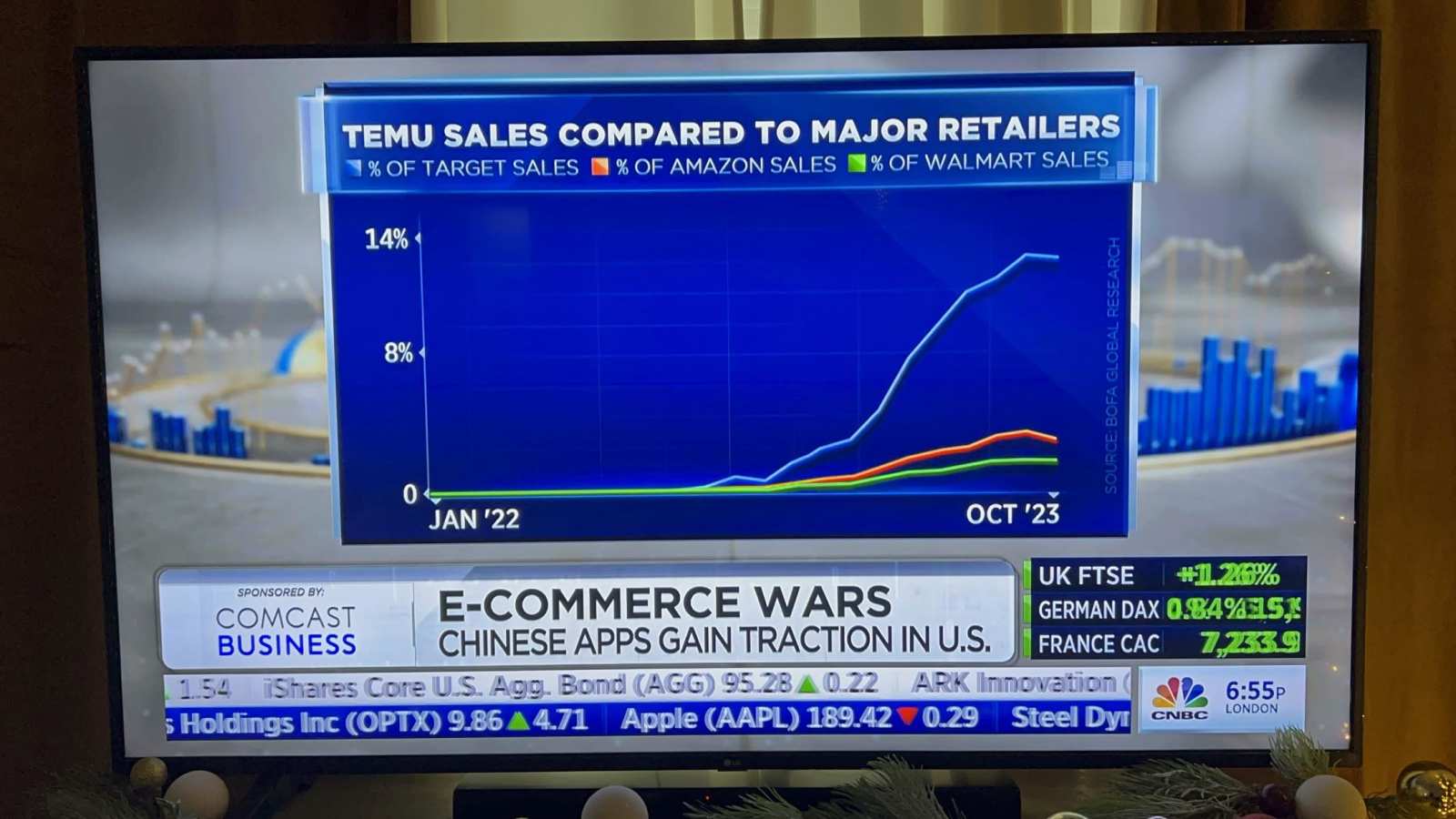

TEMU vs Amazon & Others

$PDD Holdings (PDD.US)$ as Temu continues to grown in America lets not forget that Temu also has exposure in Europe and South Asia. As $JD.com (JD.US)$ $Sea (SE.US)$ $Coupang (CPNG.US)$ $Alibaba (BABA.US)$ continues to lose market share to Temu in South Asia. Temu parent Company Pinduoduo is rapidly gaining favoritism in the Mainland China and Rural China. There biggest competitor in United States are $Amazon (AMZN.US)$ $Etsy Inc (ETSY.US)$ $Dollar Tree (DLTR.US)$ $Dollar General (DG.US)$ and Shien are also lossing share to Temu. Note that Amazon is still the gaint in e-commerce in the United States and any minor small digit of share loss to Temu is tremendous to them. The Dollar General & Tree goods are straight up trash , and many consumer can continue to purchase from Temu for better quality and value. Remember everything is made in china and Temu cuts the middles man in the e-commerce cycle.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

70504395 : It looks extremely cheap on its ad, but reality is very expensive when you go in and shop its merchandise.

Steven J OP 70504395 : More than Amazon

, I don’t think so

, I don’t think so  Temu still beats in value.

Temu still beats in value.

D454 : Temu in south east asia region will most likely be beaten down by local player, in the developing country area the biggest moat is a deep relation with govt, Temu blocker eventually is the govt which will block them to enter since Temu strategy will most likely do the price war that jeopardize local seller.

Steven J OP D454 : Yea, that could be true, but until that happens Temu will still benefits from the expansion. Just look at what how it’s affecting the South Asia giant $Sea (SE.US)$ - Shopee, they have to continue to spend a lot of money in order to stay relevant