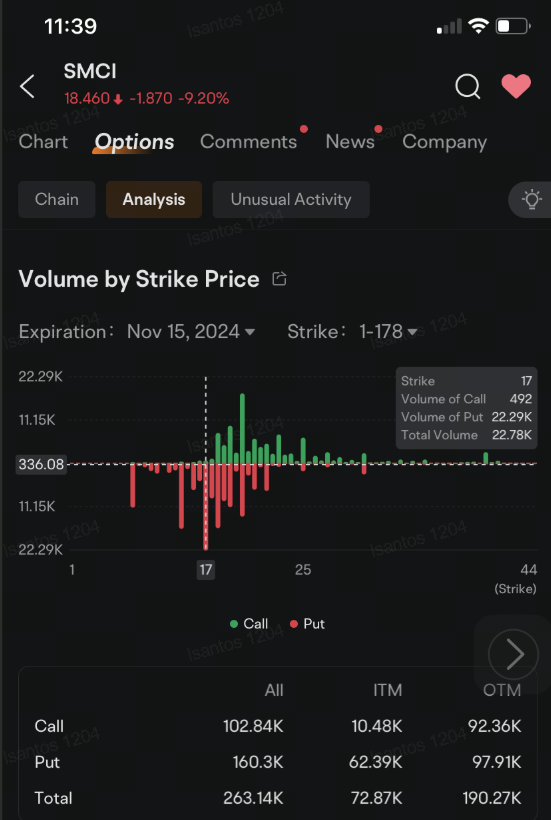

Put options that give the holders the right to sell the stock at $17 attracted the heaviest volume, with 22,290 contracts changing hands as of 11:39 a.m. in New York Thursday, almost double the open interest. The price jumped 200% for that contract that protects the holder from further stock price slump. The stock last traded at $18.43, down 9.4%.

Patientvirtue : DC

73372627 : If delist, will be one of the bigger capital market on the OTC and probablly the most traded stock there. If also there will not fill the forms, then interesting to see who will offer to merge or buyout: HP or NVDA or other????

Interesting that no insider sell or Institutional. Something fishy here.

arkar0225 : Terrible…

Space Dust : will Nvidia join SMCI?

Jermy123 : if delisted, what happened to one's share that they own in this company?

Nzm Nhr : No hound dogs (auditors) means no one can sniff any

374250 : Because I just bought it, I hope it can appreciate.

Looking4World : Let me ask a question: If a company is delisted, what would the value of a bearish put option be after the delisting?

美股小旋风 : There has been a violent surge before the market opens.

Winning kid : Honesty is uppermost important for a company, few years back SMCI had been delisted, and yet lessons never learned.

View more comments...