Financial forecasts for the next quarter

Estimates for the upcoming quarter forecast an earnings per share (EPS) of USD 0.74, a figure that has been revised downward after the disappointing delivery numbers. Revenue is expected to come in at USD 24.21 billion, not far from the USD 24.9 billion in the previous quarter but notably higher compared to the same period last year. Gross profit margins are also expected to improve but are likely to remain within the 18% range (source: Refinitiv).

Analyst consensus and share price implications

As for the analyst recommendations, the consensus appears similar to the previous quarter. There are six 'Strong Buy', 12 'Buy', a larger group of 20 'Hold', three 'Sell', and four 'Strong Sell', resulting in a slight net buy bias, which isn't as strong as the industry average. Moreover, the current share price exceeds the average price target of USD 238.79 (source: Refinitiv).

Current technical indicators

Examining the chart below, the price is still hovering within a relatively expansive bullish trend channel. Moreover, it remains above all its primary weekly long-term moving averages (MA), even if the 100-week MA is not far away - these are bullish indicators.

Conversely, the other weekly technical indicators are generally neutral, albeit with a tinge of slight positive technical bias. The price is near the middle band; its RSI (Relative Strength Index) is above 50 but not in overbought territory; its ADX (Average Directional Movement Index) oscillates below trending levels; and in terms of the DMI (Directional Movement Index), its +DI is above its -DI, but not by a significant margin

Long-term vs short-term trends

Overall, most of the technical indicators are neutral but remain within the longer-term bullish channel, offering a technical overview that leans more towards 'bull average' than 'stalling bull.' This is consistent with the technical classification from the last time we previewed Tesla's earnings.

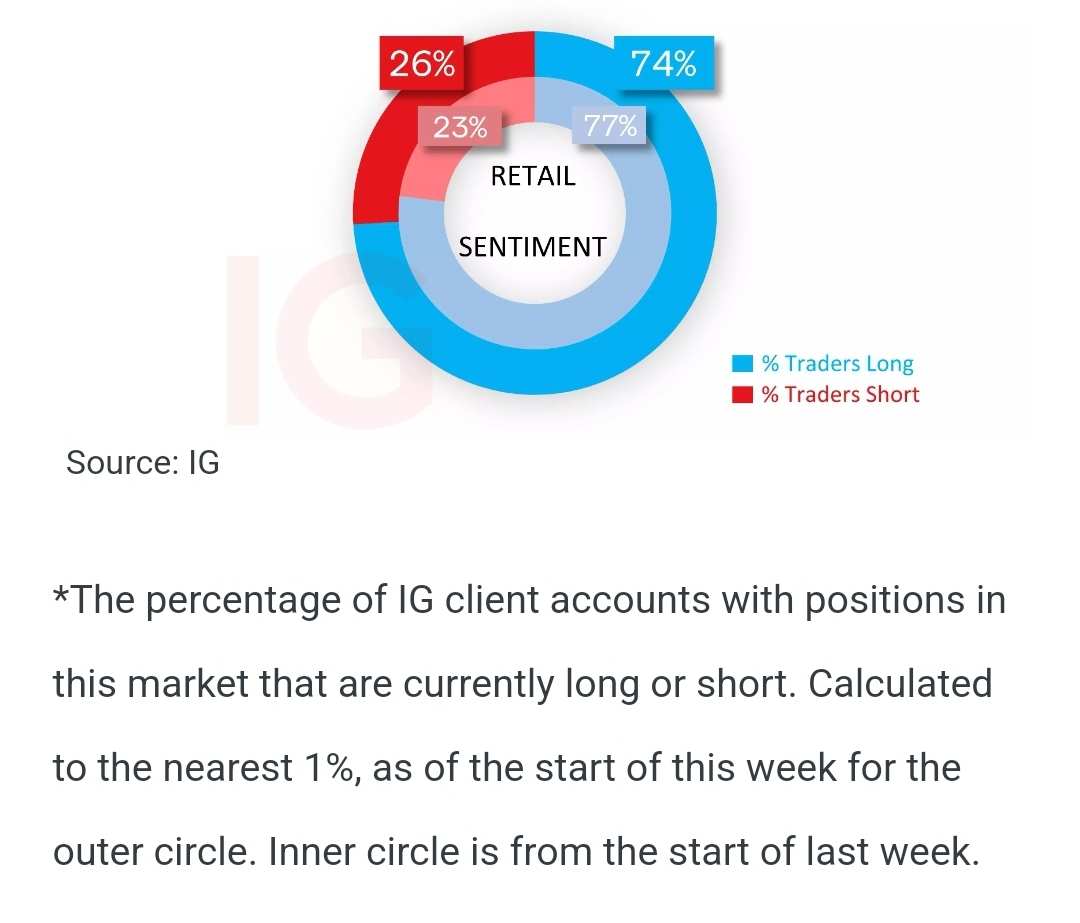

IG client sentiment* and short interest for Tesla shares

As for IG client sentiment, it's been characterised by a strong buy bias throughout this period (see chart above, blue-dotted line representing % long, left axis). To some extent, this reflects trading within the channel established at the start of the year. Sentiment began this week at 74%, compared to last week's 77%, which was just shy of entering extreme long territory.

ZnWC OP : Technical analysis Wedge Pattern and MACD Indicator Limitations

Don't follow blindly someone who lack objectivity (or bias) in using Wedge Pattern and MACD (Moving Average Convergence Divergence) to analyse Tesla stock. It is a good practice to compare with more than one indicators, macroeconomics reality and market sentiment.

https://www.moomoo.com/community/feed/111141692768262?global_content=%7B%22invite%22%3A%22101709443%22%2C%22promote_content%22%3A%22mm%3Afeed%3A111141692768262%22%7D&data_ticket=212ca245a589f1e400fb2e247953bc77

SpyderCall : Where did you find those terms "bull average" and "falling bull?" I don't think I've ever heard those before. Sounds interesting.

ZnWC OP SpyderCall : I put the link in the source, you can check. It is "stalling bull", think they meant bullish in the long term.

SpyderCall ZnWC OP : Thanks. I'm gonna check it out. I always get a kick out of some of the stock lingo that I hear. I've noticed a lot of very old common phrases that people still say in everyday life originated from financial market lingo. A lot of phrases come from military and maritime lingo as well. Just a random thought.

ZnWC OP SpyderCall : You're welcome