Technical Analysis 101 | Chapter 3: Build your strategy

Feeling lost on how to create a personal investment strategy? Uncertain about how to evaluate its effectiveness? This post might just provide some of the answers you're seeking.

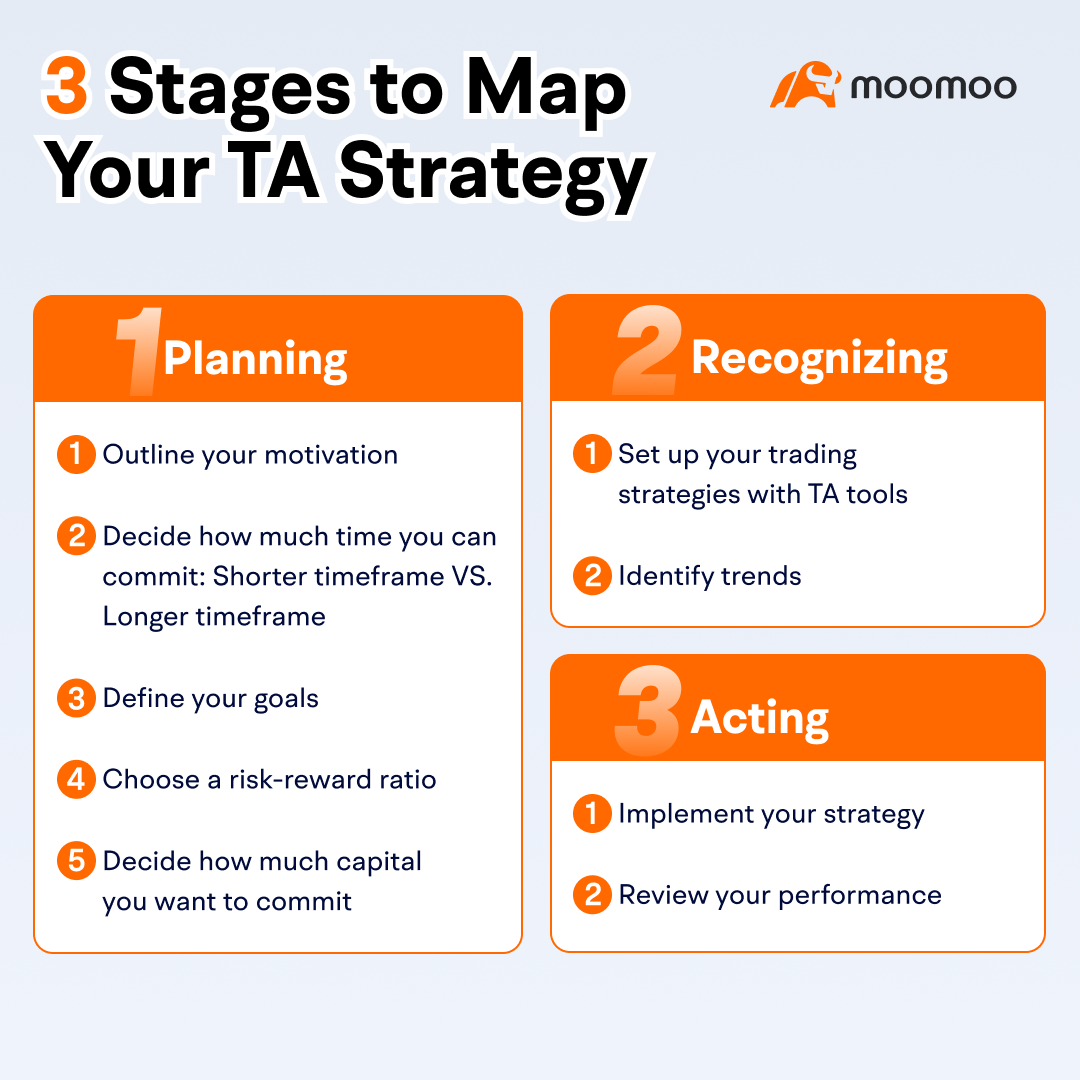

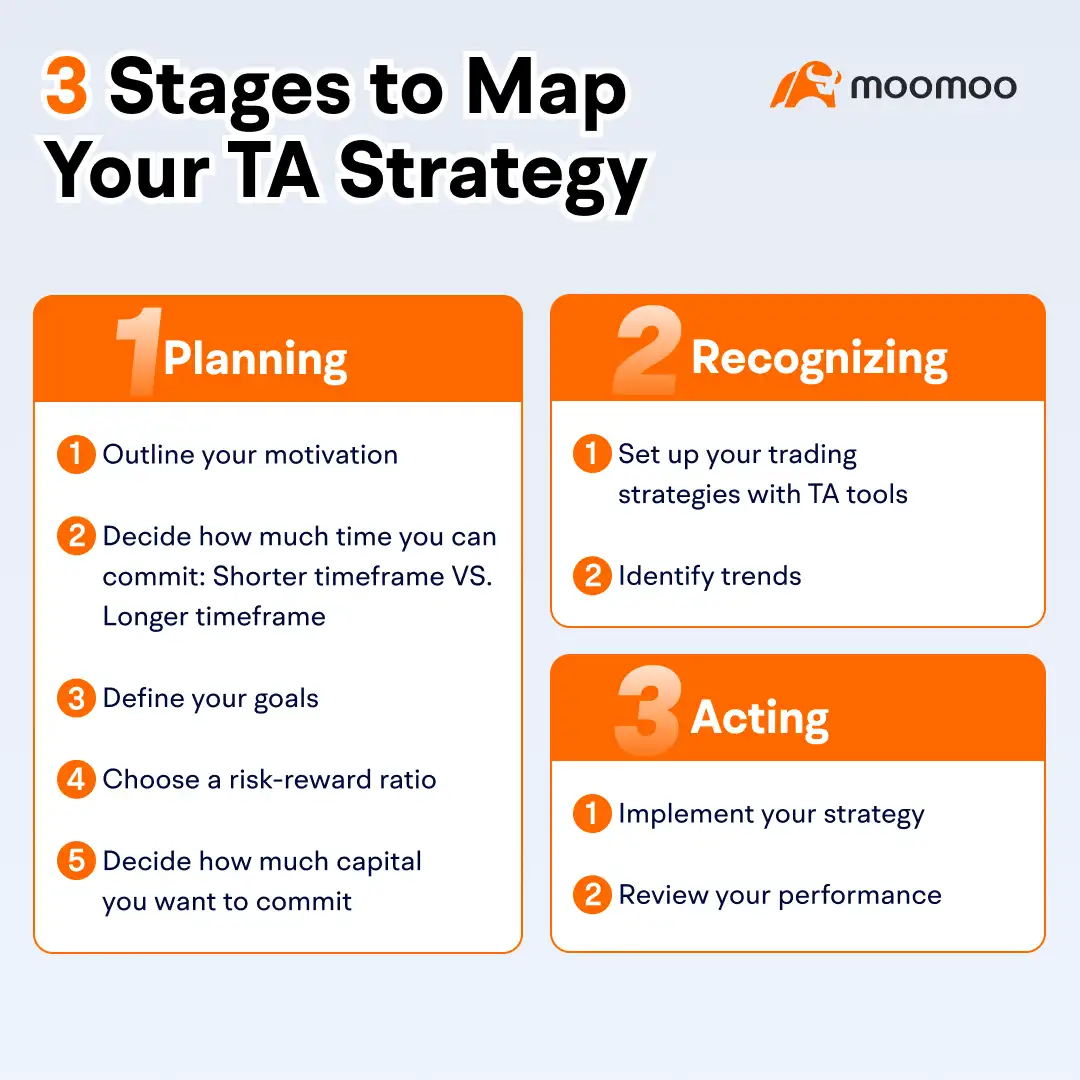

Map your TA strategy

A trading strategy that suits your personal investment goals and approach is crucial. Every strategy unfolds in three stages: planning, recognizing, and acting. It all starts with setting the trading rules you'll follow.

Map your TA strategy

A trading strategy that suits your personal investment goals and approach is crucial. Every strategy unfolds in three stages: planning, recognizing, and acting. It all starts with setting the trading rules you'll follow.

💡 Curious about different trading strategies and tips? Take a dive into the moomoo community. There, you can draw inspiration from other traders' success stories and pick up important takeaways from the trades that didn't work out.

Try out TA and see how you do

Eager to apply your TA knowledge? Go ahead and try paper trading. Remember, it's crucial to check your portfolio's profit/loss often. This helps you assess your trading strategy, pinpoint any issues, and figure out how to make it better. Tip: Gleaning insights from other mooers may give you a boost!

Try out TA and see how you do

Eager to apply your TA knowledge? Go ahead and try paper trading. Remember, it's crucial to check your portfolio's profit/loss often. This helps you assess your trading strategy, pinpoint any issues, and figure out how to make it better. Tip: Gleaning insights from other mooers may give you a boost!

💡 Moomoo features a tool that tracks four types of profit/loss data. Tap here to discover more. Also, follow our official accounts @Team moomoo for easy-to-follow guides. Don't miss the chance to win in events by @Meta Moo and @Popular on moomoo, where you can also share thoughts and tips with fellow traders.

This wraps up our extensive post. If your questions weren't addressed here, don't hesitate to visit the moo community. Simply click the search icon 🔍 in the upper right corner and type in your inquiry.

If this post was useful, please like it 👍 and share your thoughts 💬 with other mooers in the comments. Don't forget to "Save" 🔖 it for easy reference later and "Share" ➡️ it so your friends can also benefit.

*This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

CNNT : When is the deadline?

102362254 : I plan to add $Alphabet-A (GOOGL.US)$ after spotting a Bullish Sustained Wedge pattern, which signals a potential breakout following consolidation. This aligns with my strategy of combining TA with strong fundamentals. The wedge offers a clear entry point, minimizing downside risk through a stop-loss just below the recent low, while providing significant upside potential if the breakout occurs. If Google’s fundamentals such as earnings growth or advancements in AI support this move, and market sentiment is favorable, my confidence in the trade will increase.

CNNT : I entered this position based on 2 technical indicators (as a final step in the decision-making process after checking the financial health and growth prospects). This stock was already on my watch list).

$GENTING (3182.MY)$

1) Bullish divergence - recent price hit a lower low, and corresponding isolator hit a higher low as indicated the 4 circles.

2) Price penetrated the resistance line

To be honest, I would prefer a much stronger signal, but after looking at data from many counters in the past 2 weeks, I think it's hard to have a bullet-proof signal. Or maybe I am still in kindergarten on this.

CNNT : I got $MAYBANK (1155.MY)$ at a dip upon seeing the 'hidden bullish divergence'. Is it the strongest signal? No, the 2nd oscilator has not proven it reached the bottom yet. But I took it because this stock was on my watchlist and a long-term keeper.

Meta Moo OP CNNT : This event ends on October 20th.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Meta Moo OP : What recent TA moves have you made to choose when to buy or sell? Tell us in the comments. Event time: October 1st – 20th, 09:59 AM EDT/09:59 PM SGT/11:59 PM AET

Event time: October 1st – 20th, 09:59 AM EDT/09:59 PM SGT/11:59 PM AET

Earn 10 points by following these steps: tag the relevant stock and attach a screenshot showing your technical analysis. Plus, the top 5 comments with the most likes will receive 100 points (in addition to the 10 points).

Earn 10 points by following these steps: tag the relevant stock and attach a screenshot showing your technical analysis. Plus, the top 5 comments with the most likes will receive 100 points (in addition to the 10 points).

xixixixihhh 102362254 : That makes so much sense! Learned something new today!

Learned something new today!

Richard6398 : Great sharing

Topearnr-999 : Just sold all my lucid group stocks at +$3.34 ! I checked the analysis and future 3month high and 3 month low also 3 month average forecast this is how I determine weather I should sell if the average is below the current price I would sell and especially if the 3 month high is below the current value I would definitely sell !!

SupersonicBee BURRY 102362254 : Do you use buy stop or buy limit when buying in?

View more comments...