*Cash rewards represent the value of a potential credit to your brokerage account and can only be redeemed on the moomoo app and be used to buy equities (like stocks, ETFs, etc.).*The above rewards will be issued within 10 working days after the event ends. Eligibility for rewards will be determined by Moomoo Technologies Inc., at its sole discretion, on the quality, originality, and user engagement of the posts.

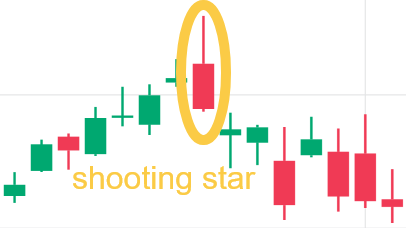

heeman : i consider shooting star as the most valuable bearish candlestick pattern in trading.

It indicated that an attempt to close at a higher price was rejected and a potential reversal might be coming

LegendaryKow heeman : three black crows

Lucky Bird : I always take 3 Black crow as a buy signal

CSChern : Shooting star pattern is a good signal to the traders to identify the bearish trend.

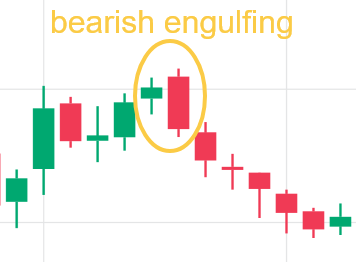

peishan97 : Bearish engulfing, as it shows the trend of the potential direction of the slowdown.

Jungle lee : I love bearish engulfing pattern the most, because once it appears, awyz gv me the signal to sold it or buy it.

Thy GoD : Shooting star, it's too iconic and easy to follow.

73724465 : shooting star.

Billionaire Farmer : Bearish Engulfing FTW

Eat Drink Earl Grey : shooting star, easily identifiable

View more comments...