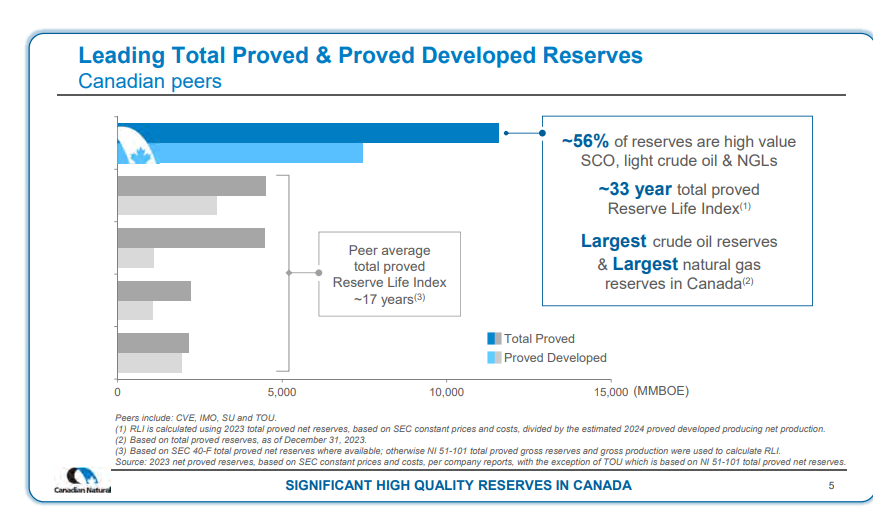

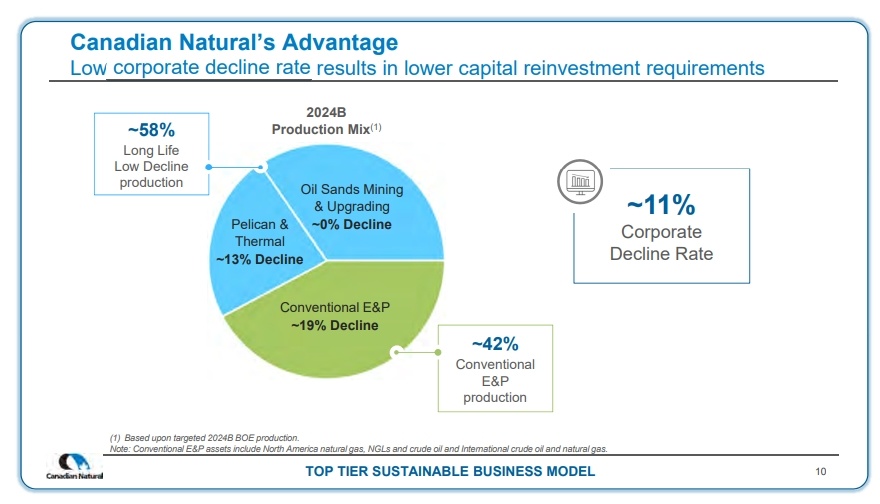

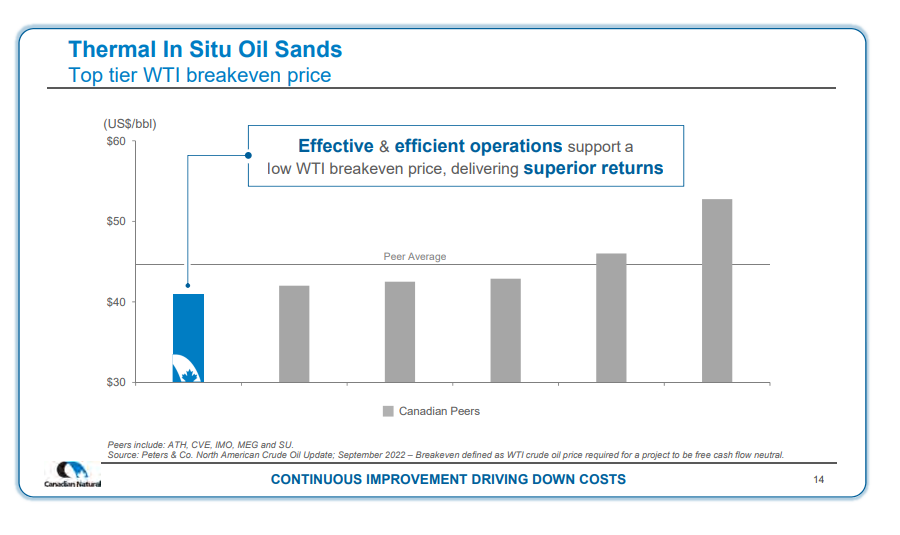

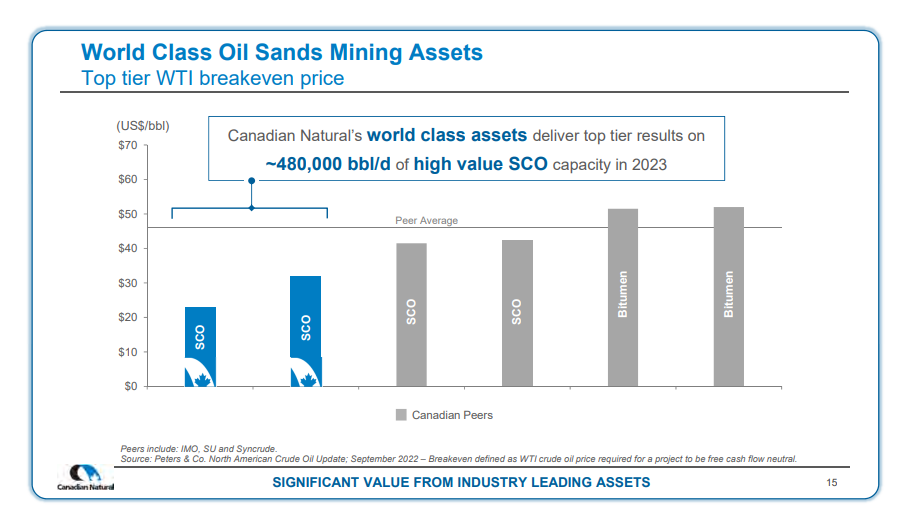

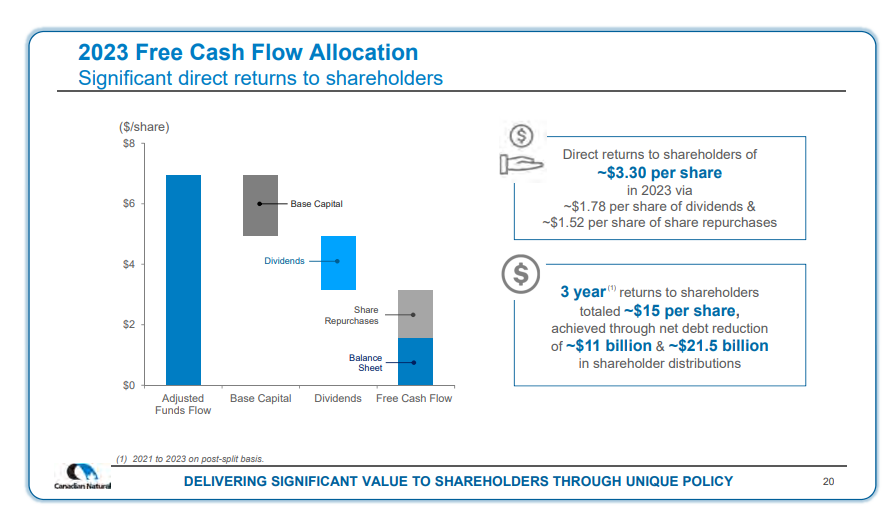

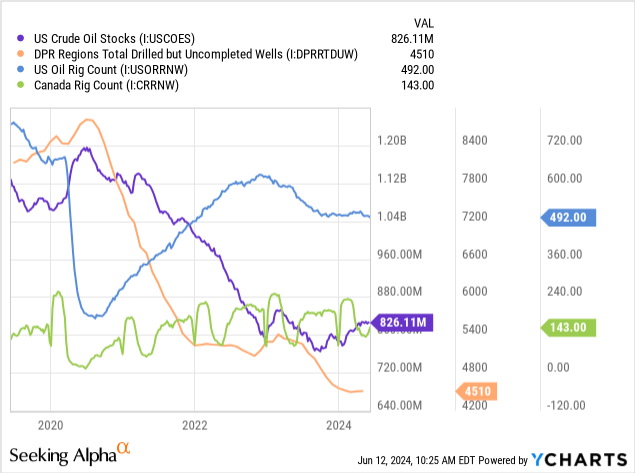

In general, CNQ, as Canada's oil and gas mining giant, has the largest crude oil reserves and the largest natural gas reserves in the domestic industry. Its large and stable reserve resources, low decline rate and break-even point below market price drive its free cash flow flow. At the same time, its shareholder return has also increased steadily for two decades, creating a good valuation and market expectations. According to market expectations, geopolitical factors and the possible reduction of oil production in the United States will also create potential market space for CNQ in the future. From the company's point of view, its continued development of new projects and increased transportation capacity will also benefit its second half and long-term production growth. In terms of shareholder return, the company plans to distribute 100% of free cash flow to shareholders once it reaches less than $10 billion. At the end of 2023, its net debt has reached $9.9 billion, meaning that its shareholder return in 2024 will continue to rise, while it is already leading the industry. These benefits are also reflected in the high valuation given to CNQ by the market. According to Bloomberg forecasts, the decline in earnings per share in 2024 will slow significantly, narrowing from -33.23% in 2023 to -6.19%, and it is expected that earnings per share will recover in 2025, with a growth rate of 21.36%. Revenue declines are also forecast to narrow in 2024 and recover with a 5.4% increase in 2025. Although in the short term its production was adversely affected by the volatility of oil prices and the wildfires in Canada and subsequent maintenance, the company will continue to maintain its good revenue and financial performance in the long term.