Star-Studded Canadian Stocks Tour:Enbridge, Oil Pipeline Giant

I will be doing a series to introduce and analyze star stocks in the Canadian market. The first stop is Enbridge. Join me as we explore this oil pipeline giant together! ![]()

![]()

![]()

Who is Enbridge?

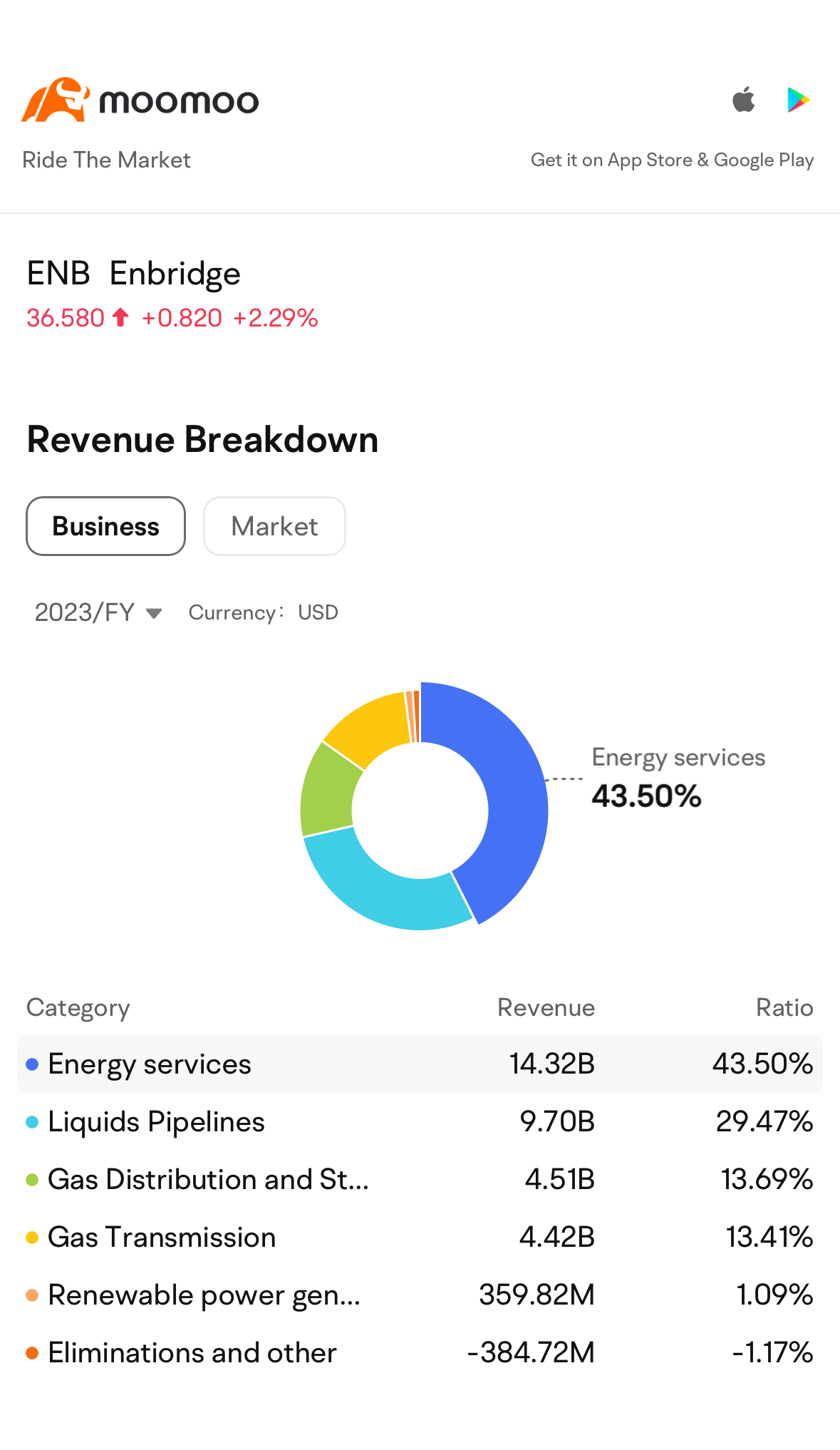

$Enbridge (ENB.US)$ $Enbridge Inc (ENB.CA)$ is an energy transportation and distribution company headquartered in Alberta, Canada. As one of the largest energy infrastructure companies in North America, Enbridge focuses on the transportation, storage, and distribution of oil and gas. The company operates across Canada and the United States, with an extensive network of pipelines used to transport oil, gas, and other liquid energy sources over thousands of miles, connecting key production areas, storage facilities, and markets.

In the first quarter of 2024, Enbridge once again demonstrated strong performance that surpassed market expectations, highlighting their excellent performance in the renewable energy, liquid pipeline, and gas distribution sectors. After a series of strategic acquisitions, Enbridge's influence in major energy sectors continues to strengthen, laying a solid foundation for future strong growth.

As a result, JPMorgan Chase gave Enbridge a very positive evaluation and raised its rating. Specifically:

I. Highlights of Enbridge's 1Q24 Performance:

Strong performance: Enbridge's adjusted EBITDA for 1Q24 was CAD 4.954 billion, exceeding the market's expected CAD 4.596 billion. The excellent performance was mainly due to significant growth in renewable energy business, exceeding expectations by CAD 129 million. Liquid and gas distribution businesses also performed well, exceeding expectations by CAD 79 million and CAD 68 million respectively. In addition, the company's clearing and other businesses brought in an additional CAD 126 million in revenue, further boosting overall performance.

Efficient expansion driving business growth: In terms of capital investment, Enbridge demonstrated its continuous deepening in energy infrastructure, especially in the natural gas sector. The company announced the final investment decision for the Tennessee Ridgeline Expansion project, an CAD 1.1 billion natural gas pipeline project aimed at connecting the Tennessee Valley Authority's natural gas power plants. In addition to the previously announced projects related to the Gulf of Mexico with a value of approximately CAD 500 million, the company also revealed further expansion plans, including opening up natural gas pipelines in Port Arthur to meet future potential demand, demonstrating the company's further expansion strategy in critical energy areas in the US.

II. Strategic Layout and Prospects for the Future of Enbridge:

Core business growth strategy: At the latest shareholder meeting, Enbridge's CEO emphasized the company's current strategy of driving organic growth through economies of scale in core businesses. Based on the company's current stable cash flow and the continuous expansion of new renewable energy businesses, management expects that after the acquisition of Dominion LDC is completed, Enbridge will have a stronger market position in the global energy sector and achieve an adjusted EBITDA growth rate of 7%-9% by 2026.

Maintaining competitiveness and strong position: In early May 2024, the expansion project of Canada's Trans Mountain Pipeline, also known as TMX Pipeline, will officially start operation, coupled with the overall reduction in international oil supply in the market, some investors are concerned about Enbridge's performance in an increasingly competitive landscape. The board of directors gave a confident answer: thanks to its competitive pricing, flow transfer resulting from the Keystone pipeline's downgrade, and increased demand for company's mainline business area, Enbridge's competitiveness remains strong and stable in the market landscape.

III. Highly Attractive Dividend Yield of Enbridge:

As of June 3, 2024, Enbridge's TTM dividend yield was 7.18%, marking the 29th consecutive year of dividend growth for the company, which is a natural advantage of its utility property. As one of the largest energy pipeline companies in North America, Enbridge has mature infrastructure and stable customer base, which brings stable cash flow to support the company's huge dividend payments.

As of June 3, 2024, Enbridge's TTM dividend yield was 7.18%, marking the 29th consecutive year of dividend growth for the company, which is a natural advantage of its utility property. As one of the largest energy pipeline companies in North America, Enbridge has mature infrastructure and stable customer base, which brings stable cash flow to support the company's huge dividend payments.

Conclusion:

Overall, JPMorgan Chase believes that Enbridge has demonstrated a good balance of growth and shareholder returns in the past. Facing a more complex competitive landscape, the company is working hard to ensure long-term sustainable development and maximize shareholder value. For investors who value dividends and sustainable returns, Enbridge is a good investment target.

In the coming days, I will continue to analyze various star stocks in the Canadian market for you. Please follow me and embark on a journey of Canadian stocks together! ![]()

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment