Strategic Trading Approaches for NVIDIA's Upcoming Earning Report | Moomoo Research

NVIDIA, as the world's leading GPU manufacturer, has not only propelled innovation and development in various fields such as artificial intelligence, data centers, and gaming, but its stock price has also become a barometer of market sentiment. With the release of the second-quarter financial report approaching, the market's expectations for NVIDIA have reached an unprecedented height.

This article will delve into the market's expectations for NVIDIA's financial report and how investors should formulate reasonable trading strategies before and after the report is announced.

Analysis of Market Expectations for NVIDIA's Financial Report

The current market expectations for NVIDIA's financial report are as follows: the expected Q2 revenue is $28 billion, with a pre-tax profit of $18.8 billion. This expectation mainly comes from the company's official information release and the market's own forecasts, such as analyzing upstream and downstream orders.

However, we find that simply comparing market expectations and financial data reveals:

The difficulty at the trading level is not small, as there are still disturbances in judging whether the financial report meets expectations. Recently, the content of the post-earnings call in the US stock market has also had a huge impact on the company's stock price.

Therefore, by constructing a decision tree model, we can better understand the stock price response mechanism under different scenarios.

1. Discussion on Trading Strategies Before NVIDIA's Financial Report

(1) If you plan to sell at the current price to achieve higher returns

For investors who do not plan to sell their base positions, they can consider short-term Covered Call operations in situations with high volatility and high target prices (by selling call options, you can gain additional option premium income while holding the stock).

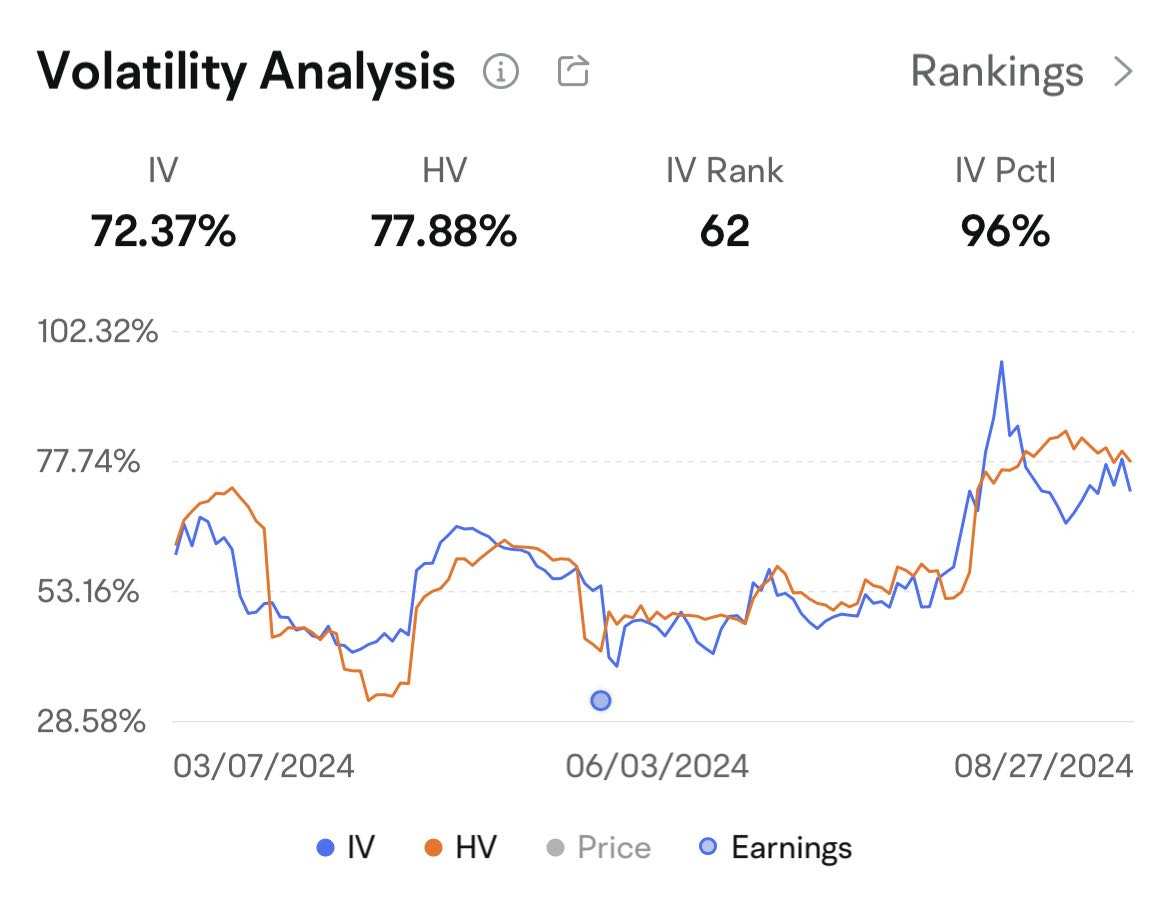

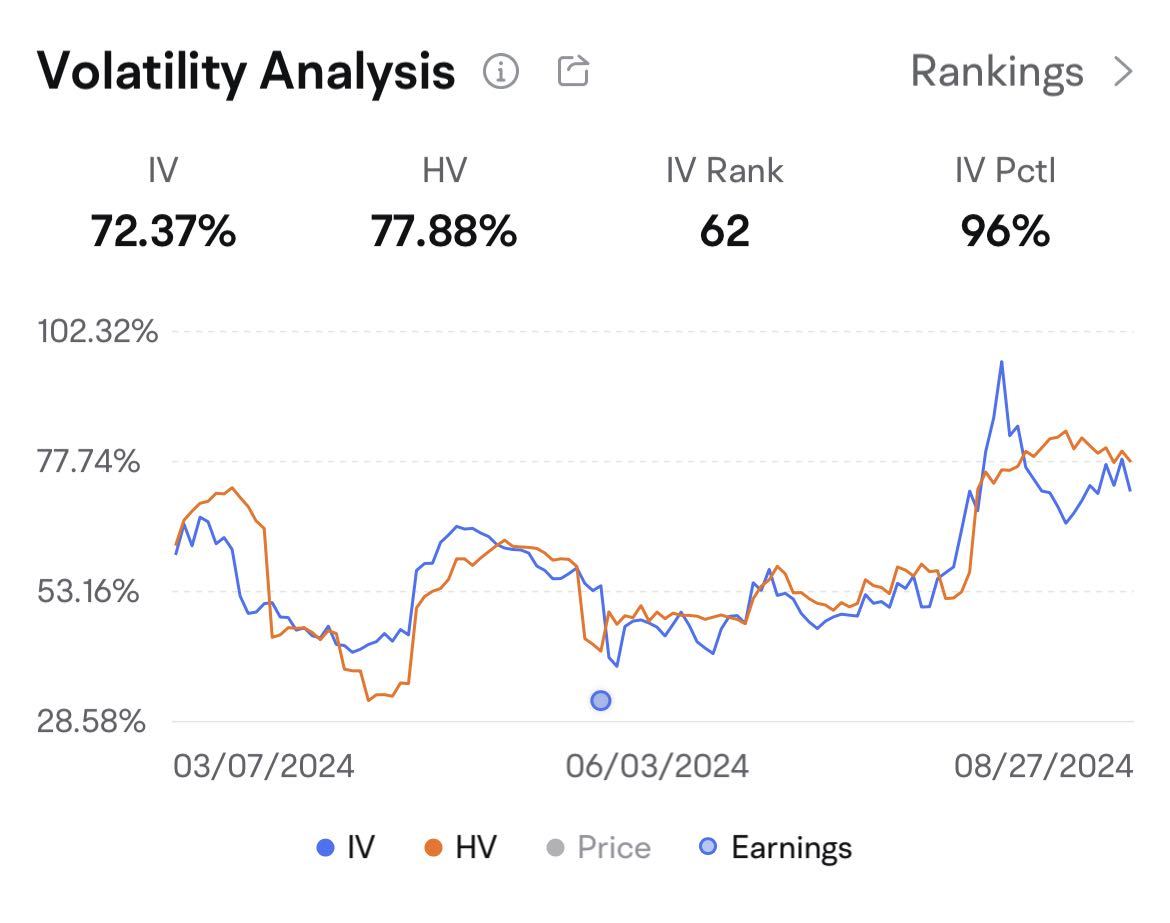

Generally speaking, the volatility of the company's options will increase before major events. The following figure shows the volatility of NVIDIA's call options with a strike price of $128 per share before the market on this Friday (August 30). With the announcement of the financial report, volatility will drop rapidly. If you expect to earn more covered call premium income and predict that NVIDIA will not rise sharply in the short term, selling this option is a good choice. The current premium is $7 per share, and if successfully exercised, the actual selling price is: $128 + $7 = $135 per share (excluding fees).

(2) Large volatility is expected after the financial report, suitable for short-term speculation

After the financial report is released, the stock price fluctuates greatly, which is suitable for short-term operations. We judge that this time is more suitable for trend-following trading, setting stop-profit and stop-loss points. At this time, it is more appropriate to learn some trend-following trading strategies in the Bull Classroom at the end of the article.

2.Analysis of Trading Risks and Stock Price Trends After the Financial Report

NVIDIA is currently very popular and has a high degree of attention, which makes the trading level more oscillatory and the requirements for the financial report higher. Therefore, we use a decision tree to view it.

(1) Financial report exceeds expectations + positive content released in the call: the stock price is expected to perform strongly;

Since the post-financial report call may provide performance guidance, this will also have a significant impact on valuation. The post-financial report call is an important link affecting the stock price. Information disclosed in the call may bring uncertainty. For example, the company's outlook for the future, market demand, technological progress, and supply chain conditions will all affect the stock price.

If NVIDIA's financial data exceeds market expectations and the call releases positive information, the probability of the stock price rising is high. At this time, we suggest that investors can boldly continue to hold and wait to sell after the buying power weakens.

(2) In the case of meeting expectations, the call needs to provide more optimistic guidance

If the financial data is consistent with market expectations, the stock price trend may be more uncertain. After all, NVIDIA is too popular at this time, with many market participants, and the buying and selling behavior of large investors may cause the stock price to fluctuate. A financial report that meets expectations is difficult to solve the problem, so the guidance of the call needs to be more optimistic.

If the financial report does not meet expectations and the call releases a general signal, it will have a negative impact on the subsequent stock performance, and investors need to be more vigilant at this time.

NVIDIA's financial report is not only a summary of the company's performance in the past quarter but also a sign of future trends. Faced with this important report, both long-term holders and short-term speculators need to carefully assess all possibilities.

In the end, no matter how the market evolves, remember this sentence:

"Investing is not about beating the market, but about controlling one's own emotions."

Stay calm, stick to your investment philosophy, and you can stand invincible in the unpredictable capital market.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment