*This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.

ZZZZakk : Very useful!!!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Stella-K : Just used the golden cross to make a trade. Fingers crossed!

Jrithe : Loving these insights! Trend lines and support levels are my go-to tools.

Blazing Option Picks : Thanks

Chia Ako : اسغسسةس

SupersonicBee BURRY : Stop loss stated in the chart is using sell stop order?

CNNT : This is my first trade using TA as a guide to enter a position.

Since I'm not a trader, I looked at long-term horizon first to see if there are patterns (chart 1). This stock has periodical highs and lows post-covid. The peaks are increasingly lower, and the bottoms are trending lower recently, signifying the more recent entry points, the less attractive the short-term earning prospects. But, we have to work with the here and NOW and now does look like an entry point has opened up.

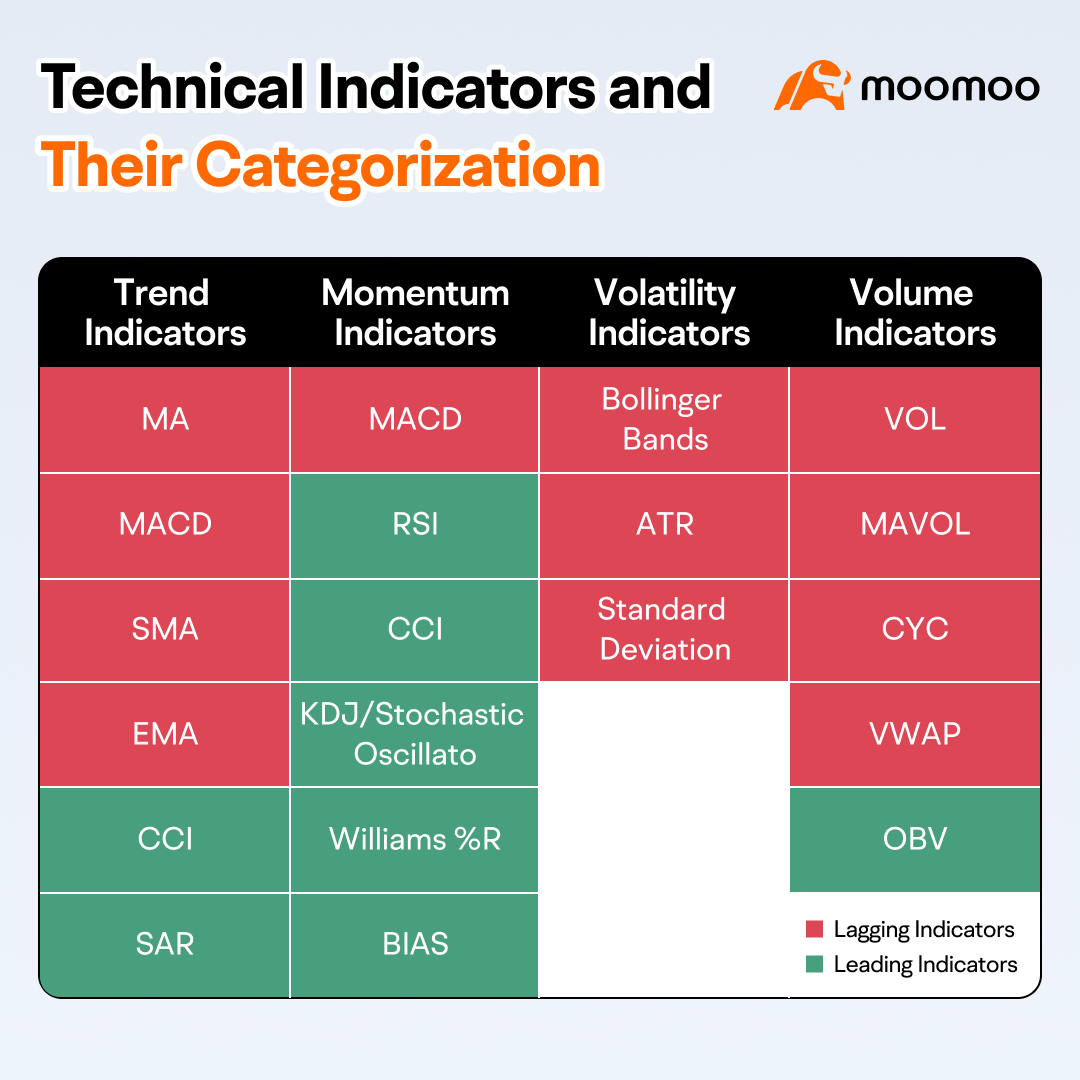

Let's zoom into the past month and look at the short-term trend now (chart 2). I think most people will say it's premature to go in now because MACD lines have only just crossed over, and ideally, we wait for a little bit more histogram momentum to get a confirmation. Furthermore, the EMA90 has only just touched the price line and not crossed it. This means the trend can still reverse.

I'm going in anyway (chart 3) as a bet that this will be a real breakout. So, it's either I entered prematurely and got burnt a bit, or I went in right at the bottom to gain a bit more.

Why am I taking this bet?

I don't plan to hold this stock for the longer term because of the macroenomy risks of the mining sector in China and the uncertainty of Brazillian government intervention in the company. This stock is more for short-term gains such as its high dividend, moderate financial performance, and trade options with it.

At the end of the day, it's ultimately a risk and reward expectation and balance.

Now that I've started to apply TA to my trades, I definitely feel more informed.

Let's see how this turns out.

Salami Ganiyu : Educative

CasualInvestor :

刘伯温 : thanks

View more comments...