Tesla 24Q2 Review: Whether the AI story can still support valuations

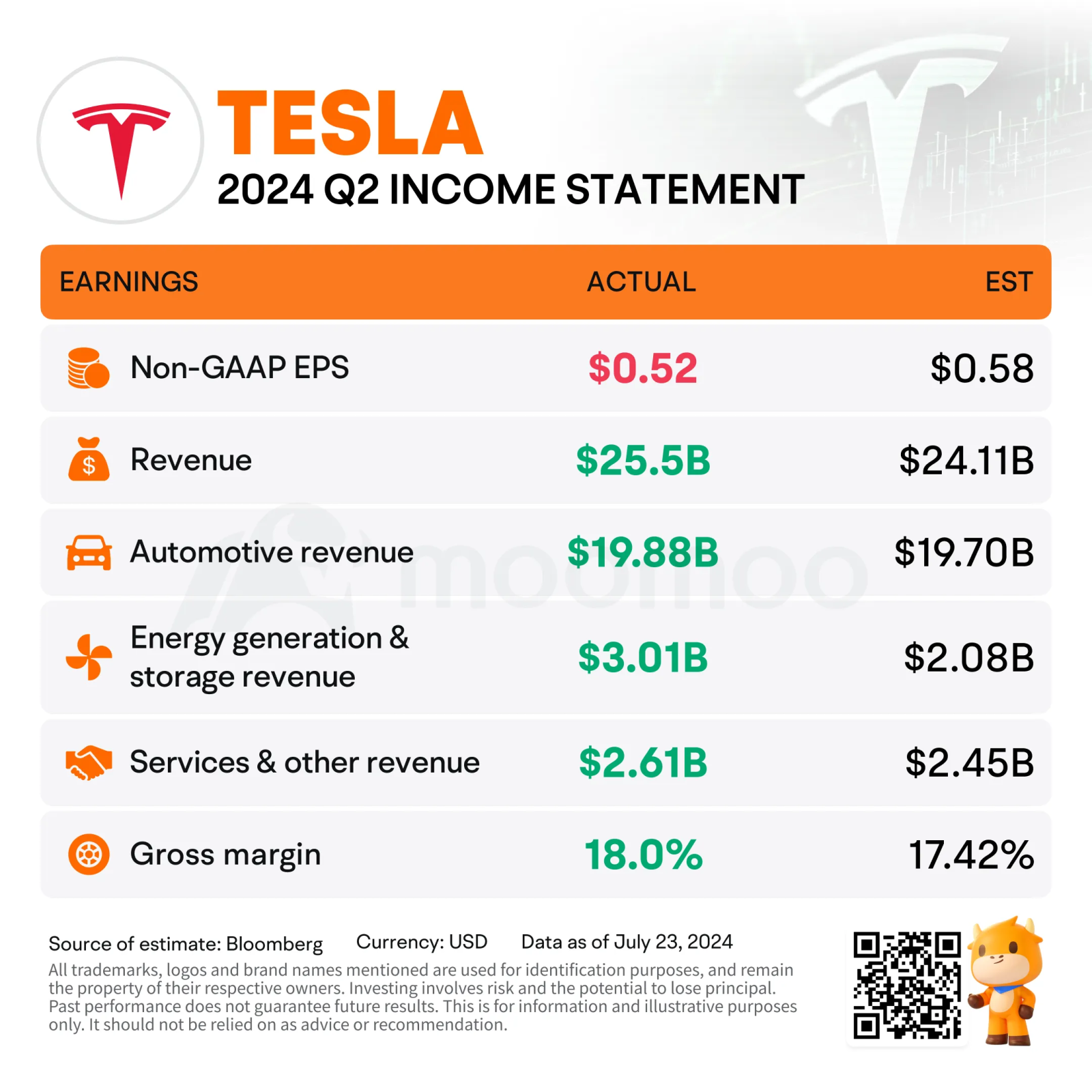

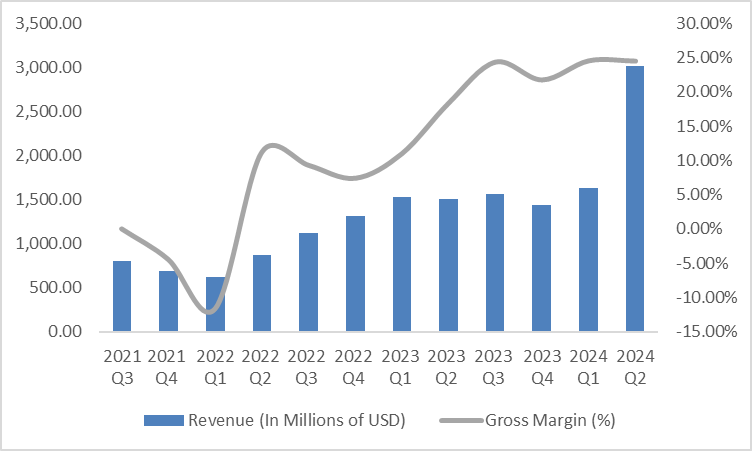

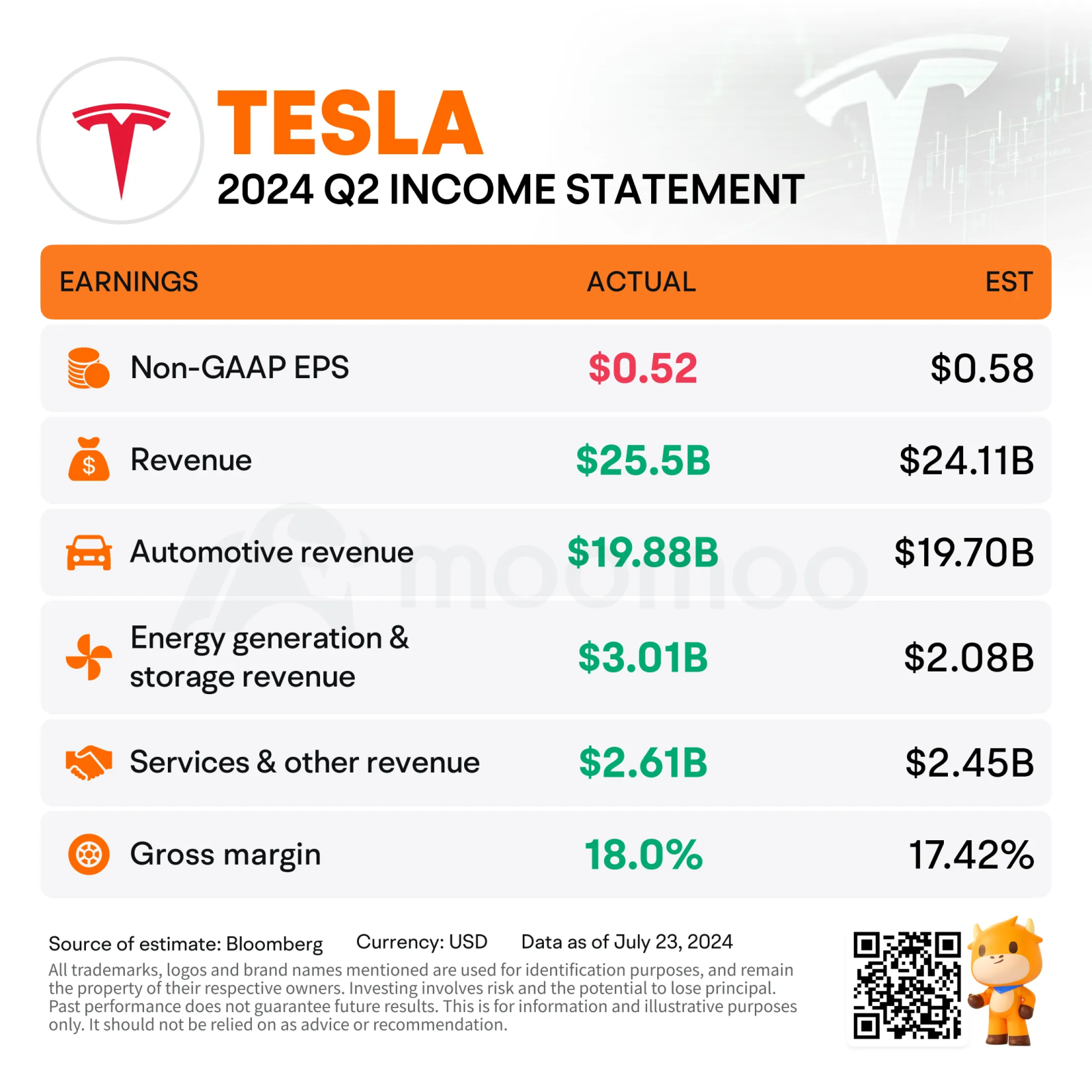

$Tesla (TSLA.US)$ released its second quarter of 2024 earnings after the U.S. stock market closed on July 24, with poor profit performance. Second-quarter revenue of $25.5 billion (the same below), up 2% year over year, exceeding the Bloomberg consensus of $24.11 billion; Gross margin for the quarter was 18%, higher than the Bloomberg consensus of 17.4%; But operating profit and adjusted EPS were weaker than expected.

The auto business exceeded expectations by relying on regulatory credits, the actual auto sales revenue performed poorly

Automotive revenue in the quarter was $19.9 billion, slightly exceeding consensus expectations of $19.7 billion. The automotive segment includes sales revenue of electric vehicles, leasing revenue, and sales revenue of vehicle regulatory credits;

However, it can be found that the revenue of pure automobile sales business was 18.5 billion US dollars, lower than the expected 18.7 billion US dollars; The reason for exceeding expectations was actually contributed by automobile regulatory points. This part of the business is clearly not a priority, and as more traditional automakers begin to increase their electric vehicle lineup, the demand for credits will become less and less in the future.

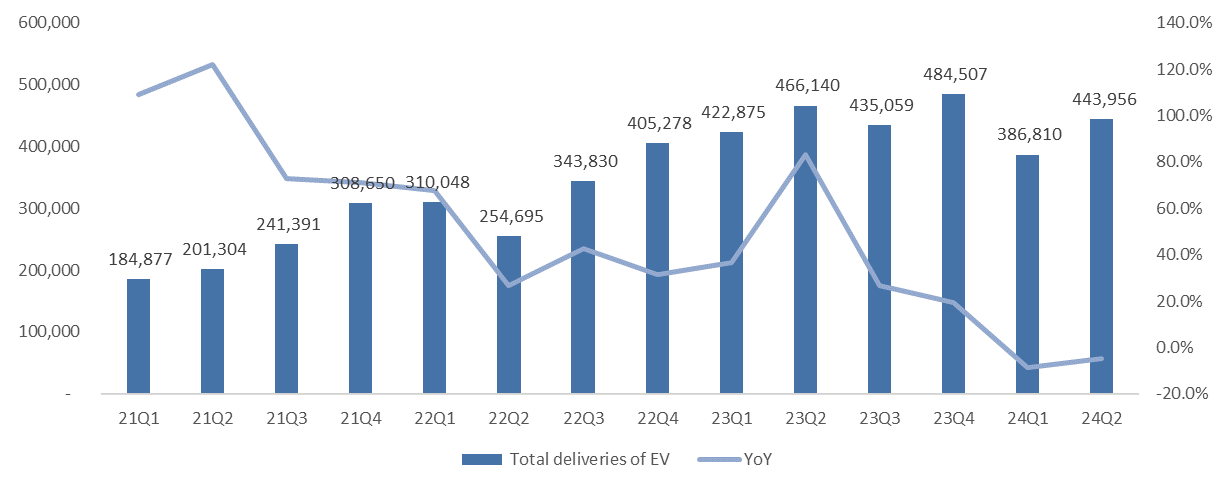

1. Deliveries improved sequentially in the second quarter, but market share declined

Tesla had previously announced production of 410,813 vehicles in the second quarter, down 5.2% quarter-on-quarter and down 14.3% year-on-year; Deliveries were 443,956 vehicles, up 14.7% sequentially and down 4.7% year-over-year.

The second quarter delivery trend, while slightly improved from the first quarter and exceeded consensus expectations of 439,302 units, remained soft and worrisome overall (especially given its extremely high valuation). Since the previous market expectations were significantly lowered, Tesla could exceed expectations with lower deliveries.

Figure: Changes in Tesla's deliveries

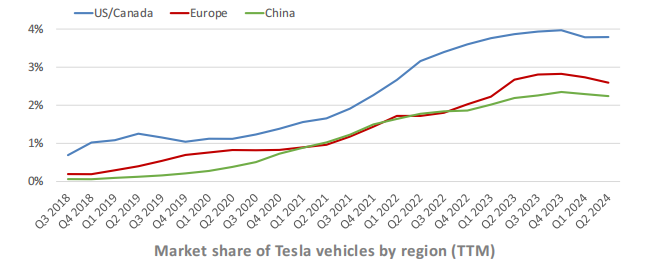

In fact, Tesla's car deliveries have declined for the second consecutive quarter, and the global new energy vehicle market grew by about 20% in the second quarter, which means that Tesla's market share in China, Europe and the United States in the second quarter is showing a downward trend, and the basic level of car manufacturing is still deteriorating.

Figure: Market share of Tesla vehicles by region (TTM)

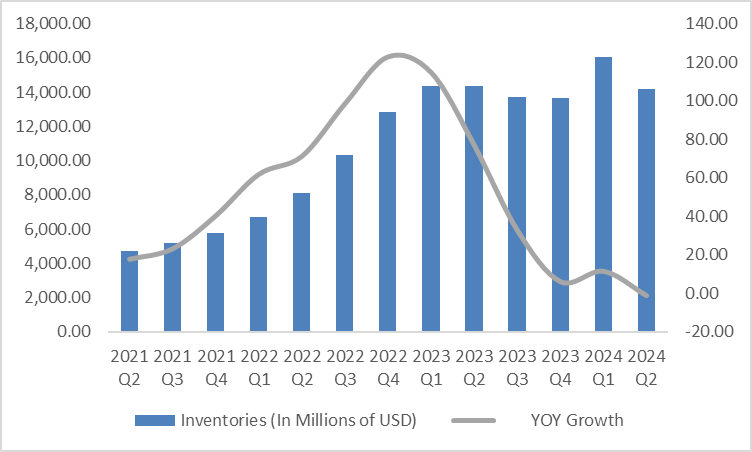

2. Tesla intends to digest inventory levels, but they are still high

Inventory levels were reduced in the second quarter. In the second quarter of 2024, 444,000 units were sold in the second quarter, but only 411,000 were produced, 33,000 more were delivered than produced, and the number of days of inventory turnover decreased in the quarter, resulting in working capital improvements, which increased free cash flow in the quarter from -2.5 billion in the previous quarter to 1.3 billion.

Figure: Tesla's free cash flow change

But overall, the level of inventory currently held by companies remains high, and in fact the end of the second quarter was the second highest after the first quarter, which could weigh on pricing and profits for some time to come.

Figure: Tesla inventory changes

Single vehicle revenue continued to decline

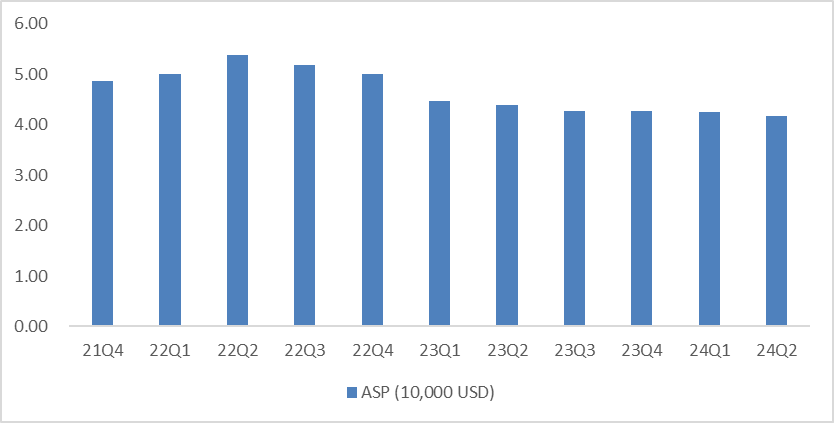

From the perspective of single vehicle revenue ASP, in the second quarter, Tesla's single vehicle revenue (excluding carbon credits and leases) continued to decline quarter-on-quarter to $42,000, down about 2% quarter-on-quarter.

The decline in single vehicle revenue is related to the price reduction strategy in China and the United States, the price reduction of Model 3/Y models in China in April, and the price adjustment of Model series models except Model 3 in the United States.

Figure: The change in Tesla's single vehicle revenue

Looking ahead to the second half of the year, the new energy vehicle market in Europe and China is still not optimistic, and the US market is expected to benefit from the interest rate cut in the second half of the year.

The European region is subject to tariffs, and higher prices could lead to weak demand. Since July, the European market has imposed tariffs ranging from 17.4 percent to 37.6 percent on Chinese-made electric vehicles, and Tesla's current Model 3 produced in Shanghai for export to Europe has been slapped with a 20.8 percent tariff. Tesla has raised the price of its Model 3 in European countries such as Germany, the Netherlands and Spain by about 1,500 euros (11,818 yuan) as a result. While these tariffs are currently temporary in nature, final tariffs will come into force in November, when Tesla and BMW, among others, will likely receive separately calculated rates. But in the second half of the year, Tesla's sales and gross margins in Europe are expected to be under pressure.

Continues to introduce preferential policies in China market, but the market share is not optimistic. Tesla cut prices on its Model S/X models in July and also announced its latest five-year zero interest rate policy. Spurred by price cuts, Tesla is expected to increase its sales in China in the third quarter. However, due to its more competitive landscape, Tesla's market share in China is still expected to decline.

The US market is expected to benefit from the rate cut in the second half of the year. With the Federal Reserve interest rate cut is imminent, the demand for electric vehicles bottomed out and new cars are expected to be released next year, and demand is expected to develop in a positive direction. The new version of Model 3/Y regained a $7,500 subsidy in the US market, which is conducive to a smooth market share.

The energy storage business has grown significantly and is expected to gradually reduce its dependence on the tram business

The energy business covers a full range of solutions from solar power and energy storage to electric vehicle charging. This segment generates revenue from the sale and leasing of related products and services.

Tesla's energy storage business mainly includes Powerwall and Megapack products. Powerwall is a home energy storage system that stores electricity generated by solar panels for use at night or during power outages. Megapack is a very large commercial energy storage system for large commercial and industrial customers such as data centers, hospitals and schools.

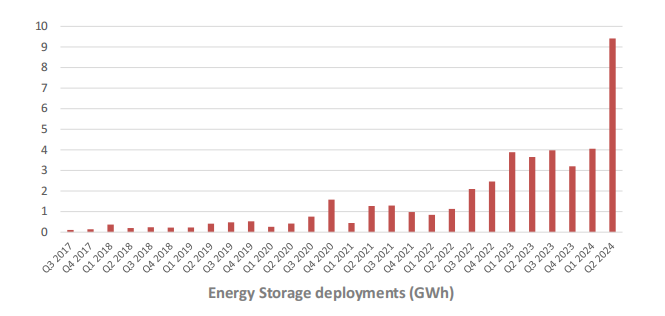

In the second quarter of 2024, Tesla made significant progress in energy storage products, and the electricity demand brought about by the AI boom is expected to drive the energy storage business. Energy storage business revenue in the second quarter of $3 billion, an increase of 100%, significantly higher than the market expected $2 billion. 9.4 GWh of energy storage products were deployed in the second quarter, more than double the 4.1GWh deployed in the first quarter and a record high for a single quarter.

Figure: Energy Storage deployments (GWh)

In the second quarter, the gross profit of the energy storage business reached $2.27 billion, with a gross margin of 25%, much higher than the gross margin of the automotive business of 15%. Moreover, due to scale effects and cost downs, the gross margin growth of the energy storage business in the past few quarters has also been very rapid.

Figure: Changes in revenue and gross margin of Tesla's energy storage business

Shanghai energy storage plant is planned to be put into operation in 2025, and it is expected that the annual capacity of Shanghai energy storage super factory will reach 10,000 units, and the energy storage scale will be nearly 40GWh. The growth of the energy storage business will help reduce Tesla's dependence on the electric vehicle business, provide performance support for Tesla, and improve the company's overall profit margin.

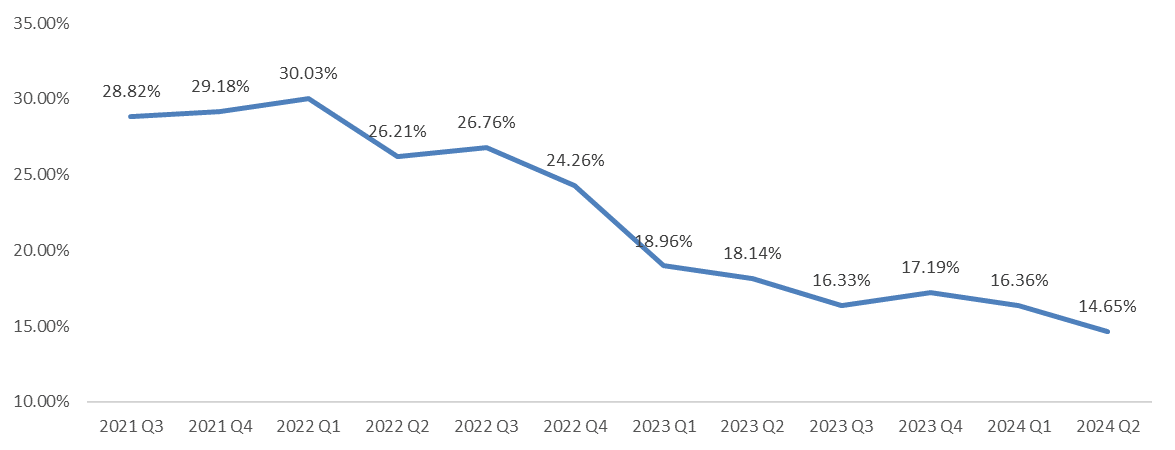

Overall gross margin exceeded expectations, but automotive gross margin performance was poor

The overall gross margin in the second quarter was 18%, lower than 18.2% in the same period last year, but higher than the market expectation of 17.4%; However, excluding regulatory points, the gross margin of the automotive business was 14.6%, lower than the market expectation of 16.2%, and continued to decline sequentially. In other words, the gross margin at the overall level is mainly brought by the contribution of the energy storage business and the service business.

Figure: Automotive gross margin excluding regulatory points (%)

Major adverse factors affecting the gross margin of the automotive business:

1) The decline in single vehicle sales prices, single vehicle revenue fell by about 2% quarter-on-quarter, the second half of the year is expected to continue preferential efforts, gross margin continues to be under pressure

2) cybertruck sales expand: In March, Cybertruck sold nearly 1,200 units, twice as many as rival Rivian R1T, showing market acceptance. In the conference call, it was mentioned that if the impact of Cybertruck climbing is removed, the cost of vehicles will decrease sequentially under the favorable conditions of upstream raw material costs. However, Cybertruck and Model 3 are still affected by raw materials and tariffs in the second half of the year, and costs are expected to rise.

3) FSD: FSD contributed positively to automotive gross margin in the first quarter. Following the price reduction, FSD's payment rate improved significantly, while the delayed release of FSD V12.4 may result in a weaker contribution to gross margin.

Restructuring charges weighed on profits. Operating expenses were up 39% year-over-year, while R&D and selling expenses declined sequentially in the second quarter. Primarily due to the impact of a one-time restructuring charge of $620 million, excluding the impact of restructuring charges, operating expenses decreased sequentially. The restructuring charge is related to about 10% of the job cuts in April.

FSD, Robotaxis and Optimus

Management went on to reveal Tesla's progress in its AI business during the call, including:

1. The Robotaxi product launch is postponed to October 10 to make important changes and improve the main display content.

2. FSD has made significant progress with the release of version 12.5, which has 5 times the number of parameters as 12.4 and merges the highway and city driving stacks. Tesla FSD will be available in China, Europe, and other countries in version 12.5 or 12.6.

3. The Optimus robot is already performing tasks in the factory, and production is expected to begin early next year with limited production.

4. The new Model 2 is expected to be launched in the first half of 2025, but the product roadmap was not disclosed.

Robotaxi and Optimus will have less of an impact on Tesla's earnings in the short term and more of an impact on its valuation. The market is more focused on whether Tesla can come up with more competitively priced models to meet consumer demand and drive the company's performance.

Conclusion

Tesla's current rally since April has benefited from the resolution of Musk's compensation issue and the injection of more AI imagination. The auto business still accounts for nearly 90% of sales. Compared with the actual performance, this round of rise is more event-driven, and although the fundamentals of car manufacturing have improved, they have not yet been substantially improved, reflected in the continued decline in gross profit margin, and the outlook for the second half of the year is still not optimistic.

Tesla's current valuation is much higher than that of its peers, the Non GAAP PE Forward in 2024 is still close to 100 times, and the market sentiment also has certain expectations for the AI story. Under the requirements of a high valuation, the flaws in performance will trigger the stock price to return to the fundamentals, and the stock price may fluctuate downward in the short term.

Given the above factors, we recommend that investors should avoid Tesla's valuation risk for now, and wait for the trolley business to stabilize at the bottom, or for the AI business to bring more event-driven opportunities in the fourth quarter.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Adamwonder : Very insightful article

NSIKAN DICKSON : $Futu Holdings Ltd (FUTU.US)$ @Analysts Notebook @Ava Quinn @Ashmajad @AY DO1

Space Dust : story. aka. fairytale. space.. lmfao

space.. lmfao  .

.

percentage excited to buy a second one? rofl

percentage excited to buy a second one? rofl

roadster in

maybe if Tesla stock can be on a green screen.

or Elon perhaps can achieve more than his hyperloop.

or amazing Semis..

don't forget the AMAZING investment Tesla trucks are!.

and the resale value. lol