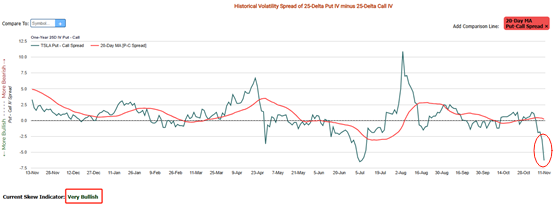

● Utilizing Volatility: Tesla implied volatility (IV) is 73.69%, which is in the 97% percentile rank. Meanwhile, Tesla’s Historical volatility (HV) is 92.05%, significantly higher than its implied volatility. This indicates that the market expects Tesla's future volatility to decrease. In this situation, investors can use short straddles or short strangles strategies to short volatility.

1047673861 : hello

73537341 : 720 target

105076413 : remember guys, anything goes up will eventually comes down. this is called the force of gravity. this force of gravity applied in almost everything including stock prices.good luck guys

Darren Invest : Tesla

102359231 : The euphoria from the Trump election triumph and EM association with Trump will definitely drive TSLA price north. After the euphoria subsides, then realities will set in n everything will be back to fundamentals n performances. The next catalyst to drive even further north is when Trump offers EM a government post. Trump 100 days review will determine the direction of TSLA.

104209762 : Emotion

warmhearted Eagle_10 : The next target is 414.00.

籠的傳人288 : It's best to do nothing if you have miss the

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101568512 :

Kevin Travers : This is great! Can we use moomoo data in the future?

View more comments...