NVDA

NVIDIA

-- 135.910 TSLA

Tesla

-- 394.740 AMD

Advanced Micro Devices

-- 116.040 PLTR

Palantir

-- 67.260 AAPL

Apple

-- 236.850

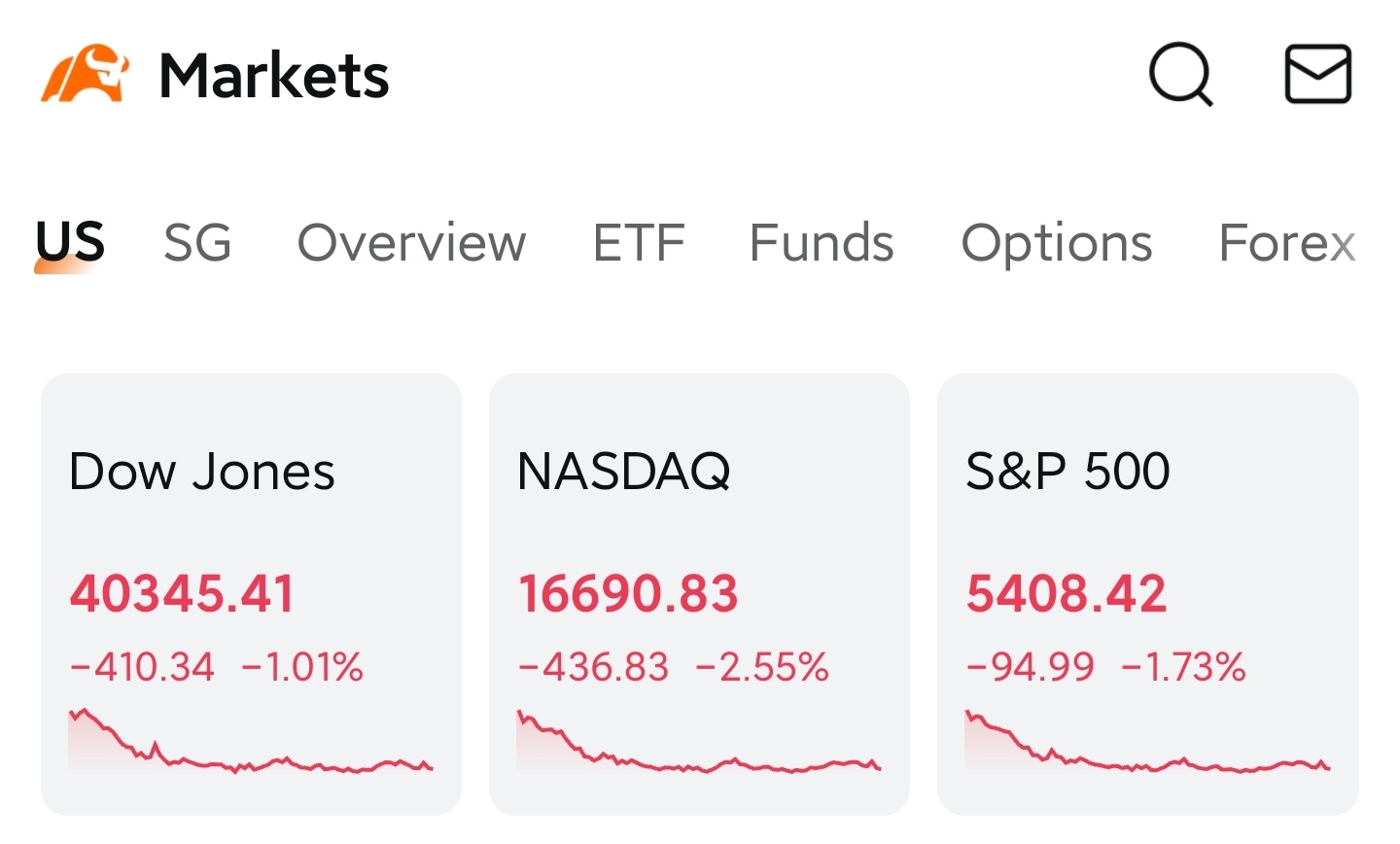

Source: Moomoo. Sept. 6, 2024.

Image provided is not current and any security is shown for illustrative purposes only and is not a recommendation.

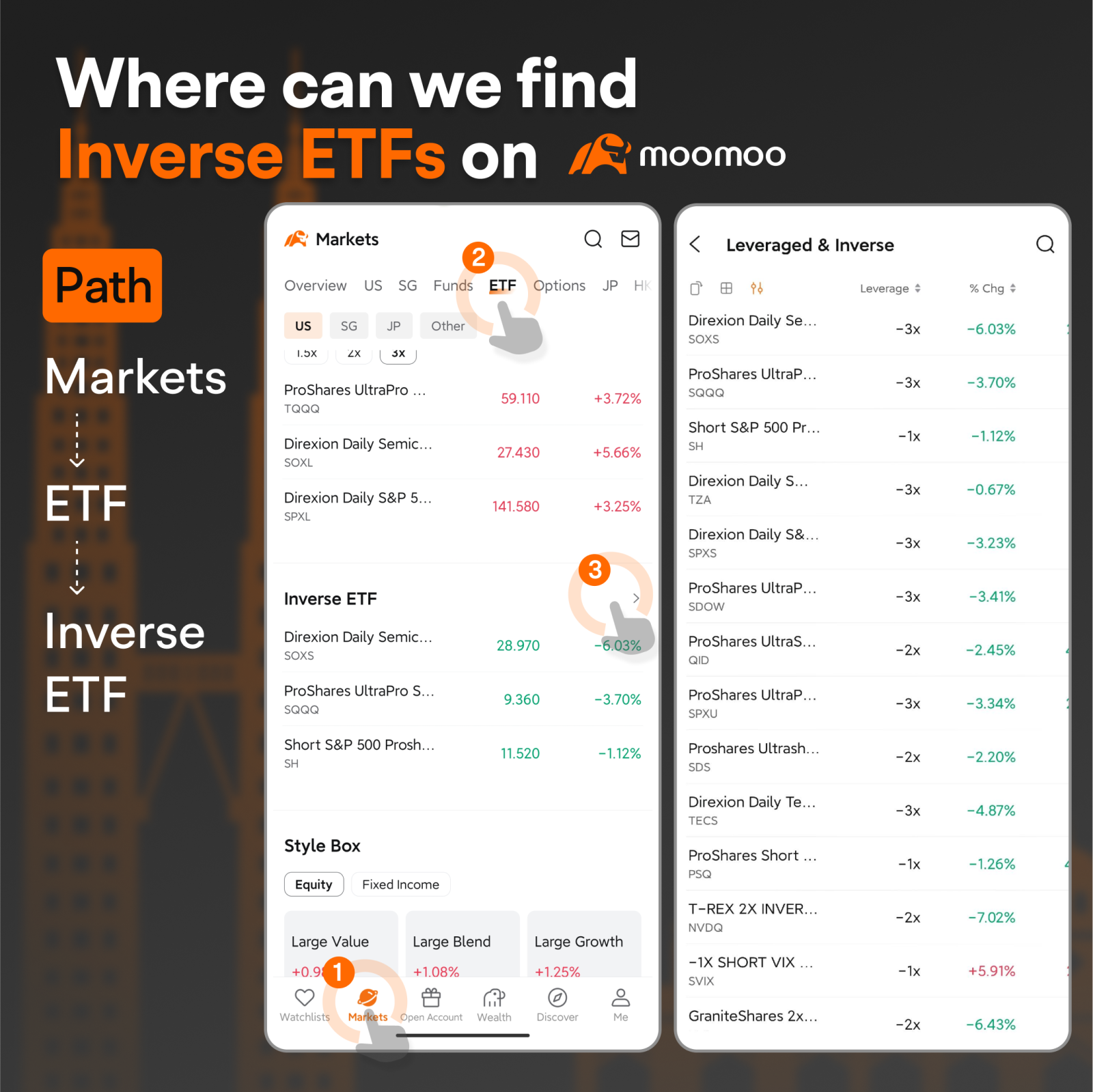

Image provided is not current and any security is shown for illustrative purposes only and is not a recommendation.

Image provided is not current and any security is shown for illustrative purposes only and is not a recommendation.

54088 FROM RWS : wow

Siew lang : Testing the waters

Elijah7 :

104917020 : wow

pokemon pang : good article, learning a lot

Zoooi3 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yowe : lol

103297413 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ATS A trade sniper : hohoho

View more comments...