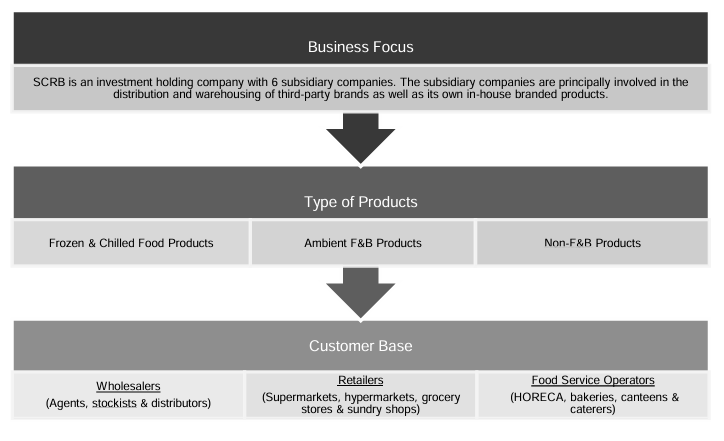

The Group's range of Frozen and Chilled Food Products includes, but is not limited to, frozen meat products, frozen seafood products, frozen potato-based products, frozen vegetables and fruits, frozen processed products, frozen pastries, butter, and cheese. The range of Ambient Food and Beverage Products includes, but is not limited to, cream, milk, pasta, juices, bread, seasonings, and dressings. The Non-Food and Beverage Products (Non-F&B Products) comprise cleaning and hygiene products such as detergents and toothpaste, which are distributed by Supreme Trading following its acquisition by the Company in May 2023.

105671137 : ok

103763868 : Ok, thank you

Vanity of vanities : Putting old wine in new bottles.

Wayne M : alright need to get in early.

105485705 : PAT drop 3M

Jimmy8mbb : 70 millions new shares but 77% or 53.7 million allocated under MITI. Only 12% under Public.

Financial figures downtrend.

93% reliance on 3rd party products.

What to worry ?

Bull365 Jimmy8mbb : Is this a good or bad sign ? sorry dont quite understand. I mean the MITI part. Usually is allocated more to MITI a bad sign or good?