$SPY $QQQ

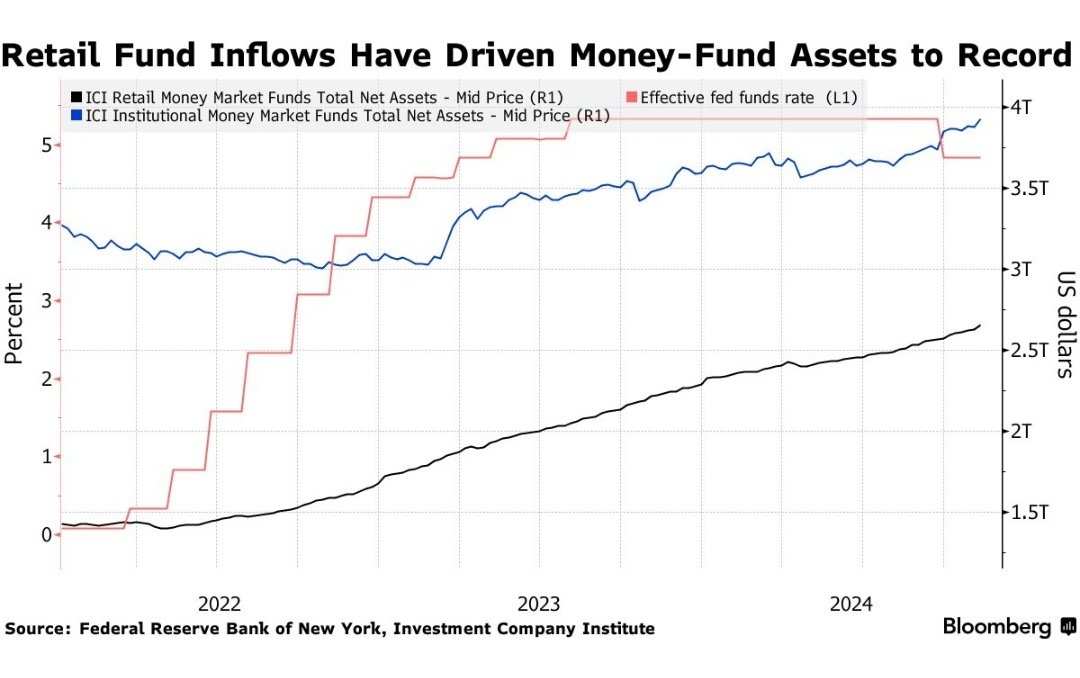

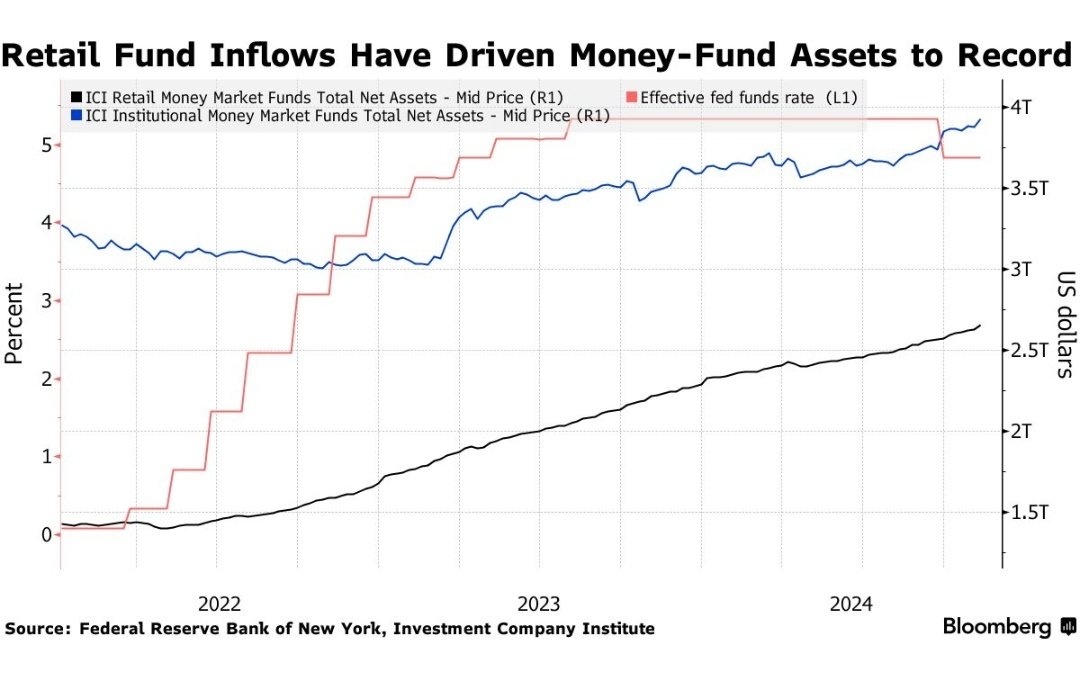

Cash on the sidelines…

A $7 Trillion and Growing Cash Pile Defies Wall Street Skeptics

(Bloomberg) It was supposed to be the year of the great money-market exodus.

Between Federal Reserve interest-rate cuts and the rally in stocks and bonds that would naturally follow, all the elements were there, Wall Street prognosticators said, to prompt investors to yank cash out of money-market funds en masse.

They were wildly off. For while the rate cuts came and stocks soared, companies and households have kept shoving cash into money funds, pushing the total assets held in those accounts above $7 trillion this week for the first time ever.

(Bloomberg) It was supposed to be the year of the great money-market exodus.

Between Federal Reserve interest-rate cuts and the rally in stocks and bonds that would naturally follow, all the elements were there, Wall Street prognosticators said, to prompt investors to yank cash out of money-market funds en masse.

They were wildly off. For while the rate cuts came and stocks soared, companies and households have kept shoving cash into money funds, pushing the total assets held in those accounts above $7 trillion this week for the first time ever.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment