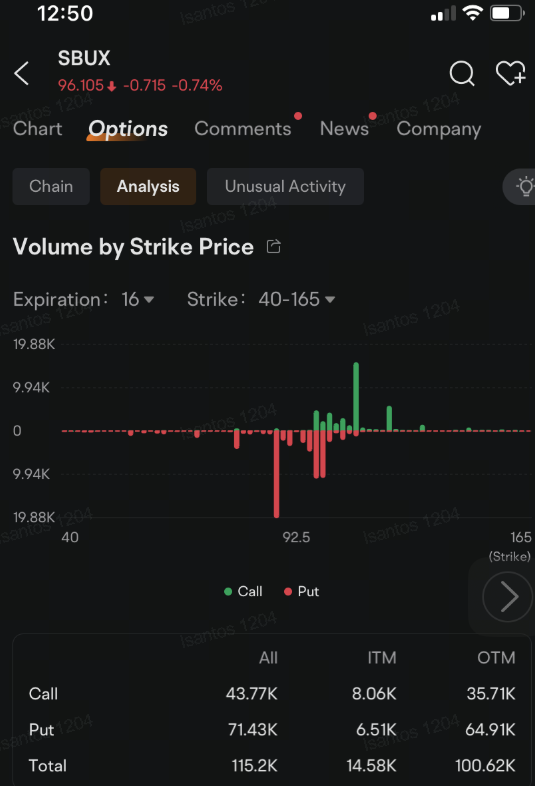

The most active Starbucks contract is the put option giving the holders the right to sell the stock at $95 in two days. Demand for such option that could protect the holder from further downside increased. The shares are now trading just less than a dollar above that strike price, increasing the probability that the contract could be in-the-money before it expires.

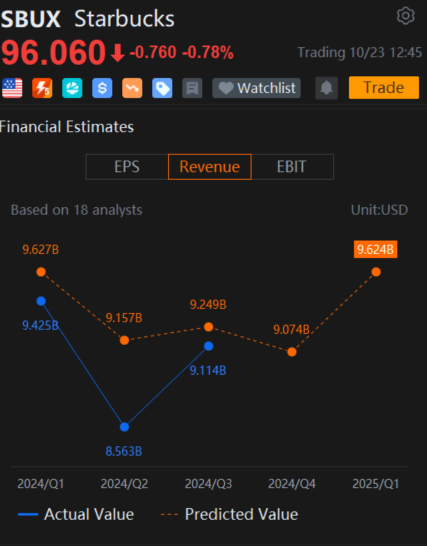

The stock price declined after the coffee chain reported that revenue for the three months ended Oct. 1 was estimated at $9.114 billion, missing analysts' expectations for a third straight quarter as sales in the U.S. and China declined. On average, analysts expected revenue to reach $9.202 billion, according to estimates compiled by Bloomberg.

Zoooi3 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Laine Ford : don't know what to say about it stock hereso I have no comment

73638957 : SBUX has no business to be up more than 27% since getting the new CEO.

Aconite Bloom : what could be causing this

anchovy3 : This company won’t become more valuable until they improve their product. Lots of chains with much higher standards. Can’t just rely on diabetes in a blender to get people in the door anymore