Tesla Earnings Preview: Will Robotaxi and Energy Storage Drive Stock Performance?

$Tesla (TSLA.US)$ is set to release its second-quarter earnings report for the period ending June 30 after the market closes on July 23. Since late June, Tesla's stock has been on an upward trajectory, driven by a combination of better-than-expected delivery numbers, anticipated valuation from AI developments, and CEO Elon Musk's political positioning. The stock has rebounded 80% from its April lows.

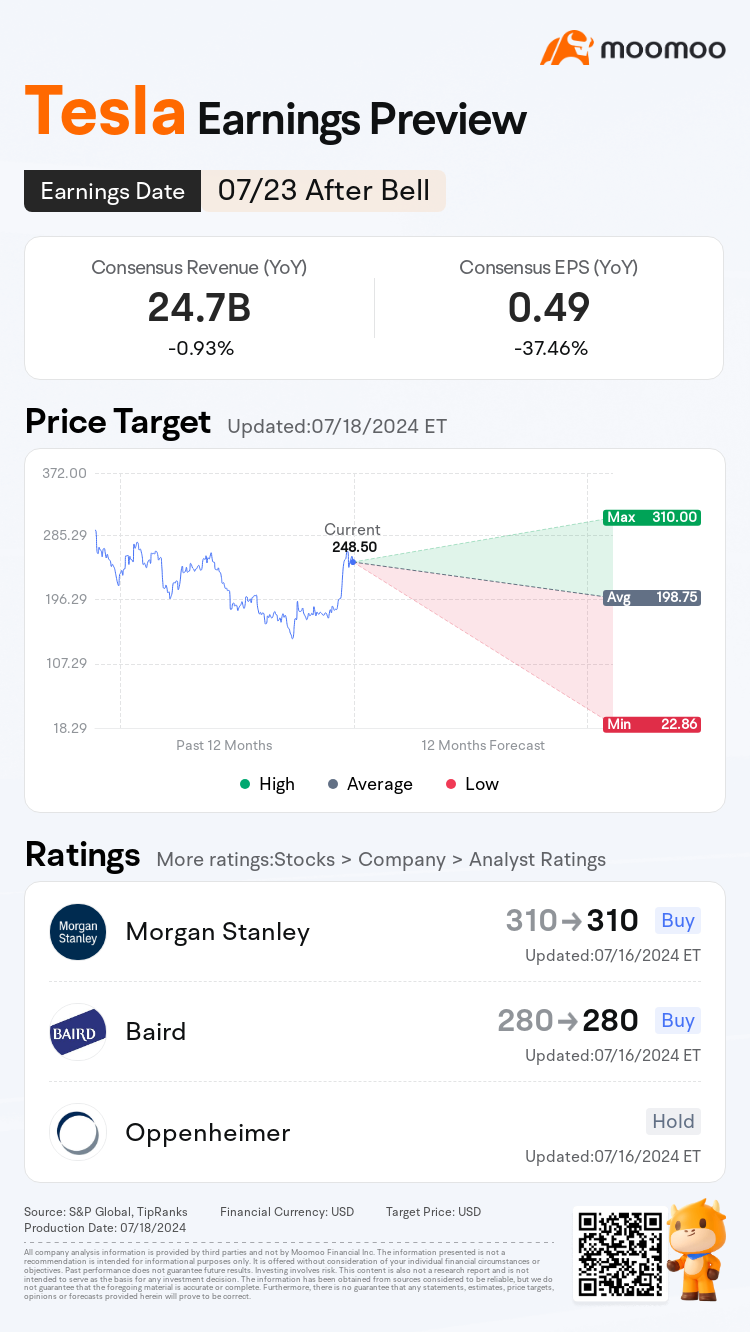

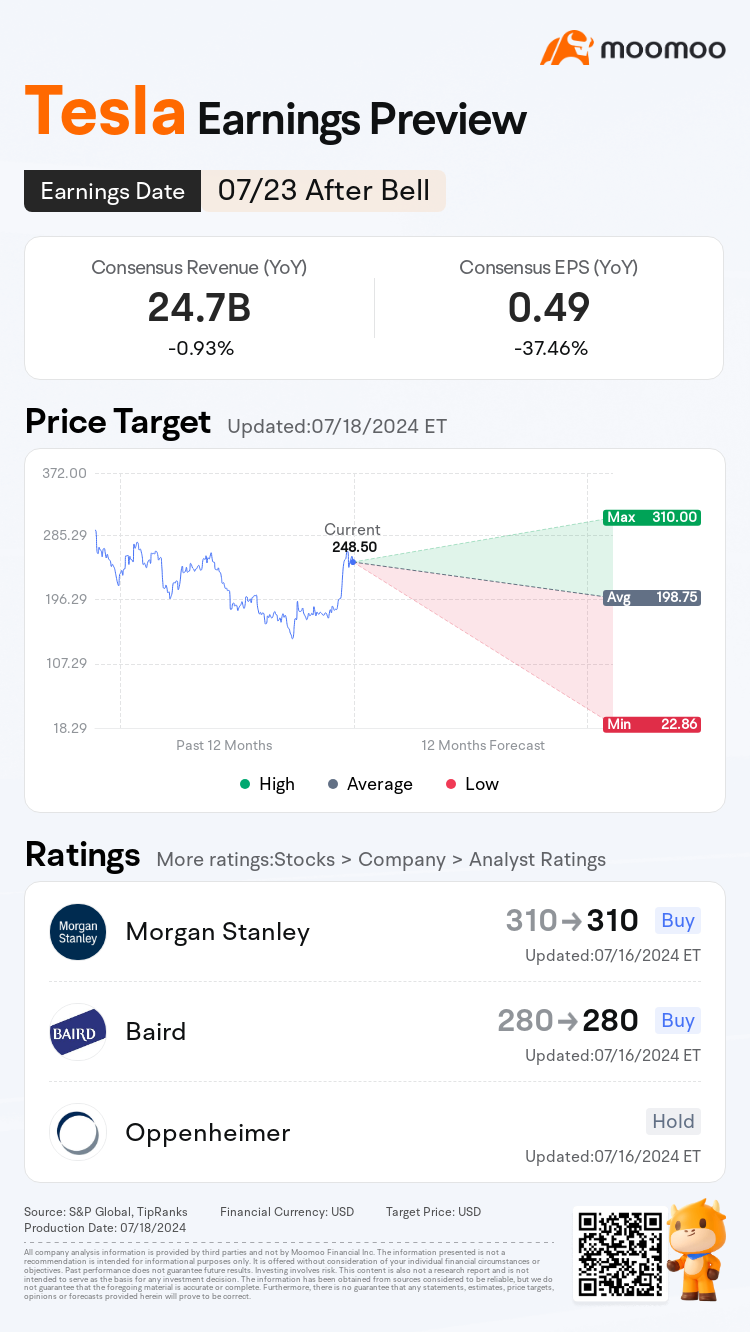

Consensus Estimates

According to consensus estimates from Bloomberg, Tesla's second-quarter figures are projected as follows:

Revenue: $24.7 billion, a year-over-year decline of 0.93% but a quarter-over-quarter increase.

Diluted Adjusted EPS: $0.49, a decrease of 37.46% year-over-year but up quarter-over-quarter. Despite the quarter-over-quarter improvement, year-over-year metrics still show a decline.

Here's a closer look at the underlying elements:

Core Business: Electric Vehicles Profit Improvement

Tesla's revenue is predominantly driven by three segments: automotive, energy generation and storage, and services and other.

Automotive: This includes sales of electric vehicles (EVs), leasing revenue, and regulatory credit sales.

Energy Generation and Storage: This division develops lithium-ion battery storage solutions and solar systems for residential and commercial use.

Services and Other: This includes non-warranty after-sales services, paid charging services, and used car sales. For 2023, over 93% of Tesla's revenue is expected to come from EV sales and related services, underscoring the core importance of its automotive business.

Automotive Deliveries: A Mixed Bag

Tesla's second-quarter production stood at 410,813 vehicles, a 5.2% decline quarter-over-quarter and a 14.3% drop year-over-year. However, deliveries were up by 14.7% quarter-over-quarter to 443,956 vehicles, albeit still down by 4.7% year-over-year. These figures slightly exceeded market expectations of 439,302 vehicles but remain weak, raising concerns given Tesla's high valuation.

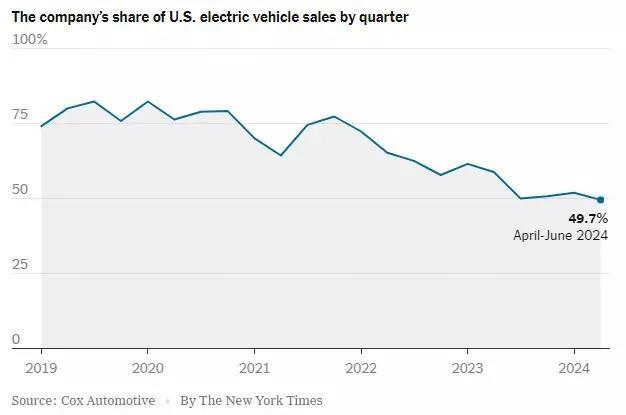

Even as overall EV sales hit a record high in the second quarter, Tesla lost market share to rivals in its domestic market.

Inventory and Market Share Concerns

Tesla managed to reduce its inventory in the second quarter, aiding in free cash flow growth. Deliveries surpassed production by 33,000 vehicles, partially reversing the first quarter's overproduction. This reduction in inventory days by seven days positively impacted Tesla's stock. However, inventory levels remain historically high, second only to the first quarter, potentially pressuring future pricing and profit margins.

Regional Challenges: Europe and China

Europe: Demand remains weak as countries like Germany and France reduce subsidies for non-EU produced EVs, impacting Tesla's European sales.

China: Despite rising sales due to aggressive price cuts and government subsidies, Tesla's market share in China is expected to decline due to intense competition. Recent promotions, including significant discounts and zero-interest financing, may boost sales but at the cost of margins.

United States: The U.S. market shows signs of recovery, aided by price reductions and lower interest rates for financing. Future demand is expected to improve with anticipated Federal Reserve rate cuts.

Energy Business: A Bright Spot

Tesla's energy generation and storage division posted significant growth, deploying 9.4 GWh of storage products in the second quarter—a sequential increase of over 129% and a year-over-year surge of 154%. This segment's gross margin of 25%, compared to the automotive segment's 16%, highlights its higher profitability. If this growth is sustained, it could significantly boost Tesla's overall revenue and net income, reducing its reliance on EV sales.

Robotaxi and Full Self-Driving (FSD): Future Prospects

Despite immediate financial challenges, Tesla continues to focus on long-term growth and innovation. A key area of interest is the development of its autonomous taxi platform, known as Robotaxi. CEO Elon Musk confirmed that the anticipated debut of these vehicles, originally scheduled for August 8, has been postponed to October. While this delay allows the design team additional time for refinements, it is expected to have minimal impact on Tesla's near-term earnings and valuation, as significant revenue from Robotaxis is not anticipated until 2027. Nonetheless, investors will be keen to hear updates on this initiative, which could be a potential game-changer for Tesla's future revenue streams.

Another focal point for investors is Tesla's Full Self-Driving (FSD) suite of advanced driver-assistance systems. According to Cantor Fitzgerald analyst Andres Sheppard, the adoption rate of FSD is a critical metric to watch. A steady stream of recurrent revenue from FSD could significantly bolster Tesla’s margins and cash flow, particularly as the company has been lowering its vehicle prices. FSD is available not only on new models but also on older Tesla vehicles, potentially opening up an even larger revenue stream.

Sheppard notes that Tesla has been "somewhat in the middle" in terms of transparency regarding FSD adoption rates. However, investors are hopeful that the company will provide more quantifiable data on this during the earnings call. FSD remains one of the most polarizing issues among Tesla's bulls and bears, central to many questions from institutional investors.

FSD is priced at $99 per month or a one-time lump sum of $8,000. The ongoing accumulation of data from FSD 12 could further bolster automotive margins if Tesla manages to increase its subscription base. Investors will be looking for clear indications of FSD adoption and its impact on Tesla’s financials.

Valuation

Tesla's current valuation is notably high, with a forward P/E ratio for 2024 reaching around 100 times. As of now, the stock trades at $248, significantly higher than the $108.1 level when the delivery outlook was more optimistic. This surge is largely driven by event-based factors and AI valuation expectations rather than fundamental performance improvements.Given the elevated valuation, the risk of a correction is substantial if Tesla's earnings or guidance fall short of market expectations. The broader uncertainty in this earnings season, characterized by mixed reactions to financial results, further complicates the outlook. Investors holding Tesla shares may consider hedging their positions. Selling call options could be a strategy to lock in some gains while earning premium income.

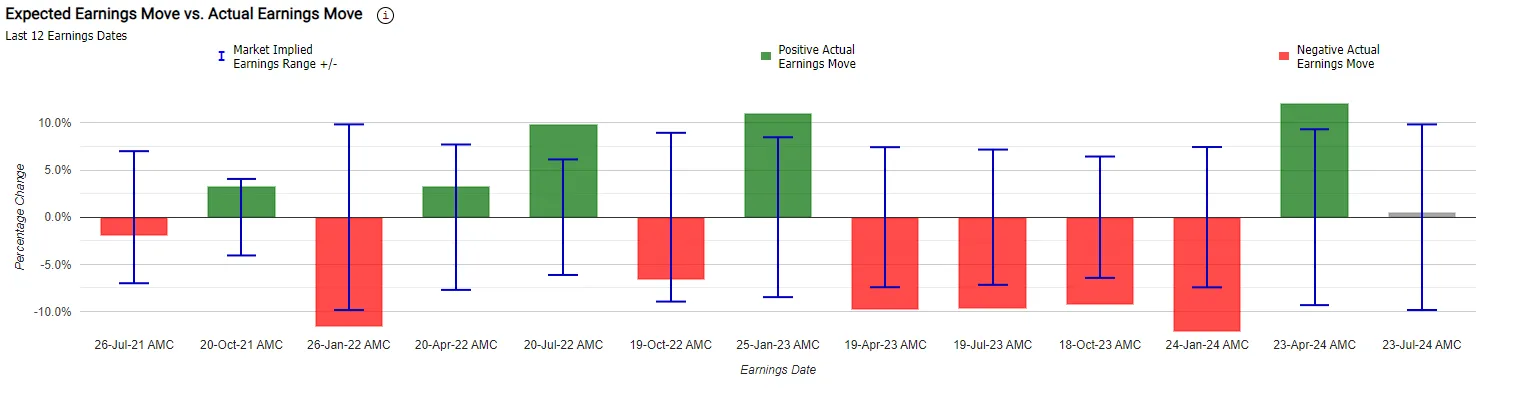

Historical Performance and Market Expectations

According to data from Market Chameleon, Tesla's stock has a historical tendency to decline on earnings release days. Over the past 12 quarters, the stock has dropped about 58% of the time on the day earnings were announced. The average price movement on these days has been ±8.4%, with the largest one-day decline at -12.1% and the largest gain at +12.1%.Currently, the options market is implying a one-day move of ±9.8% following the earnings release, indicating that traders are expecting significant volatility. This implied move is lower than the average post-earnings price change of ±10.8% observed over the last four quarters. This discrepancy suggests that the current options market might be undervaluing the potential volatility of Tesla's stock in response to its earnings report.

Source: Bloomberg, Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RedDevil7 : Postponing and missing target is common now for Tesla

103249058 : Why are they all the same?

103809741RahimiRamly : thanks

Trung Luong : It’s all about the story. U have to ask if the story is worth the premium price. If yes, the next questions is does other too cause if they are not that you are holding an ugly stick waiting to be beautiful again.

105535782 : ok

73065280 : Can you get ahold of Eli and mus for me

Market-Watcher : sell short

Malik ritduan : pad

Jooooohn : Whoever put it at a $22 price target should not be in the business. But we know what they are doing.

Laine Ford : maybe and the future

View more comments...