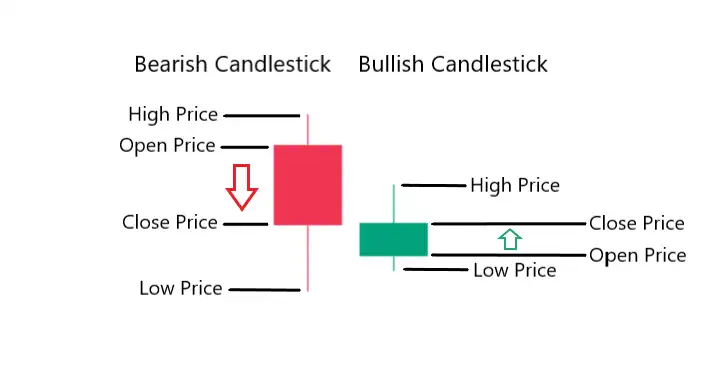

Candlestick charts are useful tools that can cater to different trading styles, such as day trading, swing trading, and long-term trading. These charts often offer insights into the balance of power between buyers and sellers, reversal and consolidation patterns, as well as unresolved market conditions. Now, let's take a look at five common bullish candlestick patterns:

Lucky Bird : Three black crows ? Not useful ?

Asphen : I'm very very passionate about TA. I analyse 50 charts per day as practice.

so all the above comes naturally now.

73514905 : bullish engulfing candle sticks is the most useful pattern for me.

狂飙浪子 : That's it

powerful Hedgehog_57 : I'm still learning. The hammer and inverse hammer are the easiest for me to identify.

Jungle lee : i like three white soldiers the most~

fearless Platypus_10 : I like 3 x white soldiers , a great set up if you get in early on the trade .

UncertainInvader : TA can be useful, but I have run across plenty of candlestick patterns that have not played out. I would suggest learning 3 market conditions:

1. Mechanical markets. In mechanical markets, the push and pull of momentum is the real driving force behind Price Action (another term to learn). This is often, but not exclusively, driven by order volume in the options market. This is most often, not always, driven by mania hypes and panic sell-offs.

2. Technical markets. This is where Tdechnical analysis shines, and candlestick patterns are most consistent. There tends to be little in the way of exciting global/national news events, and the economy is already committed to a stable path.

3. Fundamental markets. Fundamentally driven markets are where earnings reports and macroeconomic factors determine the movement of the markets. The Q4 earnings for $Apple (AAPL.US)$ that released at the beginning of the year was the worst in 6 years. The stock rallied up for 6 months, even with a lackluster Q1 earnings report. It has been in a Mechanical trend along with most of the Tech Sector for H1. Fundamental market trading will occur when the multiple debt bubbles in the USA (National debt, credit cards revolving 1 trillion, used cars 1.5 trillion, inversionof bond yeild curves, etc.) start bursting and hype driven rallies cease, leading to Fundamental correction and likely a period of Technical markets once things stabilize.

104375879 : still learning

MoMo_Kid : Three white Soldiers, great reversal pattern

View more comments...