Tesla Is Heading Into a 'Bullish Month'. Is an Annual High in Sight?

$Tesla (TSLA.US)$'s shares soared 22% on Thursday, posting the largest single-day rally since May 2013 after the company reported unexpectedly strong earnings. The surge added billions to CEO Elon Musk’s net worth and propelled Tesla’s stock back into the top ten of U.S. equities, reversing recent declines after the launch of its autonomous taxi service. Notably, the Cybertruck achieved profitability for the first time, material costs fell, and the energy unit expanded. The company also forecasted that delivery could increase by as much as 30% next year.

In response to the earnings announcement, Wall Street analysts adjusted their ratings with divergence in their assessments. Dan Ives of Wedbush led the bullish front, maintaining an Outperform rating with a price target of $300, suggesting a 15% potential increase from Thursday’s close. Ives praised Tesla for its 'Aaron Judge-like' performance in auto gross margins, which, excluding credits, surpassed expectations by 200 basis points, achieving 17.1% against the anticipated 15.1%. This key metric was pivotal, underscoring Tesla's concentrated efforts on profitability amid broader strategic initiatives, particularly as the company moves past recent price cuts and continues its AI and Full Self-Driving (FSD) transformations.

Conversely, JPMorgan analyst Ryan Brinkman took a more cautious stance, raising his price target modestly to $135 from $130 while maintaining an Underweight rating. Despite Tesla's surprising $2.7 billion operating profit, Brinkman flagged potential concerns about the sustainability of such earnings growth, citing substantial contributions from high-margin regulatory credits and significant working capital benefits.

For Tesla's investors, here are the next big things to watch.

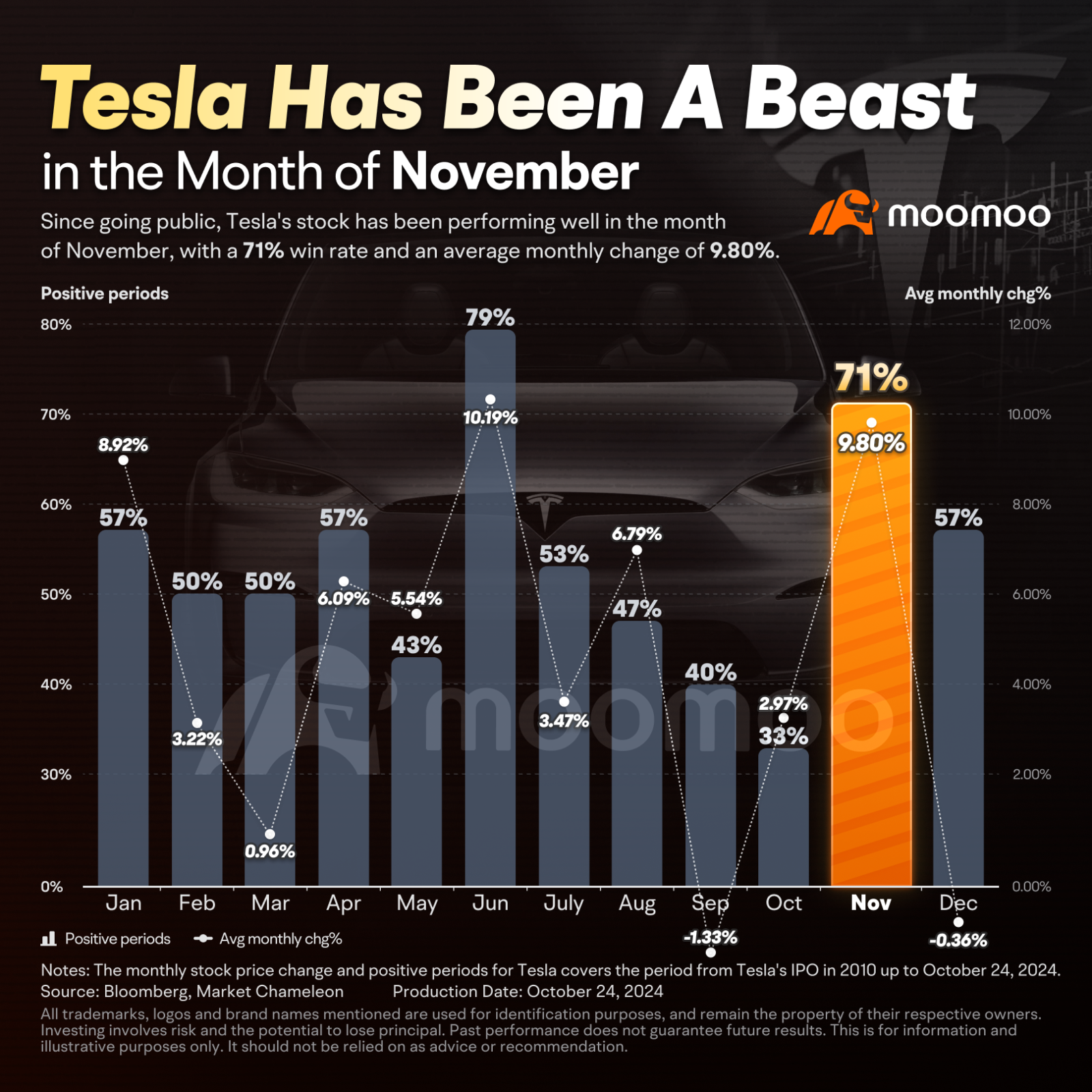

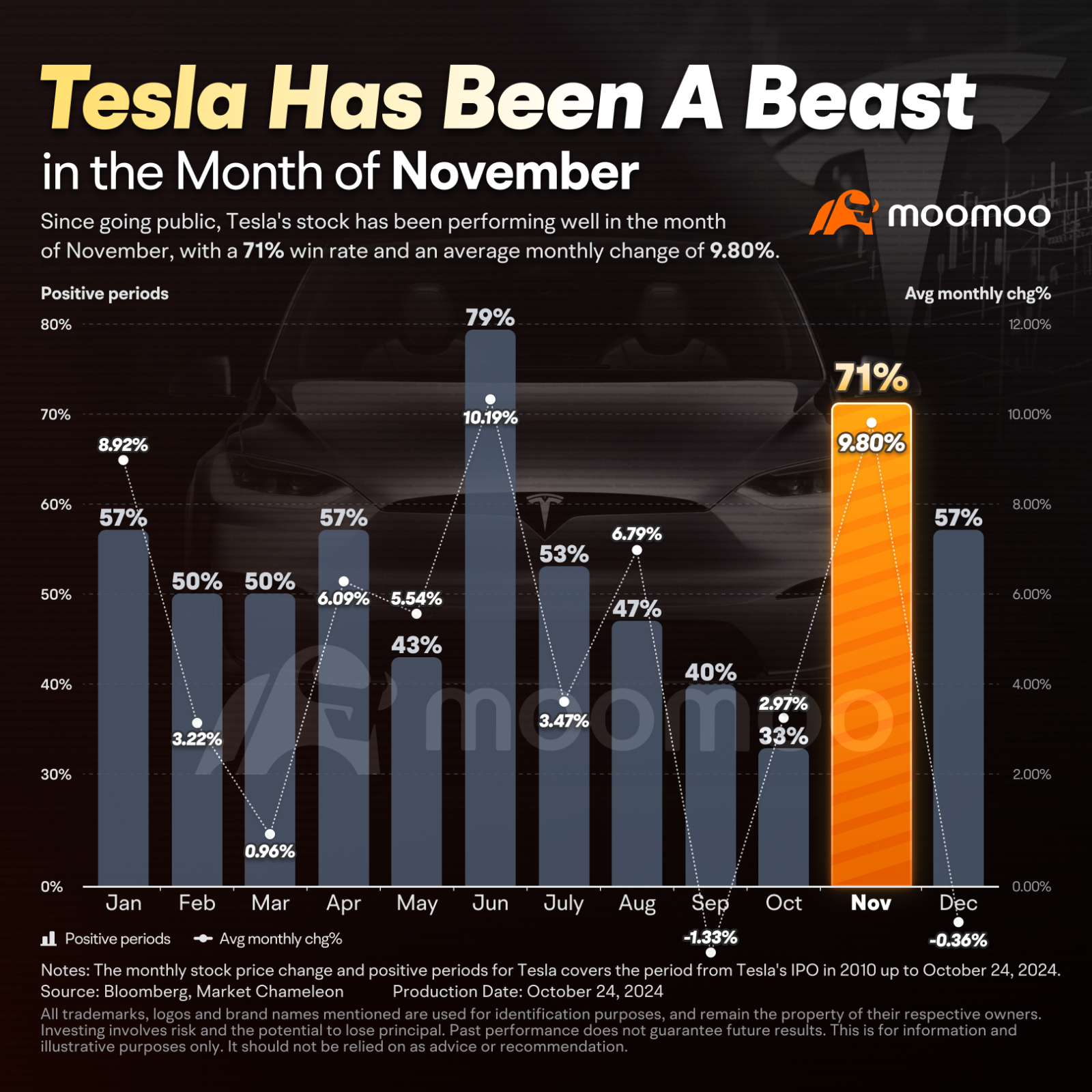

Tesla Has Been a Beast in the Month of November

Historically, November has been a strong month for Tesla, with the stock showing a 71% win rate and an average monthly change of 9.80% since its IPO.

US Election to Watch

A victory for Donald Trump could potentially boost Tesla's market momentum given that the company is seen as a potential beneficiary of a 'Trump Trade'. During Tesla's third-quarter earnings call, Musk highlighted the need for federal regulations enabling self-driving cars to operate on U.S. roads without conventional driver controls, like foot pedals or steering wheels. He pointed out the existing regulatory barriers that hinder such technological progress, using Tesla’s new Cybercab model as an example.

Musk has stated, "If there is a Department of Government Efficiency I will try to make that happen," indicating his commitment to facilitating these changes.

Though Elon Musk did not explicitly mention Donald Trump, he referenced a potential role as head of the "Department of Government Efficiency," a position Trump has proposed for the Tesla CEO. Moreover, Musk has invested over $75 million in Trump's campaign initiatives.

Bloomberg reports that Trump has expressed a desire to have Musk in his administration if he secures a second term. The plan would involve Musk leading efforts to reduce government waste through the proposed Department of Government Efficiency, humorously abbreviated as DOGE, which also nods to a cryptocurrency Musk supports.

FSD Launch in Europe and China

The Tesla AI Twitter account announced on Sept.5 that, in response to significant user interest, the Tesla artificial intelligence team has released a roadmap. The announcement detailed plans to introduce the Full Self-Driving (FSD) service in China and Europe by the first quarter of next year, pending regulatory approvals. Following the tweet, Tesla's stock price surged by 9%.

During Tesla's July earnings call, Elon Musk mentioned the company's intention to seek regulatory approval in Europe and China to implement supervised FSD. Musk expressed optimism about securing these approvals by the end of the year.

Robotaxi Ambitions in 2025

During the Q3 earnings call, Elon Musk outlined Tesla's ambitious plan to launch driverless 'robotaxi' services in California and Texas next year, aiming to revolutionize the ride-hailing industry despite facing significant regulatory and technical challenges. While Tesla has yet to secure a driverless testing permit in California—a state known for its stringent regulations, exemplified by Waymo's extensive efforts to earn permits—Musk remains optimistic about future approvals. Texas, on the other hand, presents a more favorable environment with its more lenient regulatory approach to autonomous vehicles, though testing requirements must still be met before launching.

Tesla's push into autonomous ride-hailing is part of a broader movement toward future mobility technologies. As global governments grapple with regulatory and safety considerations, companies like Tesla are at the forefront of innovations that could dramatically transform urban transportation. The success of these ventures could shape international strategies for autonomous transportation. Additionally, a potential Trump administration could provide a regulatory environment more conducive to realizing Tesla’s robotaxi ambitions in the U.S., as previously mentioned.

Source: Bloomberg, the Fly, Market Chameleon

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103613928 : Ok

104255703 : Mmm.

No b no mammmmA a

103576710 : Ok

103356238jenny tan : OK

105178621 : because I didn't know who yet

joemamaa :

joemamaa : great!

joemamaa : nice

Chris 80 : TSLL

Bow WOW : Love this