Tesla Gets New Street-high Target Following FSD V13 Rollout. What's Next?

$Tesla (TSLA.US)$'s stock saw an uptick on Monday morning following the company's initiation of its latest Full Self-Driving (FSD) update rollout to both employees and a select group of external customers over the weekend. Despite a 1% decline in after-hours trading due to a court's rejection of Musk's $56 billion pay package, Tesla shares ultimately rallied, achieving a net increase of over 2%.

FSD's Remarkable Updates and New Street-high Target

Investors have been keenly following the progress of Tesla's FSD, particularly due to its implications for the future launch of the RoboTaxi. According to Tesla AI team member Yun-Ta Tsai, the new FSD V13 is 'the biggest rewrite since we embarked on our photon counting journey four years ago.' Tsai stated that FSD V13 constitutes a complete overhaul of the system, with enhancements from V12 to V13 being more substantial than previous updates from V11 to V12. He likened the clarity and performance of V13 to that of SpaceX’s Raptor Engine V3, used in the Starship spacecraft.

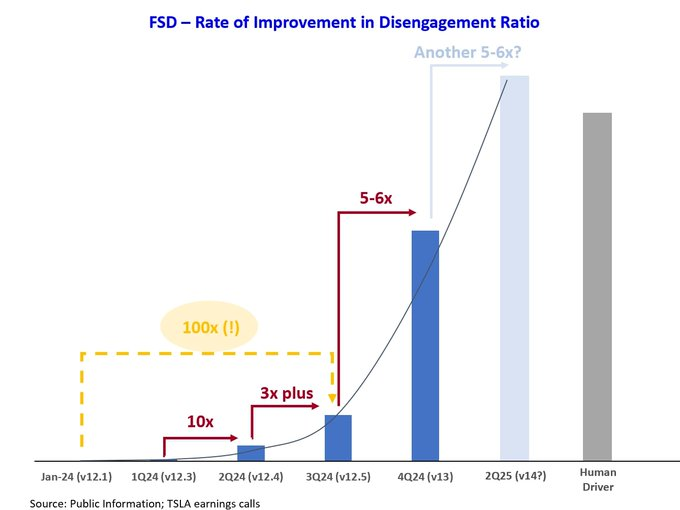

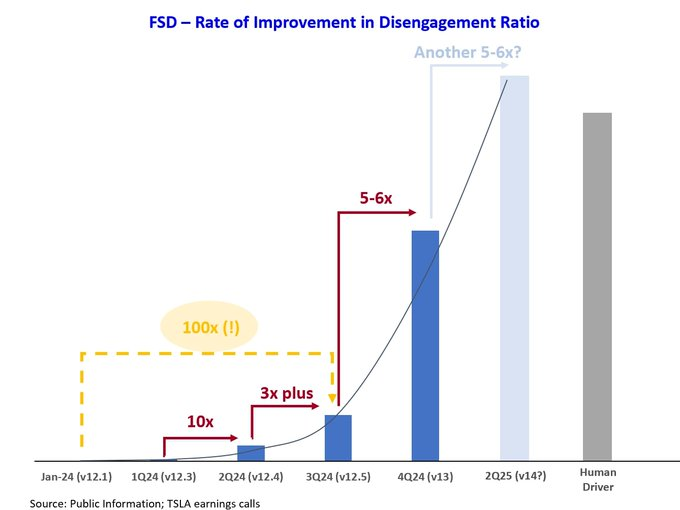

During Tesla's third-quarter earnings call, Musk expressed his expectation for achieving fully autonomous, unsupervised FSD in California and Texas by next year for the Model 3 and Model Y. The updated FSD version 13 is touted to reduce the need for driver intervention sixfold. This significant improvement is viewed as a pivotal development that could accelerate the deployment of Tesla's RoboTaxi service.

In response to these developments, Stifel has significantly raised Tesla's target stock price from $287 to $411, maintaining a Buy rating and emphasizing that Tesla is 'not just an automaker.' Stifel indicates to investors that the significant value creation potential from Tesla's AI-based full self-driving capabilities and Cybercab robotaxi underpins its positive outlook.

Additionally, Roth MKM upgraded Tesla's rating from Neutral to Buy and adjusted the target price from $85 to $380, arguing that Musk's authentic support for Trump likely doubled Tesla's pool of enthusiasts and lifted credibility for a demand inflection.' The firm highlights a transformative global landscape and praises Tesla's principal AI objective of developing a smarter copilot to handle exponentially more complex situations than competing products. It also notes that Tesla's CyberTaxi initiative is poised to benefit from a more favorable regulatory climate.

Potential Catalysts for Tesla's Stock: Investment Calendar

Key upcoming events that could influence Tesla's stock price include further updates on FSD, the RoboTaxi program, the Optimus project, and any deregulatory moves during Trump's presidency that might favor self-driving technology. Investors are also anticipating the production start of the Optimus robot in significant numbers following design improvements and the scaling of its supply chain, as mentioned by Musk on Twitter and at Tesla's annual shareholder meeting. Additionally, Musk's comments at the 2024 shareholder meeting about increasing Cybertruck production to 2500 units per week by year-end and the potential re-emergence of the more affordable rear-wheel-drive Cybertruck previously listed at $60,990 are being closely watched.

In January, Tesla is scheduled to release its Q4 production and delivery figures on January 2, followed by the earnings release for 2024 on January 24. Moreover, significant management changes are expected in the United States on January 20th, 2025, a factor that could influence Tesla's operations, especially since Musk has a forthcoming role in the Department of Government Efficiency. Any hints of governmental favoritism towards Tesla in Trump's speeches could further elevate the company's stock price.

Looking into the first quarter of 2025, Tesla aims to introduce its advanced driver assistance system, known as Full Self-Driving technology, in China and Europe, pending regulatory approvals. The approval of FSD in these regions would be a strategic win for Tesla, particularly in China—its largest overseas market, where numerous brands are challenging Tesla's dominance and developing their own advanced driver assistance technologies.

Source: Forbes, Bloomberg, TESLARATI

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104088143 : How is it?

10baggerbamm : all of these naysayers that talk crap of hell Tesla's technology is inferior to other companies that use mounted cameras/lidar. by June of next year Tesla's technology is going to exceed 500,000 miles which is the average miles driven by a human before an accident occurs. by the end of next year Tesla's technology will be approaching a million miles, and it's only going to evolve beyond that.

102983760 : all the way Tesla !

103356238jenny tan : k

105742796 Learner : I’m learning

Adrianlim90 : 1

10baggerbamm 105742796 Learner : why would you ever want to bet against Elon Musk? the guy can catch a rocket with chopsticks think about that.. so when he told everybody earlier this year if you don't believe we're going to solve autonomous driving don't buy the stock sell it buy something else. by June of next here they will be equal to 500,000 MI between an intervention and beyond that they will exceed the safety of a human and it's only going to go parabolic from there. all of the existing companies that are out there that attach cameras to a car they're the equivalent come next June of looking at a black and white television compared to 100 in flat screen because they can't evolve anymore they're done.

ZnWC : 2) Tesla share price is relatively cheap

The analysis centers on the price-to-earnings-growth ratio, a key metric for investors. Gary Black noted that Nvidia currently trades at 1.6x PEG, with a calendar year 2025 price-to-earnings ratio of 32x and a projected long-term earnings growth of 20%. In contrast, Tesla stands at 3.2x PEG, with a calendar year 2025 price-to-earnings ratio of 102x and a projected long-term earnings growth of 32%.

The price-to-earnings-growth ratio is a key valuation metric that helps investors understand a stock’s true value by comparing its price-to-earnings (P/E) ratio to its expected earnings growth rate. A lower PEG ratio suggests a stock may be undervalued, indicating the company’s stock price is relatively cheap compared to its potential future earnings growth.

YT to explain why Tesla stock will continue to surge

https://www.moomoo.com/community/feed/113594606223366?share_code=01GgZA

ZnWC : Longtime Tesla bear Craig Irwin, from Roth Capital, who has frequently appeared on CNBC to speak negatively about Tesla, just raised his Tesla share price target by a whopping 347% to $380 (from $85). For years, he had called Tesla "egregiously overvalued." Now, he has a BUY rating on the stock. Here is (one point) what he said today about Tesla:

"This quarter is probably the last quarter of relative weakness; Now he (Elon) has got a new pool of buyers. Conservatives that might not have looked at EVs quite as closely in the past that allow an acceleration of demand in the core U.S. market; I don't see very many negative catalysts. There are abundant positive catalysts. Bias is now to the upside. The market cap may be huge, but they are doing big things."

You can read the other points here:

Roth Capital raised Tesla price target by 347% to $380 (from $85)

https://www.moomoo.com/community/feed/113595271544838?share_code=01GhbC