Leaving China aside, and speaking directly about Apple phones, I think it has reached a bottleneck. Apple phones are actually not smartphones at all; at best, they can only be considered first-generation intelligence, because they have no intelligence at all. For example, if I buy something, I need to call customer service, but I don't have time. I want to tell my phone about the problem and my expectations. The phone will automatically call me, provide feedback to customer service, and then automatically select the plan closest to my expectations from the customer service responses? Another example is, if I want to make an appointment with a dentist, can my phone automatically help me contact the dentist to schedule a schedule based on my calendar? My email gets hundreds of emails every day, mostly spam ads. Can my phone filter it so I can get all the useful information in these hundreds of emails within three minutes? That's why it's called a smartphone.

sentosa island : fuelling

Ringo想买包 : I can't make money, it's more important to hurt my feelings

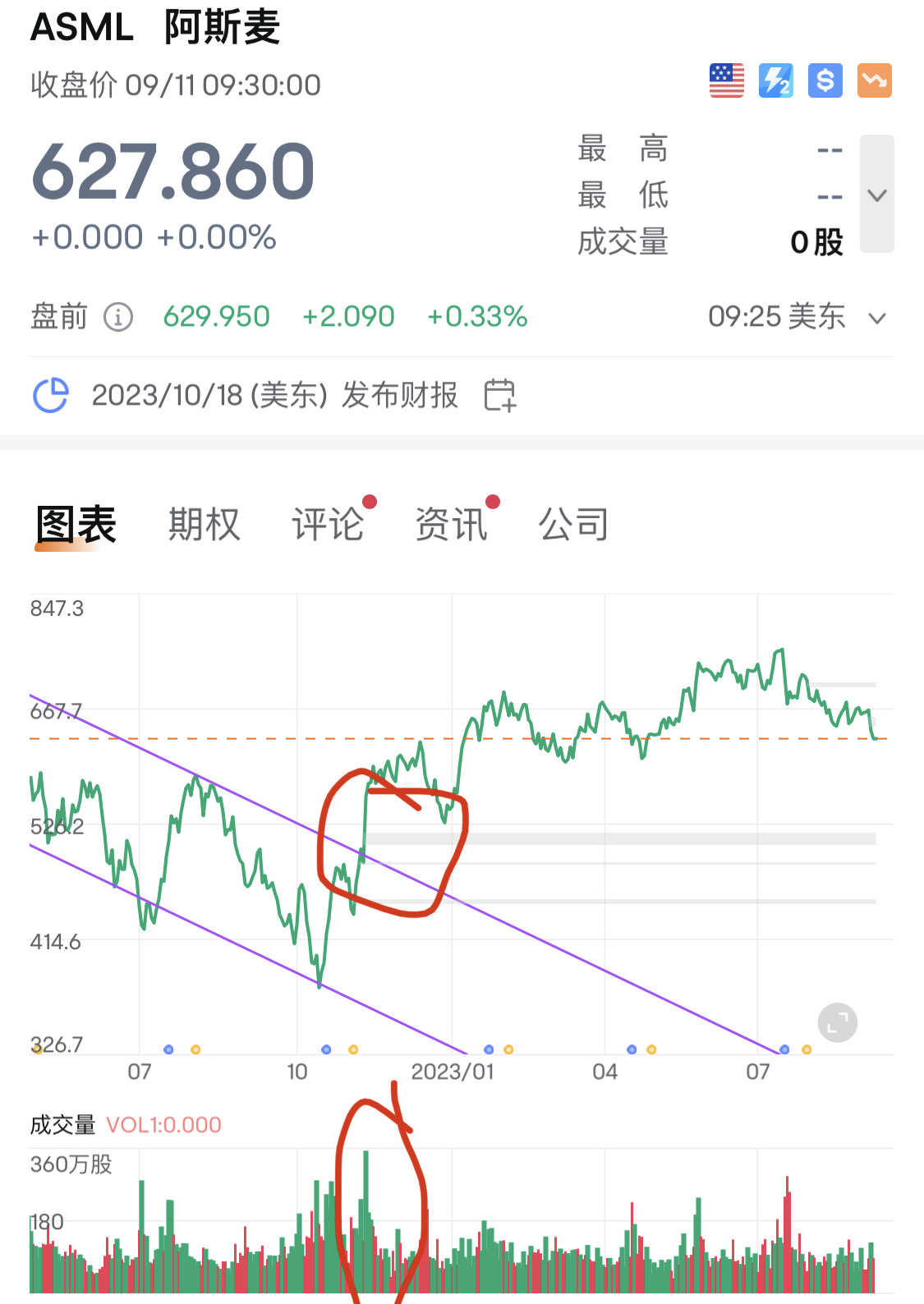

高贵的阿德莱德 OP : I opened an ASML position last week at a cost of about 630, an observational 1% position. The next position increase is expected to be around 590-600.

葱白末 Ringo想买包 : What call did you buy?

嗨 皮 : Similar trends may not necessarily be the same market demand

嗨 皮 Ringo想买包 : Money is something external to us. Investing means money makes money. Taking it too seriously affects mentality; on the contrary, it's not good

Moneys working : The explanation about Apple and Tesla was excellent