Tesla, Inc.'s Q2 2024 Earnings Call Highlights & Earning Report

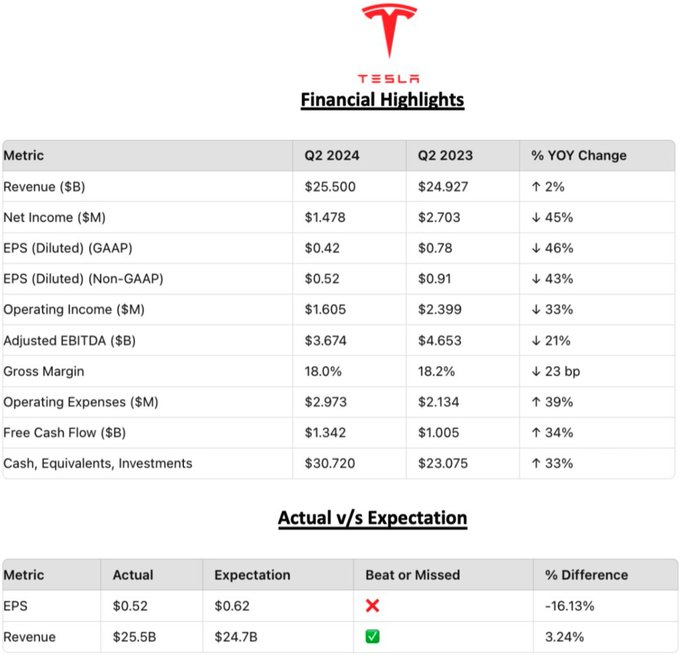

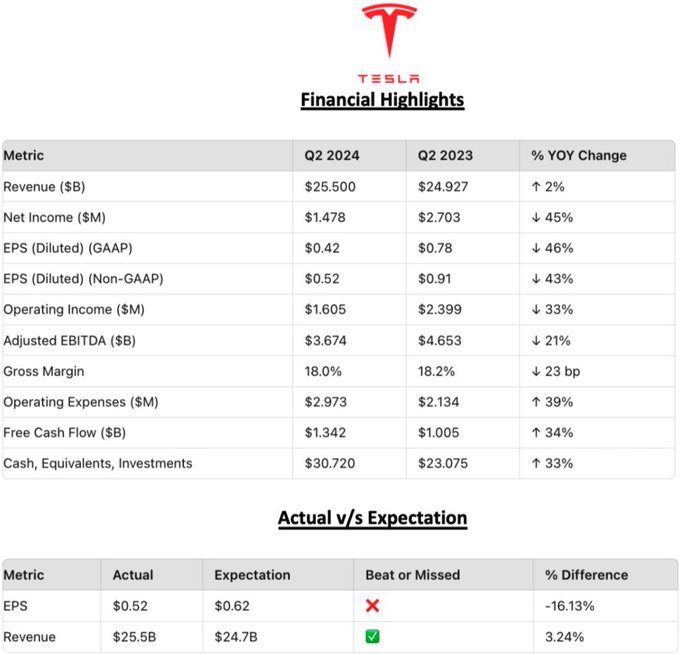

$Tesla(TSLA.US$ 👉 Revenue Growth and Financial Performance:

📍 Record quarterly revenues achieved, despite competition from discounted electric vehicles by other manufacturers.

📍 Energy storage deployments reached an all-time high in Q2, contributing to record profits for the energy business.

📍 Tesla returned to positive free cash flow of $1.3 billion in Q2.

📍 The company ended Q2 with over $30 billion in cash and investments.

📍 Automotive deliveries increased sequentially, bolstered by new financing options.

📍 Record quarterly revenues achieved, despite competition from discounted electric vehicles by other manufacturers.

📍 Energy storage deployments reached an all-time high in Q2, contributing to record profits for the energy business.

📍 Tesla returned to positive free cash flow of $1.3 billion in Q2.

📍 The company ended Q2 with over $30 billion in cash and investments.

📍 Automotive deliveries increased sequentially, bolstered by new financing options.

👉 Strategic Developments and Innovations:

📍 Full Self-Driving (FSD) progress: Version 12.5 began rollout, with significant improvements expected in customer experience.

📍 Robotaxi product unveil shifted to October 10th to incorporate important improvements.

📍 Giga Texas expansion nearing completion, set to house the largest training cluster to date.

📍 Optimus humanoid robots: Production Version 1 expected to start early next year, with several thousand robots produced by year-end 2025.

📍 Energy storage production ramping up in the U.S. and China to meet growing demand.

📍 AI initiatives: Doubling down on Dojo to ensure sufficient training capability amidst high demand for NVIDIA hardware.

👉 Customer Growth and Market Expansion:

📍 Right-hand drive Model Ys started production in Berlin and deliveries in the UK.

📍 Global import strategy adjustments in response to European tariff evaluations.

📍 Energy business demand constraint due to high interest in Megapack and Powerwall.

👉 Financial Guidance and Outlook:

📍 Continuing efforts to reduce vehicle costs, excluding Cybertruck impact.

📍 Cybertruck and Model 3 ramping up in the second half of the year, facing material cost variations.

📍 Full-year CapEx expected to exceed $10 billion, driven by investments in AI and new production capabilities.

📍 Positive outlook for AI and energy storage growth, with significant opportunities in both sectors.

👉 Product Development and Future Releases:

📍 Affordable Model: On track for delivery in the first half of next year, aimed at broadening market accessibility.

📍 Cybertruck ramp-up: Production and ramp-up in progress, with cost variations due to tariffs and material costs.

📍 Roadster Update: Engineering near completion, with production expected next year.

👉 Infrastructure and Manufacturing:

📍 Giga Texas Expansion: Nearing completion, expected to support the largest AI training cluster and significant production increases.

📍 4680 Battery Cell Production: Ramp-up strong in Q2, delivering 51% more cells than Q1 and significantly reducing costs.

📍 Mega Factory in China: Under construction, expected to double or triple energy storage output.

👉 Autonomous Technology and AI:

📍 Dojo Training Cluster: Doubling down on Dojo development to ensure sufficient AI training capacity amidst high demand for NVIDIA GPUs.

📍 Distributed Compute: Plans to leverage the AI capabilities of Tesla’s fleet for general-purpose computing.

📍 Optimus Robot Accessories: Generalized humanoid robots compatible with various human tasks and accessories.

👉 Strategic Partnerships and Collaborations:

📍 FSD Licensing: Discussions with major OEMs to license Tesla’s FSD technology, with significant potential for future revenue.

📍 XAI Collaboration: Integrating insights from XAI to advance full self-driving capabilities and AI initiatives.

📍 Regulatory Engagement: Proactively working with global regulators to gain approvals for autonomous driving and energy products.

👉 Financial Health and Capital Allocation:

📍 Strong Cash Position: Over $30 billion in cash and investments, providing a solid foundation for future growth and innovation.

📍 Restructuring Impact: Recent reorganization reflected in a $642 million charge, with ongoing focus on cost efficiency and productivity gains.

📍 AI-Related Investments: Continued investment in AI and related infrastructure to support long-term strategic objectives.

👉 Executive Commentary:

🗨️ Elon Musk, CEO:

📍 "The biggest differentiator for Tesla is autonomy. Our scale economies and efficiency make us the most efficient EV producer."

📍 "We're on track to deliver a more affordable model in the first half of next year."

📍 "We're excited about our progress across the board, changing the energy system and pushing the economy towards an age of abundance."

📍 "We firmly believe that EVs are best for customers and that the world is headed for fully electrified transport, not just cars but also aircraft and boats."

📍 "Full self-driving and autonomous vehicles are our biggest differentiators."

📍 "Optimus robots will revolutionize the workforce, and we expect to have several thousand in production by the end of next year."

📍 "We are building the infrastructure to support future products and AI advancements."

📍 "Despite regulatory and market challenges, our focus remains on delivering the best products and maintaining growth."

🗨️ Vaibhav Taneja, CFO:

📍 "Affordability remains top of mind for customers, and we are offering reduced financing options to offset high interest rates."

📍 "We had a record quarter on regulatory credits revenue, and we remain focused on providing the most compelling products at a reasonable price."

📍 "Energy storage deployments more than doubled, resulting in record revenues and profits."

📍 "Despite restructuring payments, we reverted to positive free cash flow in Q2."

👉 Looking Ahead:

📍 Tesla plans to continue investing in AI and data capabilities to unlock additional revenue opportunities.

📍 Focus remains on product innovation, enhancing go-to-market efficiency, and maintaining strong customer relationships.

📍 Strategic partnerships and new product offerings are set to drive growth and expand market reach.

👉 Key Takeaway:

Tesla is successfully navigating a competitive landscape with strong revenue growth, significant advancements in autonomy and energy storage capabilities, strategic customer and market expansions, and robust financial guidance. The company's focus on innovation, affordability, and strategic investments positions it well for sustained growth and leadership in the AI-driven and electrified future.

👉 Tesla's Q2 2024 Earning Report

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Jensen Philanthropy : Garbage performance, revenue propped up by 900 million of EV credits. PROFITS DECLINING, MARGINS DETERIORATING, TESLA IS NO MATCH FOR CHINA EVs, cheaper and better! Looks nicer too