Stocks with Notable Option Volatility: SFIX, OCEA and VTXY

Welcome to our column, where we track and analyze the ever-changing volatility of the S&P 500 indice and stocks with notable option volatility.

Implied volatility is a measure of the market's expectation of the potential price movements of the stock in the future.

The $S&P 500 Index (.SPX.US)$ has experienced a modest increase this week, inching up from 5123.68 to 5137.08. Alongside the change in the index value, there has been a noteworthy shift in market volatility perception as reflected by the Implied Volatility (IV) rank. The IV rank has seen a significant jump to 25.08 from a previous level of 9.53. This change in the IV rank suggests that the expected volatility of the S&P 500 has increased relative to its historical volatility range over the past year.

Today's option market data for $Stitch Fix (SFIX.US)$ has shown a significant surge in activity and volatility. The option volume for the day reached an impressive 4.89K, indicating a heightened interest in the stock's derivatives. Remarkably, the Implied Volatility (IV) percentile hit the maximum threshold at 100%, demonstrating extreme expectations of future stock price movements among investors. The IV over the past year reached a high of 372%, with the current Implied Volatility matching this peak. This indicates that the options market is pricing in the possibility of substantial price fluctuations. Furthermore, the 1-day IV Change skyrocketed by +181.68%, suggesting a drastic shift in market sentiment or a reaction to a significant event affecting the company, which options traders are closely watching. This level of volatility is exceptional and could imply upcoming news or developments for Stitch Fix that investors are anticipating.

The stock's decline is attributable to the quarter's earnings missing the Wall Street consensus estimate, revenue guidance for the third quarter coming in lighter than analysts had expected, and management lowering its full-year top-line outlook. The magnitude of the decrease in "active clients" might have also been a tailwind.

Late Monday, the company reported a fiscal Q2 loss of $0.30 per diluted share, narrowing from the loss of $0.58 a year earlier. Analysts polled by Capital IQ expected a loss of $0.22. Net revenue in the quarter ended Jan. 27 fell to $330.4 million from $400.6 million a year earlier. Analysts surveyed by Capital IQ expected $332.3 million.

The company expects net revenue from continuing operations of $300 million to $310 million in fiscal Q3 and $1.29 billion to $1.32 billion in fiscal 2024. Analysts polled by Capital IQ expect $307 million in Q3 and $1.31 billion in the full year.

Here is the IV Ranking of the day:

The chart only includes any company with a market cap of over 1 million and a share price of over $2.5.

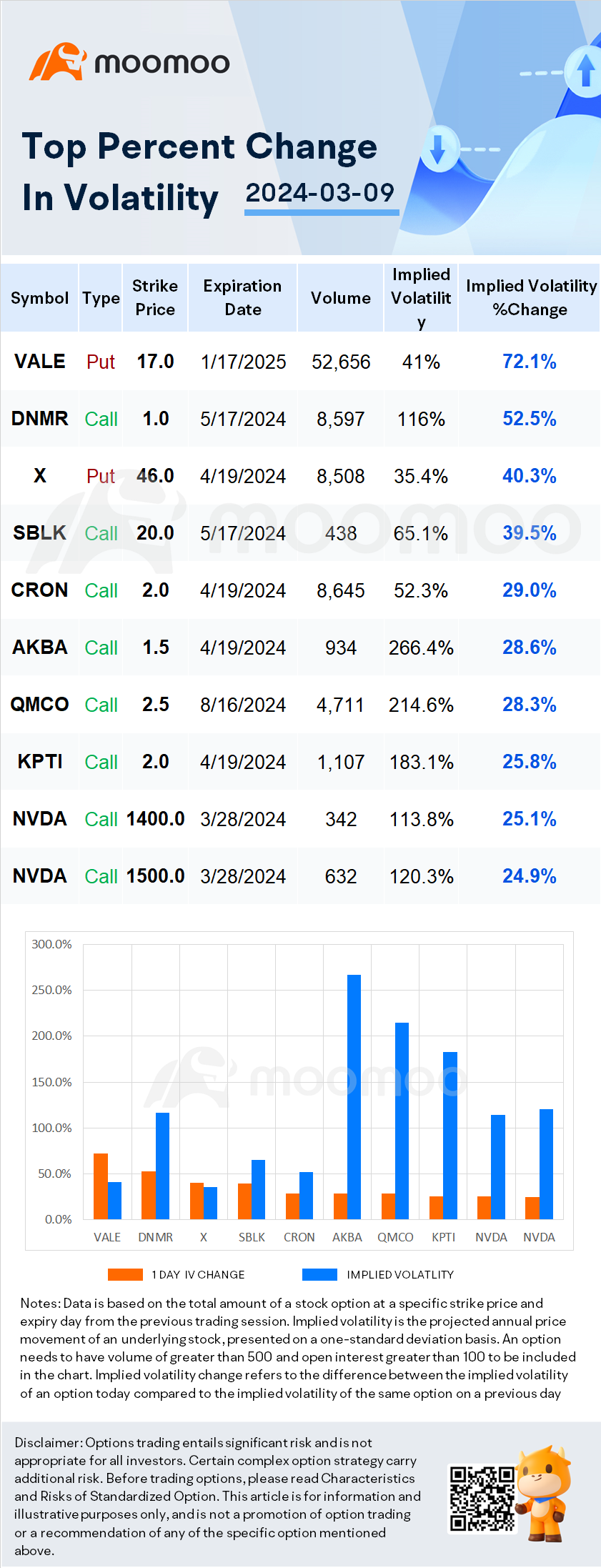

Top Option Volatility Change:

Conclusion And Risk Management

Option implied volatility is a measure of the market's expectation for how much an asset's price will fluctuate in the future, as implied by the prices of options on that asset.

Options are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time to expiration, and the implied volatility.

Implied volatility represents the level of uncertainty or risk that market participants perceive in the future price movements of the underlying asset. When investors expect greater volatility, they may be more willing to pay a higher price for options to help hedge their risk, which leads to higher implied volatility.Implied volatility is usually expressed as a percentage and is calculated using an options pricing model, such as the Black-Scholes model. Traders and investors use implied volatility to assess the attractiveness of options prices, to identify potential mispricings, and to manage their risk exposure.

Source: Benzinga, Dow Jones, CNBC

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment