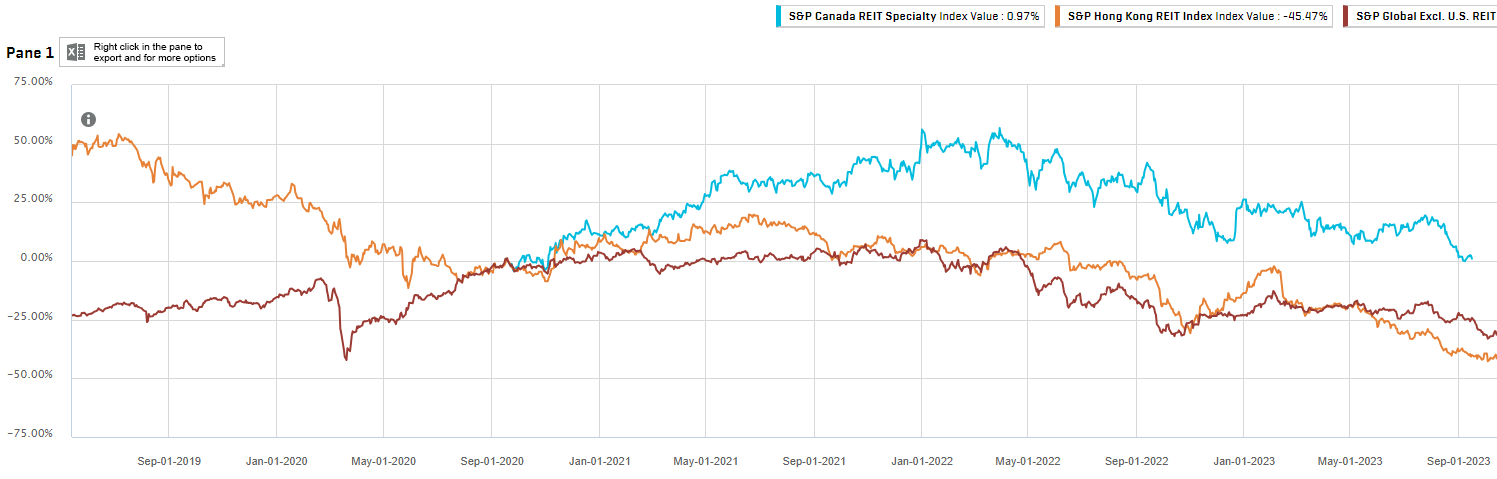

Among many capital markets, Canada's REIT market is particularly mature and vibrant, offering domestic and international investors a wealth of investment opportunities and stable return potential. Canadian REIT products cover a variety of areas, including commercial office space, retail properties, industrial logistics, residential apartments, and healthcare, meeting the needs of investors with different risk preferences. Next, let us introduce you to the relevant products and investment strategies.

74542837 : is there another company aside from wall-mart that can match the number they can or do it at a more reasonable price comparison as our company is going quickly then we would know what to order