Taiwan Semiconductor: Ahead Of Industry Recovery

Follow me on Moomoo to stay informed and connected!

Taiwan's export is showing signs of recovery, which is a positive indicator for TSMC ahead of their earnings report.

Emerging Positive Data

The two most important figures that the market is concerned about for TSMC are its revenue and gross margin. As monthly financial data is released, quarterly revenue is generally expected by the market. Gross margin, on the other hand, is one of the key focuses of this quarter's report. In Q3 2023, TSMC achieved revenue of $17.28 billion, which was within the guidance range (between $16.7 billion and $17.5 billion).

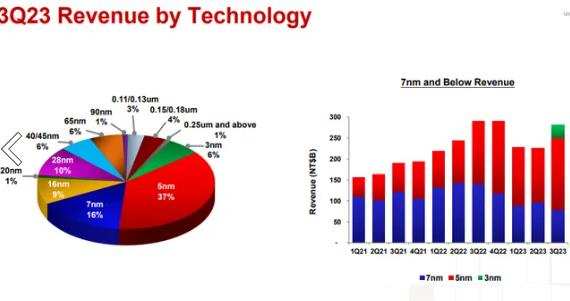

The 10.2% QoQ increase in revenue was mainly due to the production of 3nm chips, which drove up the company's wafer shipment prices. In terms of quantity, TSMC shipped 2,902 thousand wafers in Q3 2023, a decrease of 0.5% QoQ.

In terms of capital expenditure, TSMC spent $7.1 billion in Q3 2023, continuing to decrease from the previous quarter. The company's capital expenditure plan for 2023 has also been revised down to $32 billion. In terms of price, TSMC's revenue per wafer (equivalent to a 12-inch wafer) increased by 10.7% QoQ to $5,955 per wafer. This significant increase in wafer shipment prices was mainly due to the production of 3nm chips. In Q3 2023, TSMC's revenue share for processes under 7nm increased to 59%, driving up the product average selling price.

Taiwan, heavily reliant on TSMC for its economic growth (15%), has experienced a lackluster export data. However, as semiconductor demand through consumer electronics, AI, and data centers increases, the country's monthly export results are showing firm signs of recovery. Further, monthly sales data are showing that consumer demand is recovering. Consumer electronics companies in Taiwan, MSI and ASUS, release monthly sales data. As the chart below clearly shows, both companies have been continuously recovering since the demand trough in late 2022 to early 2023, which is shown by the trend line.

Based on TSMC's guidance for the next quarter, it is expected to achieve revenue of $18.8-19.6 billion (an increase of 8.6%-13.3% QoQ) and a gross margin of 51.5%-53.5% (a decrease of 0.8-2.8pct QoQ). Even though the company's product shipments have not shown significant growth, the production of 3nm chips has directly driven up revenue through their impact on pricing.

Gross margin: Recovery, but still relatively low

TSMC's gross margin for Q3 2023 was 54.3%, an increase of 0.2pct QoQ. Although the gross margin was better than the expected 53%, it was still significantly lower than the over 60% seen previously. While the production of 3nm chips can drive up wafer shipment prices and have a positive impact on gross margin, the increase in costs also puts pressure on gross margin.

The production of 3nm chips has led to an increase in depreciation and amortization expenses, thereby increasing the company's unit fixed costs. The increase in variable costs per wafer is mainly due to the increase in manufacturing costs. The production of 3nm chips will continue to put pressure on the company's gross margin and it is unlikely to return to levels above 60% in the short term.

The semiconductor industry is likely entering the early stages of recovery and sequential growth after multiple quarters of contraction. With the PC and smartphone market charting strong growth momentum in 2024, it should support the tailwinds in AI GPUs and the high-performance computing segment.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment