Target Options Volume Jumps as Stock Plunges 21%, Boosting Demand for Puts

$Target (TGT.US)$ options trading jumped amid increasing demand for protection against continued slump for a stock that has already plunged by more than 21% after posting its biggest earnings miss since 2022.

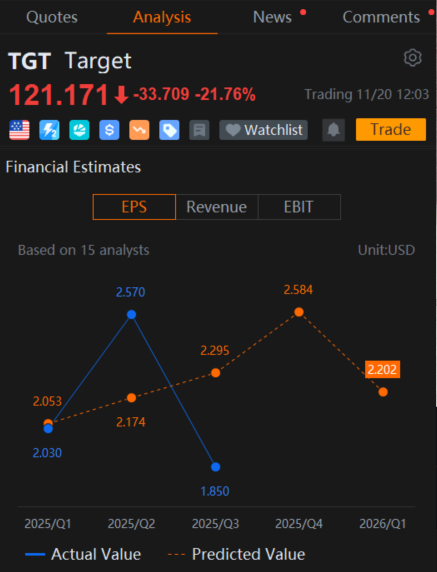

Shares tumbled to $121.18 at 12:02 p.m., poised for the lowest close in a year, after the company reported Wednesday morning a 12% decline in adjusted earnings to $1.85 for its fiscal third quarter that ended Nov. 2 after higher inventory boosted supply chain costs, eating into margins. The adjusted EPS missed the average analyst estimate by almost 20%. Sales of $25.2 billion also trailed expectations.

At the same time, the retailer lowered its full year earnings guidance to a range of $8.30 to $8.90, after raising it to $9 to $9.70 in August, as it expects flat same-store sales in the fourth quarter. The latest outlook is below the $9.54 expected by analysts, according to estimates compiled by Bloomberg.

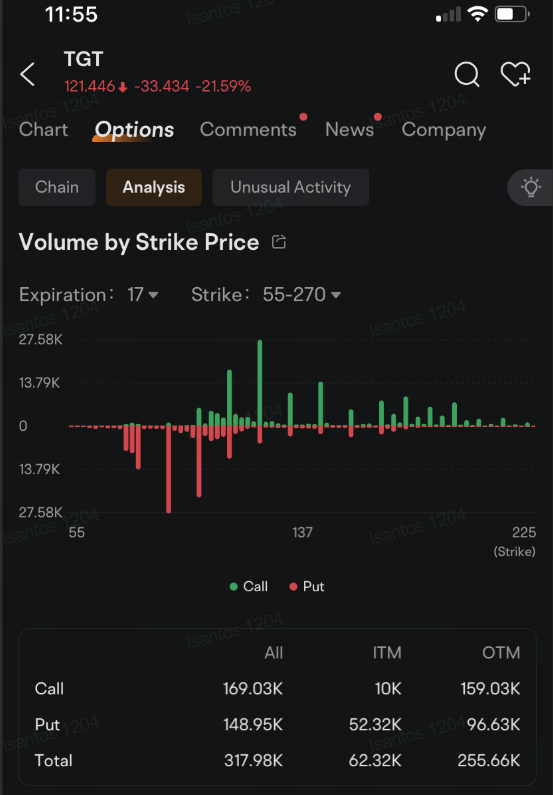

Put options that give the holders the right to sell Target shares at $120 in two days attracted the heaviest volume, with more than 12,500 contracts changing hands so far. That's more than 13 times the open interest. The price of that contract surged 3,500% amid increasing demand for a hedge against continued slide.

Almost 149,000 Target put options changed hands so far across 17 expiration dates that stretch through Jan. 15, 2027. That's almost 12 times the 20-day average, according to Bloomberg data. Including the call options, total volume reached 317,980, more than 8-fold the average. That made Target the seventh most active stock option behind $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $MicroStrategy (MSTR.US)$, $MARA Holdings (MARA.US)$, $Apple (AAPL.US)$ and $Super Micro Computer (SMCI.US)$. (To see the options ranking page, click here.)

The more than $33 slump in the stock price Wednesday boosted the probability that the $120 puts will be in-the-money before they expire Friday.

The quarterly results signal Target is likely losing market share to Walmart, Bloomberg quoted Citi analyst Paul Lejuez as saying. Target may need to implement more promotions to drive traffic and sales, making its fiscal 2025 outlook more uncertain, he said. The analyst cut his rating on Target to neutral from buy and lowered his price target to $130, from $188.

The stock's biggest decline since May 2022 took the price well below the lower line of the Bollinger band, a sign to some who study charts that the shares could now be oversold and the trend may turn bullish. Ten other technical indicators tracked by moomoo agree.

Institutional investors and speculators are also posting bullish Target trades, fanning the unusual option activities. The biggest of them was the $3.2 million sale of put options that give the holders the right to sell 400,000 Target shares at $105 by Jan. 16, 2026. That trade could be profitable for the seller if Target shares trade above that strike price by the expiration date.

Share your thoughts on Target in the comments section. Do you see it continuing to lose market share to Walmart? Can it still bounce back, or do you expect the stock to keep sliding the rest of the year?

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Moon fairy 大炮仙 ❤ :

Mrstocksplitsundae : target here in canada is dying ... so from my point of view its not a investment , same could be said for Tim Hortons...sad really the state this side of the boarder.

Judy wealthy Dula : WOW

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

sensitive Wolf_1649 : What the hell is this

Adrianlim90 : 1

104327919 : wow

Brandon Daniel : usa is not as great as it used to be

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)