Tesla's Meteoric Rise: Why $1000 a Share Isn't So Crazy

Tesla's Meteoric Rise: Why $1K a Share Isn't So Crazy

Tesla's Rapid Rise: Why $1,000 per share Isn't So Crazy

Tesla (TSLA) CEO Elon Musk and his team have been doubted and bet against since the start for what seemed like good reason. Successful startups are rare in general, but in the USA auto market, with legacy competitors like General Motors (GM) and Ford (F) they are unheard of – especially when they are an unprofitable electric vehicle (EV) start-up going public in the wake of the worst global financial crisis in decades.

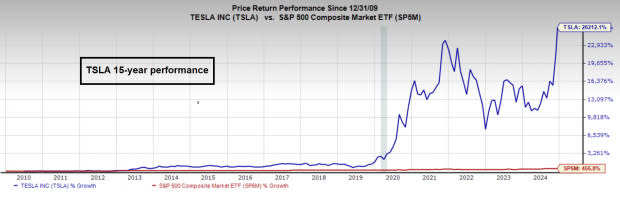

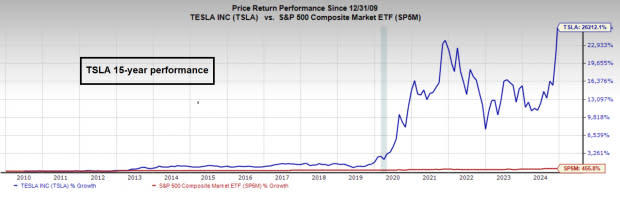

However, in proper Musk form, Tesla found a means to rewrite the script. Since its inception, the Zacks Rank #1 (Strong Buy) stock has been up a mind-boggling 32,564%, but who’s counting?

Tesla Lives Up to Expectations

Tesla (TSLA) CEO Elon Musk and his team have been doubted and bet against since the start for what seemed like good reason. Successful startups are rare in general, but in the USA auto market, with legacy competitors like General Motors (GM) and Ford (F) they are unheard of – especially when they are an unprofitable electric vehicle (EV) start-up going public in the wake of the worst global financial crisis in decades.

However, in Musk's capable leadership, Tesla found a way to rewrite the script. Since its establishment, the stock, which is ranked first in Zacks as a Strong Buy, has increased an incredible 32,564%, but who cares?

Zacks Investment Research

Image Source: Zacks Investment Research

With such extraordinary profits, it is natural for investors to feel dizzy buying stocks at such high levels. However, the background of Wall Street is crucial. Since the peak of the stock price at the end of 2021, TSLA investors have had to endure a long, frustrating, and volatile correction.

Despite the many difficulties, TSLA has finally rebounded strongly, hitting a historical high this week. Although the stock may continue in the short term, many long-term investors may want to map out potential price targets as the breakthrough continues. Here are four methods predicting the long-term price targets of the electric vehicle giant:

Tesla Fibonacci Extensions

Fibonacci Extension is a technical analysis tool that uses a series of numbers to help predict (or at least provide a roadmap for) how stock prices may extend after significant fluctuations. Standard extension levels include 161.8% and 261.8%. When drawing the Fib extension of the current long-term TSLA breakthrough from the end of 2021, the first two long-term TSLA targets are approximately $600 and approximately $900 each.

Zacks Investment Research

Image Source: TradingView

Zacks Investment Research

Image Source: Zacks Investment Research

With such amazing profits, it is natural for investors to feel dizzy buying stocks at such high levels. However, Wall Street background is crucial. Since the stock price peaked at the end of 2021, TSLA investors have had to endure further, shocking mid and short-term adjustments.

Despite the challenges, Tesla finally rebounded strongly, hitting a historical high this week. While the stock may be strong in the short term, many long-term investors may want to await potential price targets during the ongoing breakout. Here are four methods for forecasting long-term price targets in the electric car Industry:

Tesla Fibonacci Extensions

Fibonacci Extensions are a technical analysis tool that uses a series of numbers to assist in predicting (or at least providing a roadmap for) how much a stock price could extend after major moves. Standard extension levels include 161.8% and 261.8%. In the unclear situation at the end of 2021 when the long-term TSLA broke the Fib extension, the first two long-term TSLA targets are approximately $600 and $900, respectively.

Measuring moving techniques is the most direct method for price targets. Simply identify the high and low points of the base and take the difference. Then add the difference to the height of the base to determine the price target. The price extension for TSLA using the measuring move method provides investors with a target of $727.

Zacks Investment Research

Image Source: TradingView

Smart Money: Ron Baron and Tesla

Billionaire investment legend Ron Baron believes that Tesla will become a $5 trillion company in the next decade. Tesla's current market cap is $1.31 trillion, and Baron expects the stock price to soar to around $1600. While skeptics may mock such price targets, Baron's words are worth listening to - especially about Tesla. Baron invested hundreds of millions of dollars in Tesla from 2014 to 2016, and since then his profits have surged to over $6 billion.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment