Super Investor Strategies Unveiled: Q2 Portfolio Shifts and Market Insights

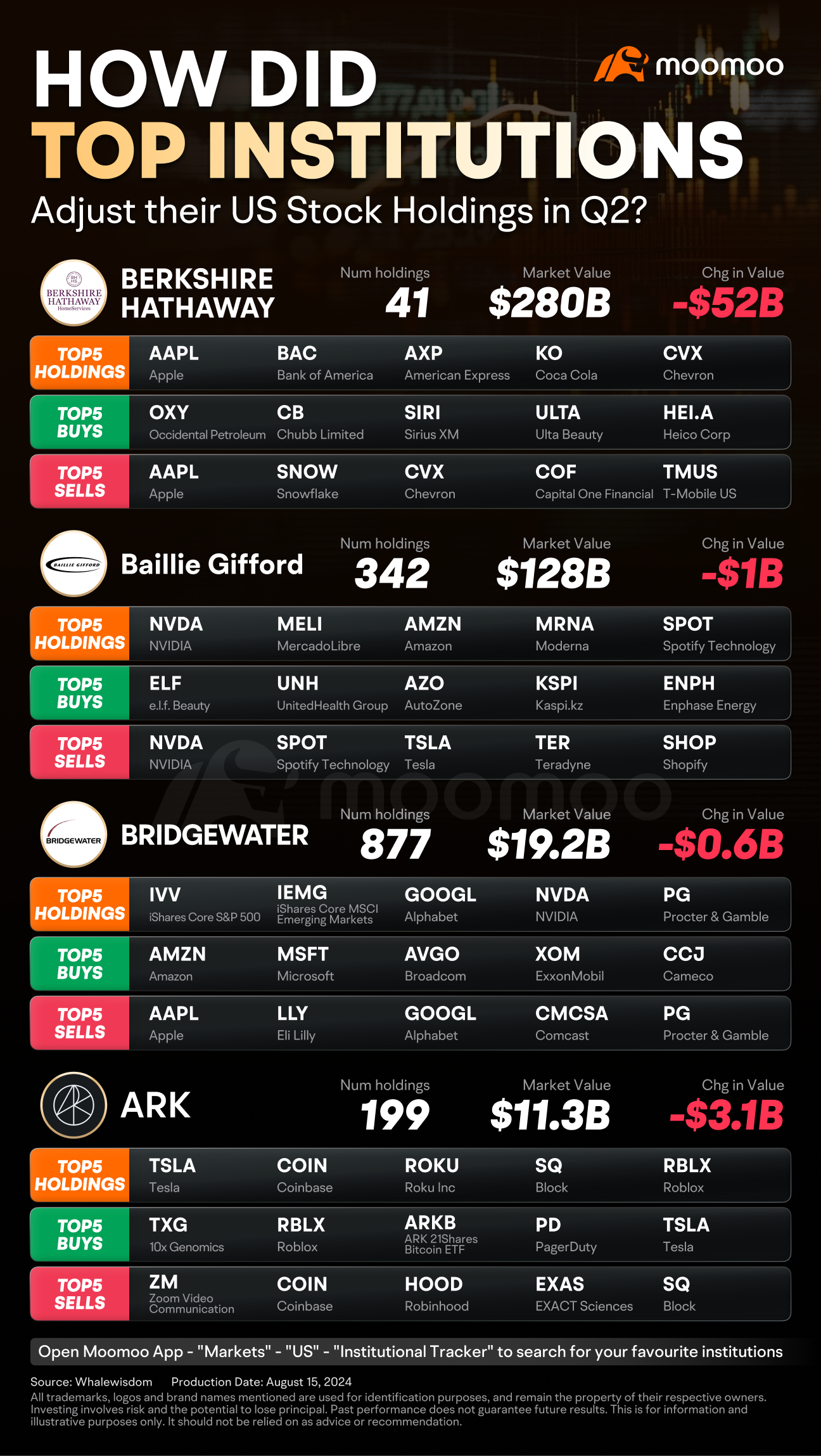

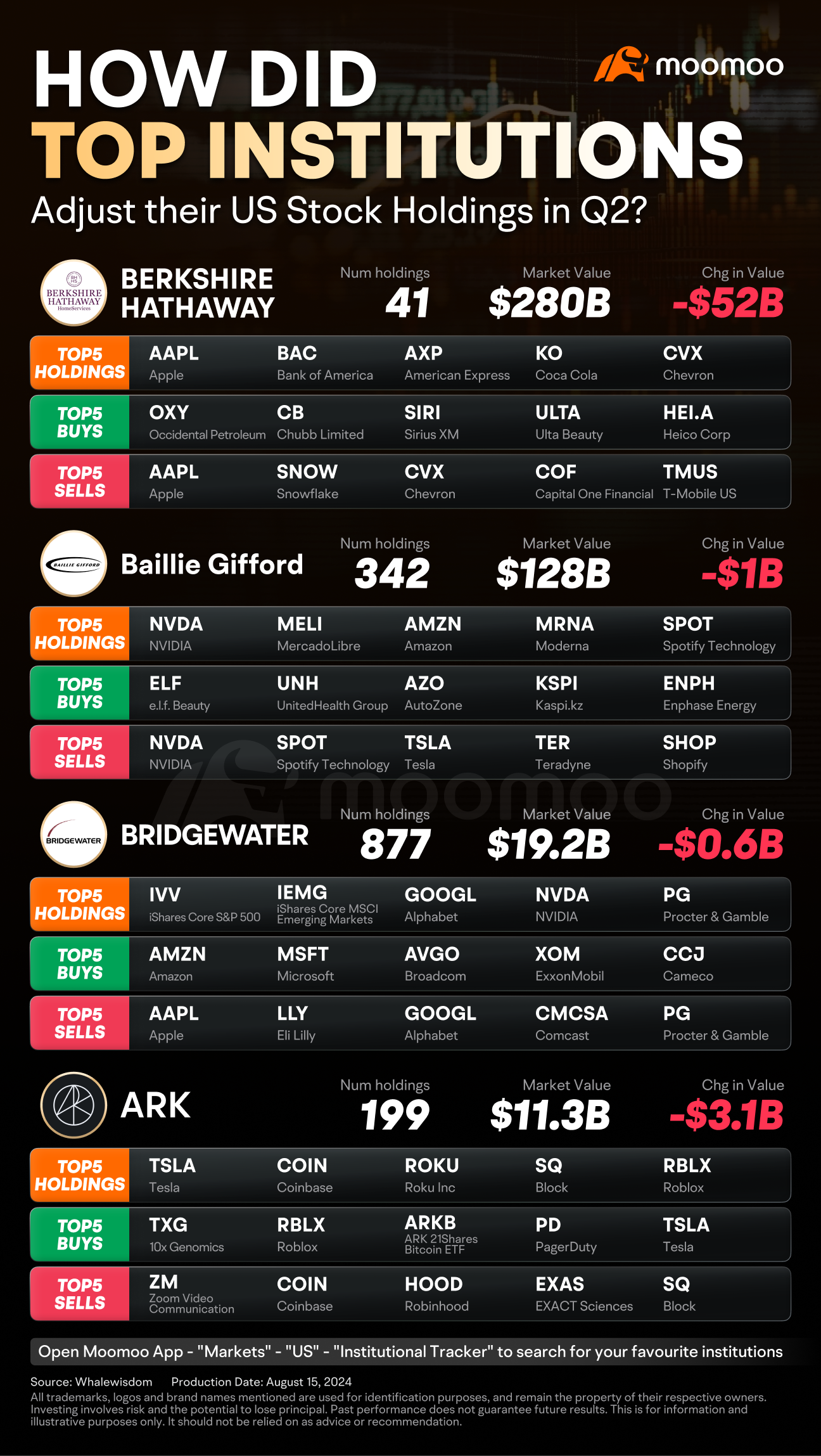

Today, let's take a look at the changes in the positions of super investors. Recently, the disclosure documents for Q2 of the large funds have been released one after another. Besides Warren Buffett, what have other funds done in the second quarter? Let's take a look together.

According to DataRoma, overall in the second quarter, nine super investors bought Berkshire Hathaway of Buffett, and eight bought UnitedHealth, occupying the top two spots in the quarterly purchases. Microsoft and Uber followed closely with seven investors each, then Apple, MSCI, and CVS with six each. In the big tech sector, after Microsoft and Apple, the next were Google, Meta, and Amazon, with five, five, and four investors respectively. Nvidia, however, was far behind, with only three investors buying.

The sell list is even more interesting. The top four are Microsoft, Meta, Google, and Amazon, and the number of sellers is much higher. Microsoft has seventeen, Meta and Google have sixteen, and Amazon has thirteen. This means that in the second quarter, more super investors chose to sell tech stocks. In addition to tech, finance is also an area that has been significantly sold off, with Wells Fargo, JPMorgan, and Visa following Amazon, all with more than ten investors choosing to sell. These are also the stocks that performed well in the Goldilocks environment at the beginning of the year.

In the consolidated positions, Microsoft has the heaviest position, while Berkshire Hathaway of Buffett occupies the second and seventh places respectively. The third to sixth places are taken by big tech, with Google occupying two seats. If added together, the total position is higher than that of Microsoft. The rest are Amazon and Meta. This quarter, Apple fell out of the top ten to eleventh place, and Nvidia was fifty-ninth. Among the top ten, Visa ranked eighth, which is quite normal, but the ninth place is Carvana, which surprised me a bit. You know, in the past two years, the company almost went bankrupt. Now it has completely reversed, and the stock price has increased by 34 times from the beginning of 2023 to now, from $4 to the current $150. The tenth place is St. Joe. This is a real estate management company in Florida, providing residential, office buildings, and resorts in the northwest.

So let's take a closer look at the famous investor Ray Dalio, whose Bridgewater Associates significantly increased its position in Nvidia in the second quarter, adding 5.85 million shares at one go, now the fourth largest position in the investment, with an expected cost of $123.5. In addition to Nvidia, he also significantly increased his positions in Amazon and Microsoft, buying 1.6 million and more than 400,000 shares respectively. Interestingly, he also bought more than 2 million shares of Chipotle, which encountered the CEO's departure and a sharp drop in stock prices the day before yesterday. In addition to reducing Apple's position by 75%, the fund also cut positions in Eli Lilly, Uber, and CVS by more than half.

Another famous investor, Bill Ackman, established positions in Canadian real estate investment company Brookfield and Nike in the second quarter, buying 6.85 million and more than 3 million shares respectively, accounting for 2-3% of the total holdings. At the same time, he reduced his position in Chipotle by 22.5%, and Google's position was also reduced by nearly 20%. Now Google, if the two positions are added together, exceeds 20%, becoming Ackman's largest position, with Hilton in second place, accounting for 19%, and Chipotle in third place, accounting for 17%.

Summary:

Overall, the second quarter reflects the overall thinking of super investors, which is defensive. More people choose to reduce the big tech and financial stocks in their hands, and instead buy health insurance stocks like UnitedHealth and Berkshire Hathaway. Sales are more than purchases.

And it's not just this quarter, in the past six months, financial stocks and tech stocks have been the most sold, while healthcare still occupies the top of the purchase list, and utilities are also among them. I don't think we investors should sell tech stocks now and buy healthcare. The regulatory disclosure documents are also relatively lagging, but it is advisable to learn from the overall defensive mentality. The future market still faces economic, election, and geopolitical uncertainties, and with a defensive mindset, we may be more at ease in our investments, which may lead to better investment performance.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment