Magnificent Earnings Week: What was your fave?

Magnificent Earnings Week: What was your fave?

Views 97K

Contents 472

ZmjjkK

joined discussion · Nov 1 18:36

Tech Giants' Earnings Roundup, Eyes on NVIDIA's Upcoming Surprise🚀

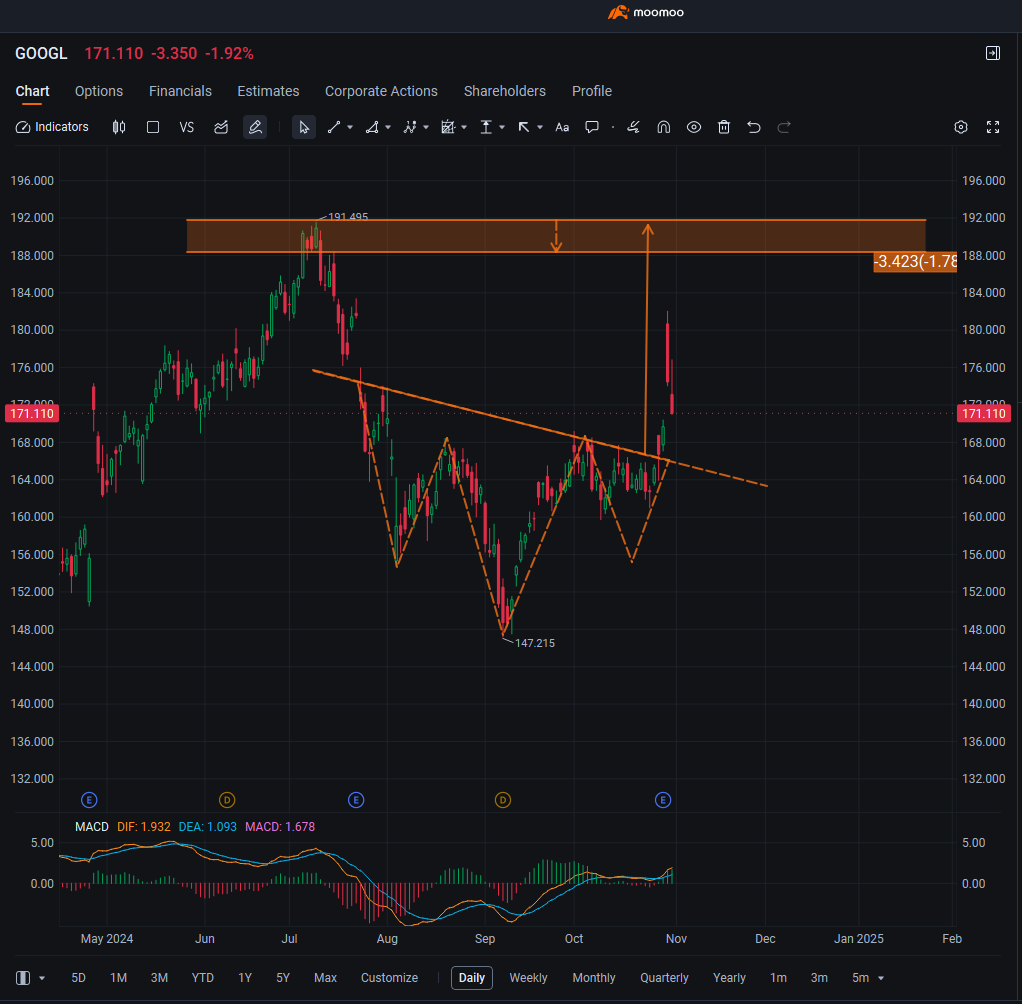

$Alphabet-C (GOOG.US)$ 's third-quarter results, reported on Tuesday, exceeded analysts' estimates due to increased advertising revenue, easing concerns about AI search competition. Technically, Google has seamlessly followed a bullish trajectory, breaking above its previous all-time high and continuing its upward momentum. Despite potential retests of the breakout level, the stock maintains an overall uptrend with the path of least resistance pointing higher. Levels to monitor include $200, $150, long-term bullish outlook.

$Advanced Micro Devices (AMD.US)$ 's recent financial update was followed by a breakdown of the critical support level at $148.01, indicating a potential continuation of bearish momentum and increased selling pressure. A significant bearish candle formed post-earnings, reinforcing bearish sentiment and highlighting sellers' control following support failure. AMD now appears to be testing the weekly trend line, a crucial support area, which if breached, could lead to a significant reversal in its trend.

$Meta Platforms (META.US)$ 's significant losses due to its metaverse business, which is projected to continue, have led to a substantial decline in its share price. The stock appears to be targeting a retest of support at $560. If a bounce occurs at this level, it will signal the arrival of buyers on weakness. Notably, both the 50-day and 200-day moving averages are in uptrends, confirming our bullish SID Buy Signal and providing confidence to buy any pullback in price, such as the current one following earnings.

$MicroStrategy (MSTR.US)$ 's share price, trading at 3.15x price/BTC, is approaching its all-time high and nearing the pre-DOTCOM bubble high of $333/share, adjusted for stock splits. While share price alone is not a crucial metric, this surge is fueled by the potential continuation of BTC's upward trajectory amidst buy-and-hold strategies and a declining Federal Funds Rate. Technical analysis suggests that this rally may indicate peak euphoria among MSTR shareholders.

$Microsoft (MSFT.US)$ 's Q3 earnings per share (EPS) of 3.30surpassedexpectationsof3.10, with gross revenue of 65.58 billion also beating forecasts of 64.57 billion. Despite these positives, MSFT shares experienced volatility in after-hours trading, dipping to 410from444. Today's technical analysis indicates a potential bearish gap at the opening, pushing MSFT's price towards the ascending blue channel's lower boundary, where buyers and sellers may reach a new consensus, setting up scenarios for either a rebound or a breakdown to the $400 level.

$Apple (AAPL.US)$ 's Q3 revenue set a new record for the period, growing 6% faster than expected, with iPhone revenue up 5.5% YoY following a decline in Q2, beating market expectations. However, services, iPad, and wearable device revenues fell short of forecasts. In my opinion, the shares of this company should be 13.4% lower than the current price, which means at $199.So, any correction in the shares of tech giants is an opportunity for investment entry.

$Amazon (AMZN.US)$ 's earnings significantly surpassed expectations, with total revenue and profits beating forecasts, while AWS and advertising revenues met expectations, and the cloud business showed accelerating YoY revenue growth. The midpoint of the guidance range for Q4 operating profit was above market predictions, driving a nearly 6% post-market rally. Technically, Amazon has been consolidating for nearly four years but is poised to break its previous all-time high and embark on a new major bullish cycle. Levels to watch are $190 and $500, and the stock remains fundamentally bullish, with a High Five Setup indicating potential upside to $220/$240/$260.

$Intel (INTC.US)$ delivered a standout performance, with its share price surging over 15% in after-hours trading before paring gains but still up over 7%. Recently trading at a .6 price-to-book ratio, the stock appears undervalued. My short term target is the 20 week moving average of around 25$. I still believe the stock is valued at 28-32$ based on assets and cash flows combined.

As of now, all tech giants except for

$NVIDIA (NVDA.US)$ have reported their earnings. Overall, revenues and profits exceeded expectations across the board. However, each company had its own shortcomings, which, given the high valuations of tech stocks, significantly impacted their share prices. This earnings-related sell-off provided an opportunity for share price adjustment. A common theme among the companies was an increased investment in AI, with no signs of reducing capital expenditures for next year. This bodes well for NVIDIA's performance, and based on Jensen Huang's statement about the high demand for Blackwell architecture chips, we can expect a positive surprise from NVIDIA's earnings after the market close on November 20.📈

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

胡空 HuKong : Thank for sharing. It’s great

73372627 : Very nice analysis, except a few points. Market react backward now because majority do not undersood that the companies push the flow cash in AI, in the detriment of big surprises. Hard to me to understand momentum reaction with out analizing the out-come.

For NVDA, I do not expect a super big surprise. Some of the Blackwell was ship but not on full scale. Maybe over the expectations of who??????. Ignore. They will be OK, and not to forgot: they push cash in the new facility and more development. Adverse institutions and many retails will not took this very well for the moment and will regret later.

Intel it is on his own path. Do not want the crown, just keep the first place in his business. They understood from long time that try keep the overal crown do not work to long. I think they has the best approuch: First in PC and develop on Defence.

Thanks, I appreciate your analyse. Go ahead, you are a valuable member.