Super Micro Computer: No Longer Dead In The Water (Rating Upgrade)

Summary

Super Micro Computer, Inc. stock is collapsing as the feared margin story hits the AI server infrastructure stock.

Despite margin challenges, the company forecasts FY25 revenues of $26 billion to $30 billion, showing 100% growth potential.

Super Micro's financial model for FY25 suggests potential for significant EPS growth, with stock trading below 10x high-end EPS targets.

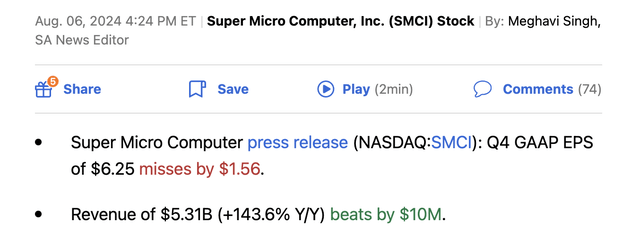

The biggest risk to the Super Micro Computer, Inc. (NASDAQ:SMCI) story hit home following FQ4 ’24 results. The AI server infrastructure company was already depressed going into earnings, and the low gross margins hit has the stock down further. My investment thesis is now Bullish on Super Micro, with the stock over $200 below the prior dead money call at $750.

Big Upside

Source: Seeking Alpha

The big problem is that Super Micro aggressively took share via cutting prices, due in part to the highlighted risk of Dell Technologies (DELL) pushing further in AI servers. Gross margins collapsed to only 11.3%, down from 17.1% last FQ4.

In essence, the company lost a third of their gross margins over the last year. Super Micro already has thin margins and naturally operating margins cratered as well.

A company should report explosive margin expansion with surging sales growth. Super Micro took such a big margin hit that net income and adjusted EPS fell sequentially from FQ3. The company still boosted EPS to $6.25 from only $3.51 last FQ4.

The market came into this quarter with questions regarding server demand due to Nvidia (NVDA) Blackwell chips being pushed out a quarter. Super Micro suggests no slowdown with demand exists by forecasting FY25 revenues of $26 to $30 billion for another year of 100% growth.

Super Micro appears to be leading the market in liquid cooling technology, now producing 2,000+ DLC racks per month. This massive ramp up in DLC racks is apparently pressuring margins.

Source: Super Micro FQ4'24 presentation

The company went so far to claim gross margins would rise back to prior levels as Super Micro benefits from lower manufacturing costs with scaled up production in Malaysia and Taiwan going forward. On the FQ4 '24 earnings call, CFO Dave Weigand forecast a path back to the gross margin target range:

We have a path to improve gross margins to the target range of 14% to 17% as we introduce innovative platforms based on multiple new technologies from our strategic partners and improved manufacturing efficiencies on our DLC solutions.

Explosive Profit Growth Ahead

The stock slumped to $515 on the market nervousness on the lower gross margins. Super Micro saw operating margins dip below 8%.

The good news is that the financial model improves dramatically on Super Micro, just keeping gross margins and operating margins flat in FY25. The story turns very positive on a ramp back up in gross margins, leading to an expansion of operating margins.

Super Micro has the following basic financial models for FY25:

14% Gross Margin

Revenue - $30 billion

Gross profit - 14%

Operating expense - 4%

Taxes - 14.6%

Net income - $2.56 billion

EPS (66 million share - $38.82

17% Gross Margin

Revenue - $30 billion

Gross margin - 17%

Operating expense - 4%

Taxes - 14.6%

Net income - $3.33 billion

EPS (66 million shares) - $50.46

The consensus analyst estimates were at only a $34 EPS for FY25, with sales of just $23 billion. In essence, Super Micro guided up EPS targets for the year dramatically based on how gross margins can rise for the year, but the market is stuck, focused solely on weak margins in the short term.

The stock trades at only 17x the consensus numbers, but the upside potential is massive, with Super Micro having an upside of nearly $10 per share solely on the higher gross margin. The company could easily hit a $50+ EPS, making the stock trading at closer to 10x realistic EPS targets now.

The company has easily smashed estimates recently, so one might expect sales could actually reach $32+ billion in FY25. The investment thesis just doesn't need higher sales, just higher gross margins.

The stock has now dipped over $200 from our “dead money” call around $750. The opportunity is too good here to ignore, with Super Micro now trading below 10x our high-end EPS targets while the company is growing at a 100% clip.

The biggest short-term risk to the stock is the cash needed to fund 100% growth in rack server sales. Super Micro reported cash outflows in the last quarter, and the company had to raise $1.75 billion back in March via selling 2 million shares at $875 per share.

The BoD has authorized a 10-for-1 forward split of its common stock and expects trading to commence on a split-adjusted basis on October 1, 2024. The stock split and a potential additional stock offering will make the stock volatile, though attractive on any dips.

Takeaway

The key investor takeaway is that the market is too fixated with Super Micro Computer, Inc.'s gross margins in the short term and missing the long-term growth story. Investors should use the ongoing weakness to load up on Super Micro with massive EPS growth not factored into the stock price, trading down towards only $515.

If you'd like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start August, consider joining Out Fox The Street.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Goodjobguys OP : Remember the 10 - 1 split in October 1. I think it is a great move for SMCI, because stocks usually performance very well between October to December… And, don’t forget it is an election year!

Tonyco : Forgot to take that into account. Ugh. Because majority of wealth is concentrated in 60+yr Olds, they fear the dotcom burst like crazy. So they're essentially skittish rabbits, and run at the first sign of danger.