Mag 7's diverging Q2 results: Will they boost the market again?

Mag 7's diverging Q2 results: Will they boost the market again?

Views 6.7M

Contents 1465

Tesla Investors, Speculators Rush to $200 Puts as Disappointing Earnings Spark Stock Sell-Off

Tesla investors are rushing to put options that could protect holders against continued slump after disappointing earnings results sent the stock tumbling more than 10%.

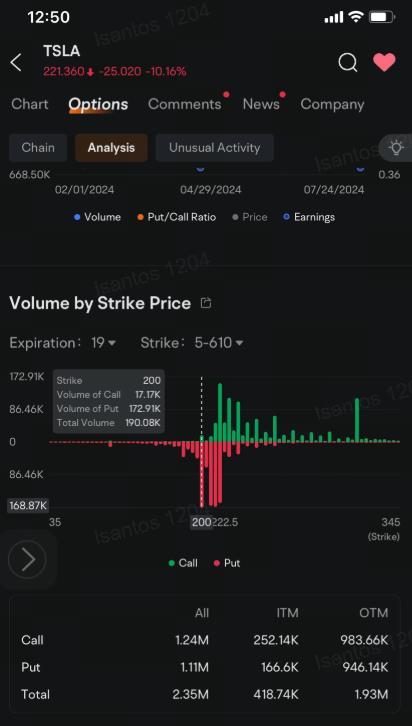

Put options that give the holders the right to sell $Tesla (TSLA.US)$shares at $200 are seeing the heaviest trading among contracts across 19 expiration dates stretching through Dec. 18, 2026. Volume for that strike price reached almost 173,000 as of 12:50 p.m. New York time Wednesday, data tracked by moomoo showed. Source: moomoo mobile app The company's earnings shrank 43% to 55 cents a share in the second quarter from a year earlier, missing the 62-cent average of analysts' estimates compiled by Capital IQ. Tesla said revenue declined 2% to $25.5 billion after cutting the average selling price for S3XY vehicles.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin narrowed by 4.26 percentage points to 14.4%, according to the company's presentation slides released after the market closed Tuesday. (To see Tesla's options chain, click here.) Among Tesla contracts expiring in two days, the most popular are put options giving the holders the right to sell the electric vehicle maker's shares at $215 each. More than 127,000 of those puts changed hands as of 12:28 p.m. Eastern Time. Demand for a hedge against continued slump rose as the stock price slid to $221.20.

Source: moomoo mobile app Momentum is turning for the stock that just earlier in July climbed to $271, its highest intra-day level since September 2023. That ascent came after Tesla reported a smaller-than-expected decline in quarterly deliveries. Wednesday's price slump trimmed the stock's gains over the past month to 21%.

Today's decline took prices below the middle line of the Bollinger Band, a sign to some technical analysts that that the stock could head lower towards the lower line of that band. Still, only four of the remaining 14 technical indicators tracked by moomoo share the same negative signal. Another six were neutral while the rest are flagging that the stock could be oversold and may be poised to reverse course.

Citi analyst Itay Michaeli cut his price target on the stock to $258 from $274 after the quarter financial results were released.

To see the options market page, click here. Show your thoughts on Tesla. Do you expect the shares to reverse course?

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

103492747 : Thanks you sharing

73146505 : PANIC on HIT PIECES sell yes I will buy more have already 2600 shares !!!

Laine Ford : I just want to ready that why I say no comment dayi just want to ready to day call want much

Bull Let Bull 73146505 : you must be the diamond hand for this.. did you set a limit to cash out

73146505 Bull Let Bull : Just holding since got in 180’s but will sell if I need to … mental Stop loss