$T-REX 2X LONG NVIDIA DAILY TARGET ETF (NVDX.US)$ if you are...

$T-REX 2X LONG NVIDIA DAILY TARGET ETF (NVDX.US)$ if you are bullish on Nvidia and you want to purchase Nvidia common stock or ownership through this leveraged ETF. I would like to provide you a strategy that you may wish to take advantage of. practice what I preach I will be doing exactly what I am suggesting you to consider this morning.

many people say I would like to own a particular company if it falls to a certain price. so if the company is ABC company it's currently at $19 a share and the person says if they get to 18 I want to buy it. so they enter a limit order at $18 for the day or good till cancel and hopes that the stock falls to that level and the price gets triggered and they buy the stock.

there is a better way in my opinion to take advantage of ownership of a company at a lower price. selling a put at a strike price where you want to own the company is a better way of obtaining stock ownership then entering a limit order below the market.

by selling a put you are providing another individual the ability to give you the stock or put the stock to you in the future at a predetermined date and time at a set price. in exchange for their flexibility their option to stick it to you if the price falls, they pay a premium. so they pay the premium but you collect it.

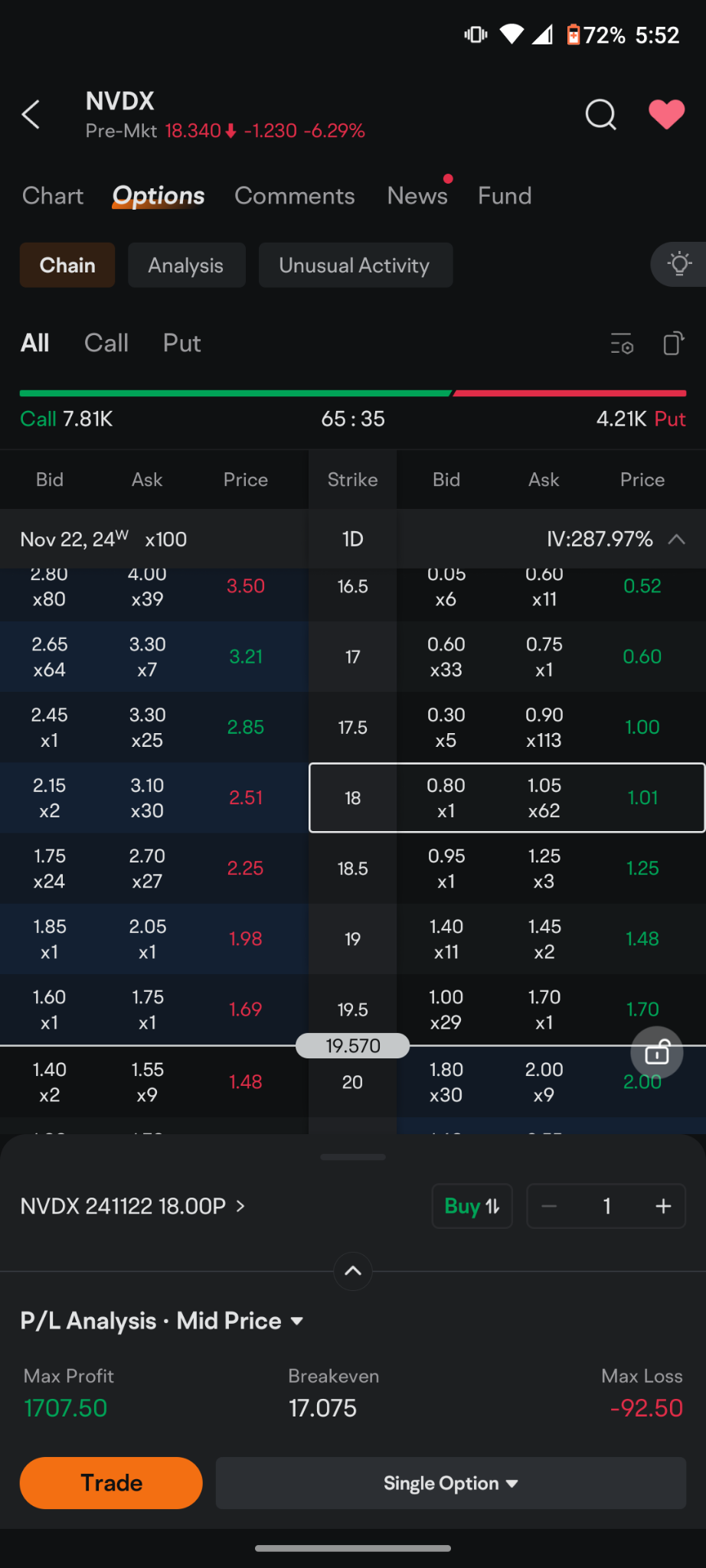

in this particular example of this leveraged ETF. we know Nvidia is opening down this morning. we know that people will be buying the common stock and there is a ratio this leverage ETF is pegged to most of the time. there are options available on this particular leveraged ETF and they just so happen to expire tomorrow at 4:00 p.m..

if you sell a put an 18 strike price for tomorrow's expiration you are going to collect about 80 cents a contract. what this means is if tomorrow at 4:00 p.m. the stock closes at $18 or less you will be the proud owner of this leverage ETF come Monday morning. every contract is 100 shares so if you sell 10 contracts you are going to collect about $800 up front guaranteed to be your money immediately. you can then take this money and go out and buy this leverage ETF directly and own it with that premium you collect. and if tomorrow at 4:00 p.m. this ETF is above 18 you don't own the ETF but you keep the premium if it's below 18 you own the ETF and you keep the premium which lowers your cost basis to $17.20.

selling puts is a great strategy to increase income to obtain ownership of a company that you want to own and that's very important you don't sell puts on companies that you do not want to own. and many companies have weekly options so you can sell puts on a Monday for Friday expiration and do that four times a month. and you can see very quickly how those premiums add up to equal real dollars.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

10baggerbamm OP : as a follow-up I just want to mention that this leverage ETF has weekly options. it use to only have monthly options and there is another leveraged ETF nvdu that only has monthly options. so in my opinion this ETF nvdx is superior to all others because it permits you to sell puts on a weekly basis.

so if every Monday you sell puts for a Friday expiration at a dollar below the current price you're going to collect about 80 cents. do that four times in a month that's $3.20

this makes an assumption you don't get put the stock or if you do you have the financial means to continue this strategy to build a position in the company.

but if you collect $3.20 that would be the equivalent of this stock / ETF being $21.20. so if you only buy the stock you would need to see it go up by $3.20 and it may do that but it may not. by selling puts you absolutely collect that premium right up front and it adds up to real money very quickly. you can stay within one or two companies and build a significant return on your investment dollars by selling puts

TheOracleOfBroMaha : Like I said, you have good stuff