Tesla Call Trades Reach Highest Level of the Year: Will a Gamma Squeeze Happen Again?

Options traders swapping Nvidia for Tesla

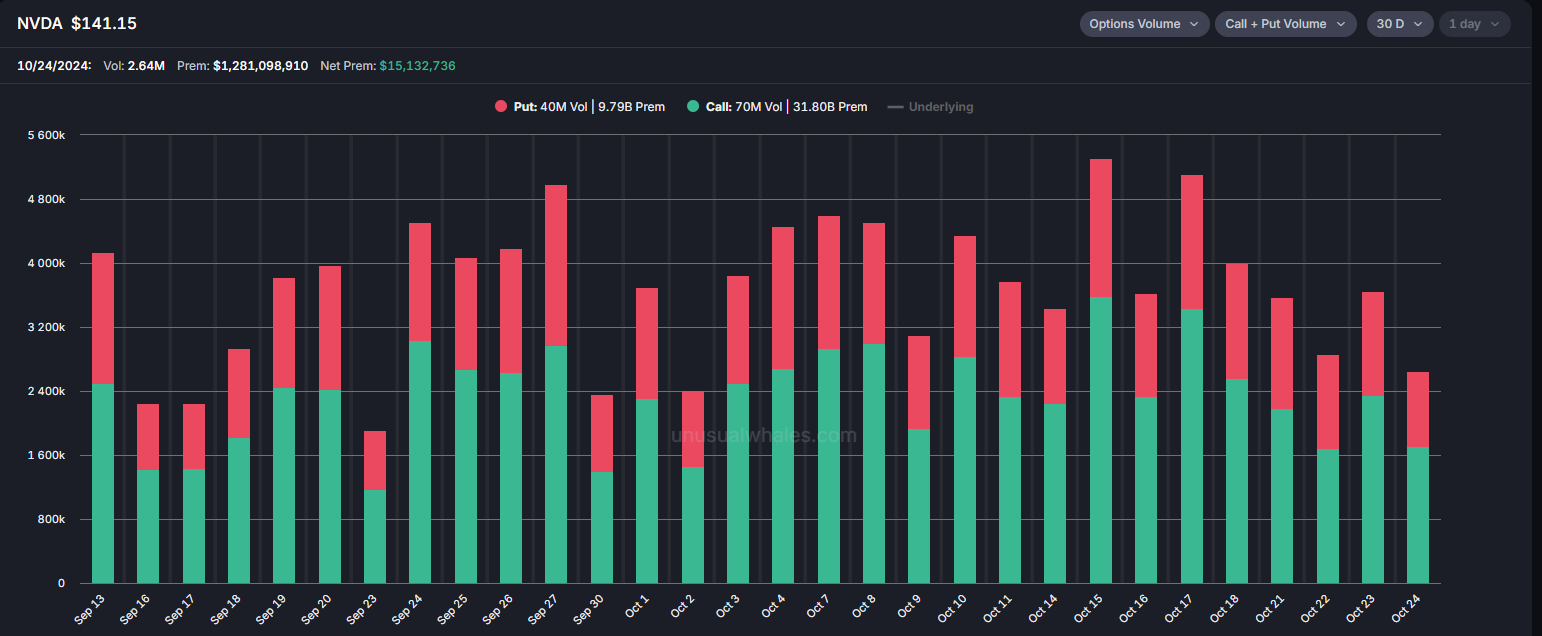

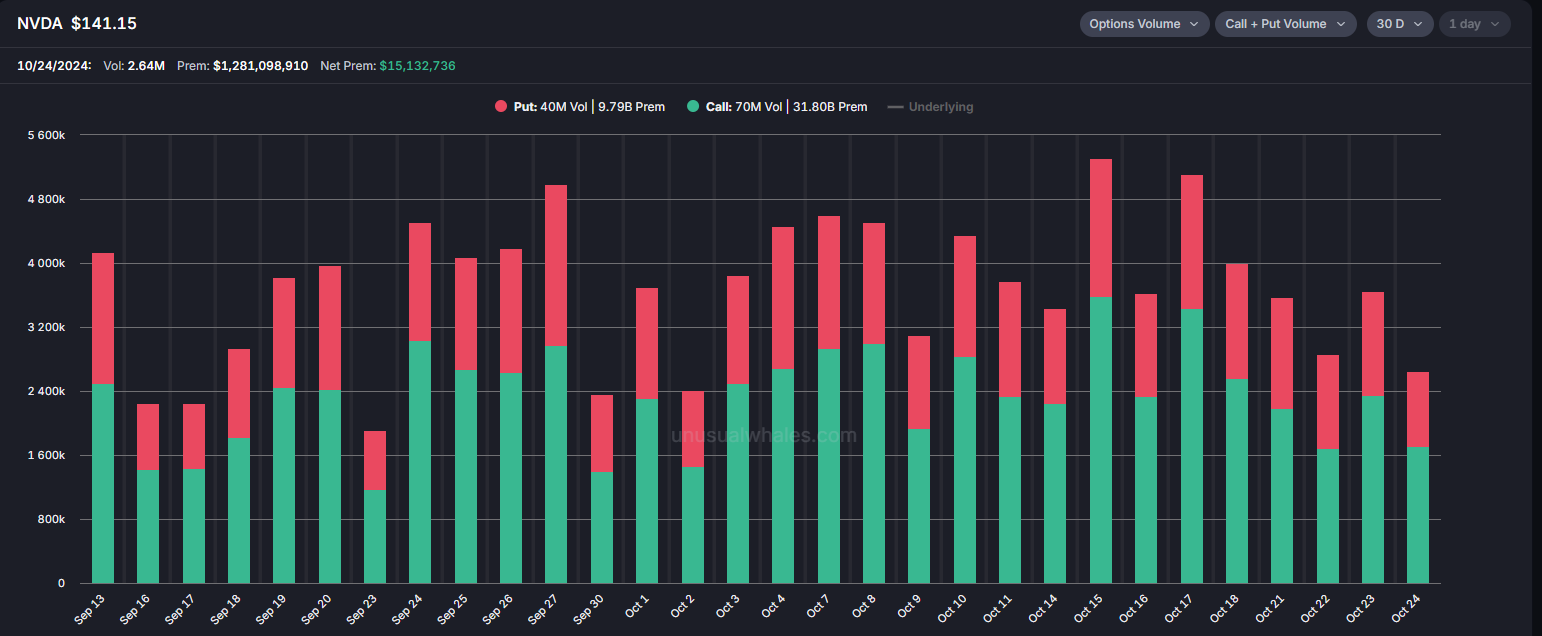

As Tesla's stock soared, Nvidia lost some of its allure for option traders. Call volume for Nvidia plummeted, with just 1.7 million contracts traded yesterday, significantly below the 20-day average of 2.5 million.

Attention clearly shifted to Tesla yesterday, as the stock soared over 20% on strong earnings and optimistic 2025 guidance. Call volume surged, more than tripling during the session.

In fact, yesterday's Tesla call trades reached the highest level of the year and marked the third highest on record, according to Gunjan Banerji, a journalist at the Wall Street Journal.

Will a gamma squeeze happen again?

A gamma squeeze is a rapid rise in a stock's price driven by options market makers buying shares to hedge their positions as the stock price increases. This occurs when there's a high open interest in call options, causing a feedback loop of buying pressure. If many short sellers are involved, it can amplify the price increase even more.

Such squeezes are not uncommon. In early August 2020, Tesla's stock price approached $300 for the first time in its history, and by the end of August, it was nearing $450. A series of factors contributed to this surge—electric vehicles were becoming increasingly popular, the company was preparing to join the S&P 500 index, and the board had just announced a five-for-one stock split. However, the primary driving force appeared to be the short sellers: in 2020, Tesla's short interest remained at double-digit levels for an extended period.

Notably, Tesla's current short interest is much lower than the levels observed in those years.

The options market is slightly bullish but overall calm

The volatility skew for Tesla stock, specifically the difference between the implied volatility of 25-Delta Put IV and 25-Delta Call IV, shifted more towards the bullish side yesterday. This skew reflects the market's tendency to price in volatility risk, favoring downside puts and upside calls in the option premium.

In terms of overall volatility, yesterday's implied volatility (59.28%) was even lower than the day before (63.74%) and significantly below yesterday's historical volatility (81.37%). This indicates that while high volatility occurred yesterday, the market expects future volatility to decrease.

Which options have the highest increase in open interest?

The call option with a strike price of $240 expiring on February 21, 2025, saw an increase of 49,642 contracts in open interest yesterday, bringing the total open interest to 52,488 contracts.

The call options with strike prices of $262 and $282 expiring next week saw increases in open interest of 38,356 and 37,816 contracts, respectively, yesterday.

The put option with a strike price of $250 expiring today saw an increase of 37,816 contracts in OI yesterday.

Source: investing.com, unusualwhales

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Lavelle Smith : understand completely thank you for opportunity too investment make moneylines HAPPINESS

Chak : So the sudden surge in price at 9:30 AM is due to the options market opening

SHng80 : yes

Laine Ford : good new about tesla

Adrianlim90 : 1

Mrstocksplitsundae : what aload of maneur! more short sellers ampliy. what clown plant this guy from.

Mrstocksplitsundae Chak : yup if they don't they lose and are about too.

101587649 : Ok

105446847rich Chak : yes...the share was push up by call option...the fund get huge profit by option trade...by the way this share can have big drop in any time if Trumpth loss the election...be careful...even it look bullish...

enfath2022 : yess!

View more comments...