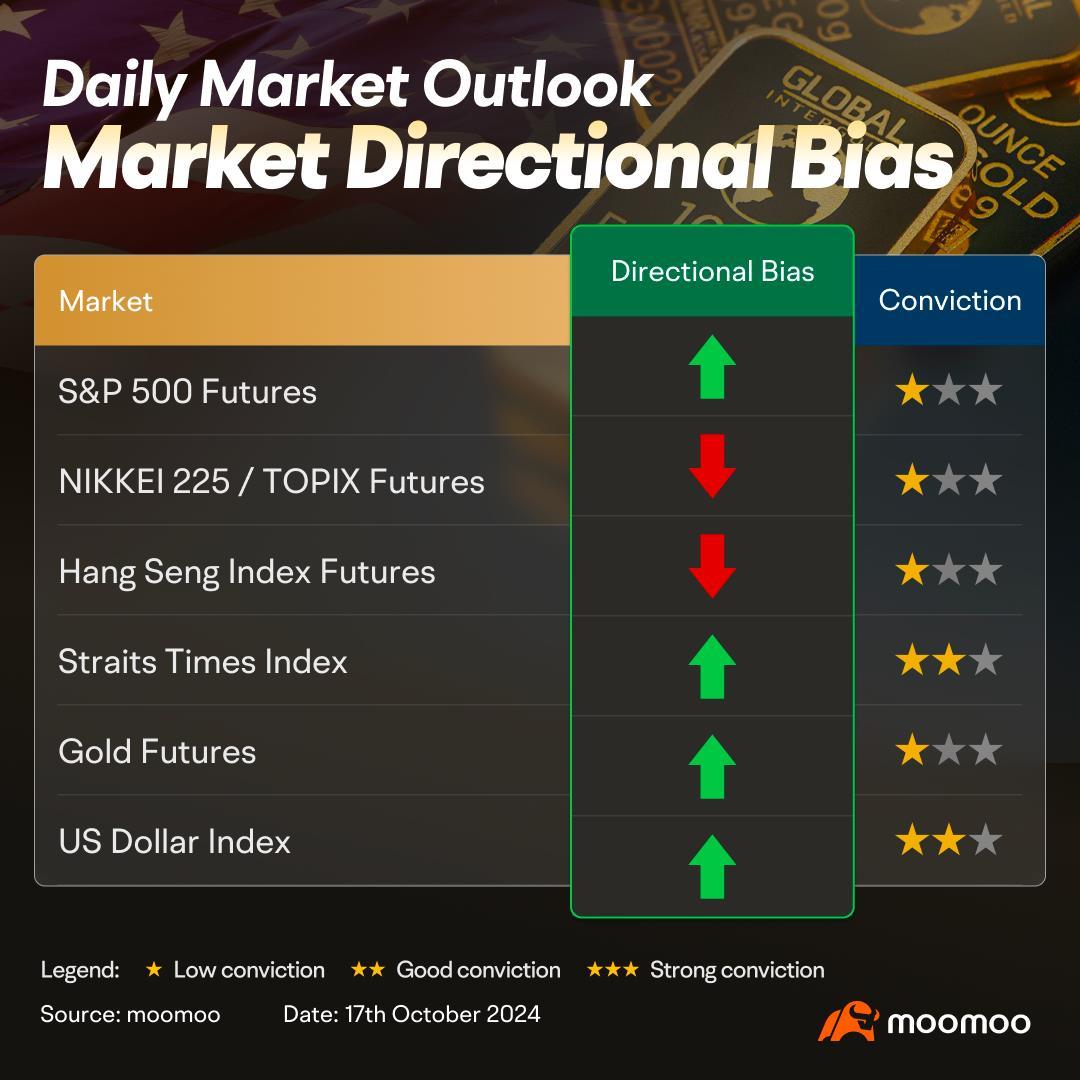

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We continue to maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support couldopennext drop towards 5710 support level.

$USD (USDindex.FX)$ (4 Hour Chart) -[BULLISH↗ **]We turn bullish as price pushed above previous resistance level at 103.358. We expect price to continue pushing towards 103.656 resistance level. Technical indicators are leaning towards a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 103.358 support level would open next drop towards 102.986 support.

$Gold Futures(FEB5) (GCmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We continue to stay bullish as price is holding in its ascending channel. As long as price holds above 2645 support level, we expect price to drift towards 2710 resistance level. A 4 hour candlestick closing above 2710 resistance level could open next push towards 2770 resistance level. Technical indicators are leaning towards a bullish directional bias.

Alternatively: A 4 hour candlestick closing below 2645 support level could open next drop towards 2615 support level.

NIKKEI 225 / TOPIX IndexFutures

$Nikkei 225 (.N225.JP)$ (4 Hour Chart) -[BEARISH ↘ *]We turn slightly bearish as price broke below its ascending trendline support. As long as price holds below 39900 resistance level, we can expect a drop towards 38650 support level. Technical indicators are leaning towards a bearish scenario as well.

Alternatively: A 4 hour candlestick closing above 39900 resistance could open next push towards 40220 resistance.

HSI IndexFutures

$HSI Futures(DEC4) (HSImain.HK)$ (4 Hour Chart) -[BEARISH ↘ *]We remain bearish as we expect price to continue to push down towards 20000 support level. A 4 hour candlestick closing below 20000 support level would open a next drop towards 19700. Technical indicators are leaning towards a bearish scenario as well.

Alternatively: A 4 hour candlestick closing above 20840 resistance level will open the next push towards 21500 resistance level.

SG Market - STI

$FTSE Singapore Straits Time Index (.STI.SG)$ (4 Hour Chart) -[BULLISH↗ **]As expected, price pushed above 3620 resistance-turn-support level. We stay bullish as we expect prices to push towards 3640 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 3620 support level will open a drop towards 3570 support level.

Summary - What Is Happening In The Markets

US markets closed higher last night, with $E-mini S&P 500 Futures(MAR5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ drifting higher by 0.41% and 0.04% respectively. Utilities and financials advanced the most. Earning reports taking the spotlight, with $Morgan Stanley (MS.US)$ and $Abbott Laboratories (ABT.US)$ climbed higher by 6.50% and 1.67% respectively after the release of their earnings report. $NVIDIA (NVDA.US)$ managed to push higher by 3.13% after dropping by 4.69% in its previous session due to $ASML Holding (ASML.US)$ forecast. Traders can look forward to tonight's data on retail sales, initial jobless claims and Philadelphia Fed Manufacturing Index data last night.

Asian stocks open mixed today. $Nikkei 225 (.N225.JP)$ edged lower by 0.61%, due to underperforming trade deficit data. Traders should look towards CPI data released tomorrow morning. $HSI Futures(DEC4) (HSImain.HK)$ climbed higher by 1.20% this morning. There is risk-on sentiment among traders as China pledged to provide more financial support for estate projects and speed up banks lending. Traders should keep an eye out for GDP data out tomorrow morning. $FTSE Singapore Straits Time Index (.STI.SG)$ edged higher by 1.04%, after outperforming new home sales data. $UOL (U14.SG)$, among other stocks, climbed the most by 3.33%.

Prepared by:

Moomoo Singapore

Isaac Lim CMT, CFTe

Chief Market Strategist

Chief Market Strategist

This report is provided for informational and general circulation purposes only and should not be construed as an offer, solicitation, or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into consideration any particular needs of any person. This advertisement has not been reviewed by the Monetary Authority of Singapore.

For full disclaimers, please visit https://www.moomoo.com/sg/support/topic5_935.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : ok

J Servai (JLAPT) : Thnakyou

EZ_money : green on the dollar soooooo... it's going to sell off today

EZ_money : doesn't make sense for gold and the dollar go up at the same time

The Newbie : Ok

Alster EZ_money : Probably demand for gold increasing faster

EZ_money Alster : that's actually sign of what's to come because you know the dollar won't last