TSLA

Tesla

-- 421.060 PLTR

Palantir

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

-- 119.210

This is for information and illustration purposes only. Past performance is not indicative of future performance. It should not be relied on as advise or recommendation.

For more on channel trading strategies, check out our Premium Courses.

This is for information and illustration purposes only. Past performance is not indicative of future performance. It should not be relied on as advise or recommendation.

For more on channel trading strategies, check out this course: How to Gauge Trends with Bollinger Bands

This is for information and illustration purposes only. Past performance is not indicative of future performance. It should not be relied on as advise or recommendation.

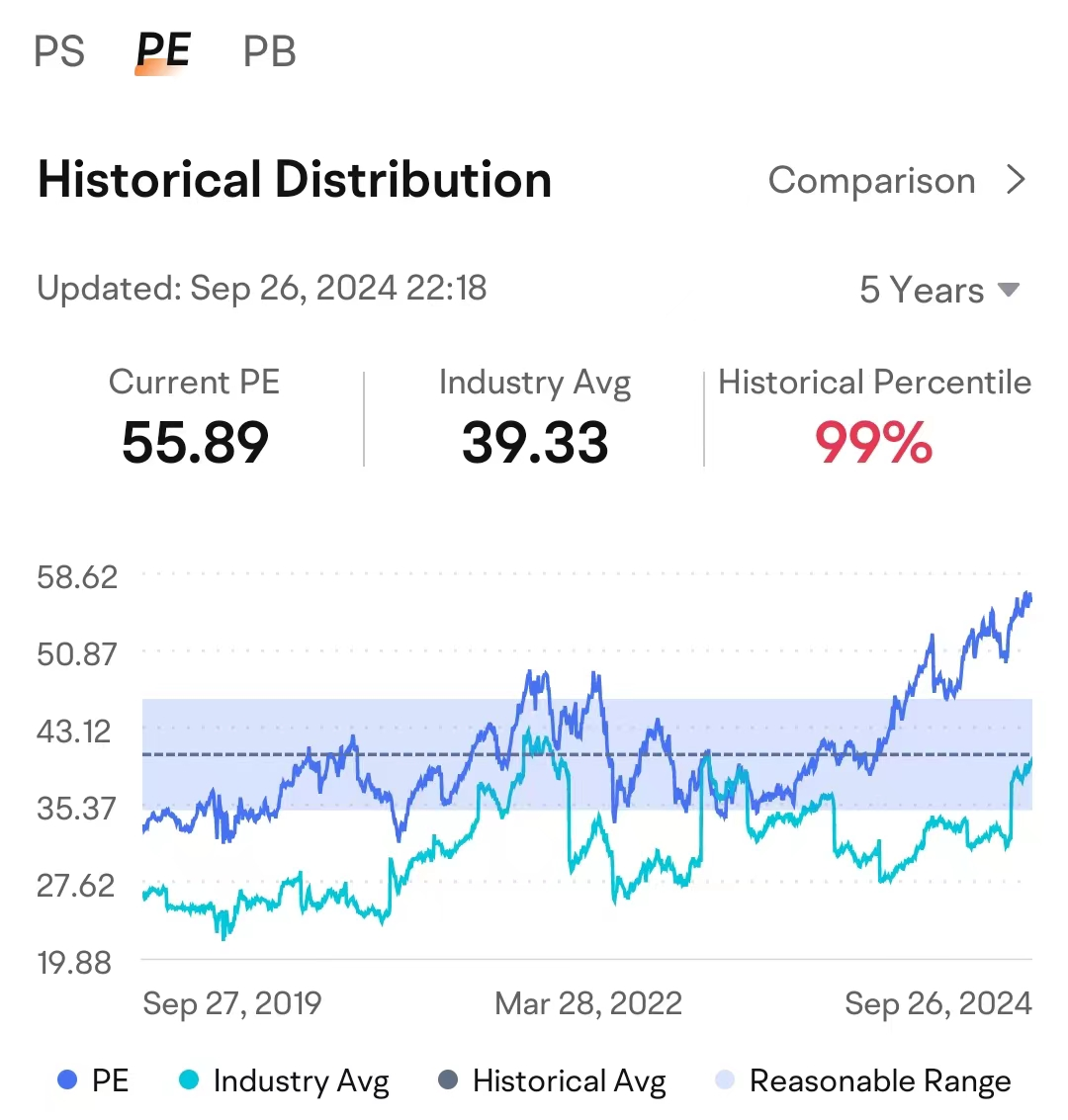

If you're not familiar with P/E valuation, you can refer to this course:Four Common Methods for Valuing a Stock

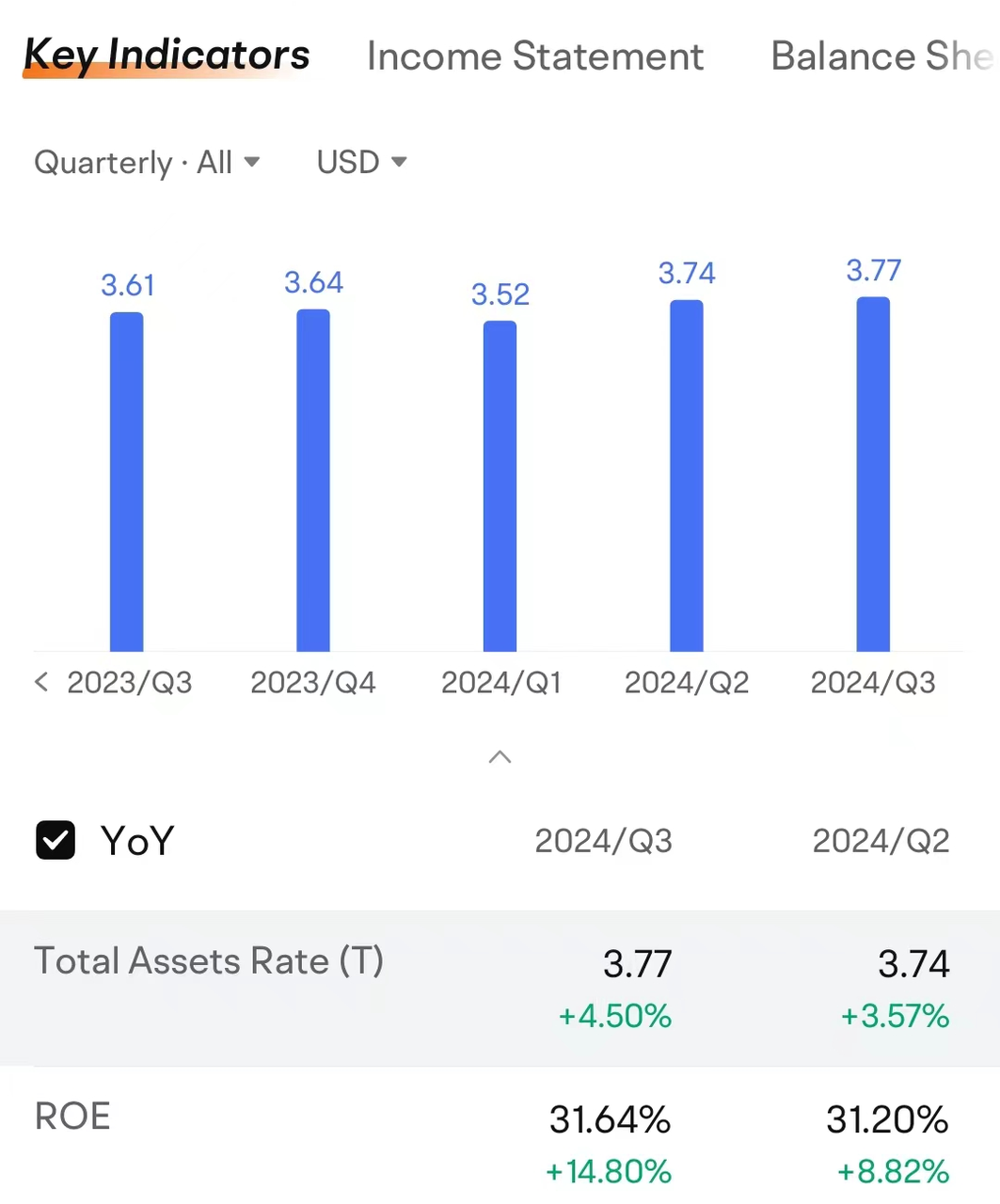

Source: moomoo. This is for information and illustration purposes only. Past performance is not indicative of future performance. It should not be relied on as advise or recommendation.

Source: moomoo. This is for information and illustration purposes only. Past performance is not indicative of future performance. It should not be relied on as advise or recommendation.

103916021 : k

103677010 : noted

CNNT : Suggestion: Let us have the opportunity to earn some points while learning. you can give us some hard challenge to solve or a small project to do to work for it.

Lucky plus : I have also been tangled up all the time.

JiG3125com : Thank$

MsJoy72150670 : understood

FENNY CHEE :

SnowVested : any useful info is good info moomoo

legend68 : good

Chan Hin Pui :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...