Are EV's dead?

Are EV's dead?

Views 22K

Contents 443

Tesla's Share Price Faces Pressure From Multiple Factors Beyond Biden's UAW Support, HSBC Downgrade, and Cybertruck Skepticism

HSBC started off coverage on Tesla (NASDAQ:TSLA) stock with a Reduce rating, Tesla dipped nearly 5.5% at Thursday's close, with shares shedding 18.9% in the past month.

Can Tesla's growth story continue? What are the reasons behind the increasing bearish sell side voice to the discussion about Elon Musk's EV automobile empire?

Biden Supports UAW Organizing Tesla, Toyota Workers

President Joe Biden threw his support behind the United Auto Workers’ efforts to unionize employees at Tesla Inc. and Toyota Motor Corp. in the wake of the labor group's historic contract with Detroit's Big Three automakers.

UAW President Shawn Fain has said he wants to use momentum from the agreement to target non-union manufacturers such as Tesla and Toyota.

Tesla's factory in Fremont, California currently has a UAW-organized committee whose members are discussing the advantages of collective bargaining. The source stated that UAW has pledged to provide all necessary resources for this initiative.

Tesla slapped with Reduce rating at HSBC

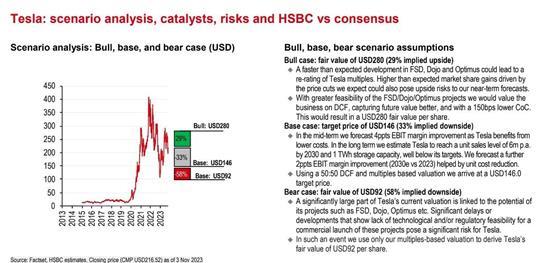

HSBC analyst Michael Tyndall initiated coverage of Tesla on Thursday with a Reduce (or Sell) rating and $146 price target, implying a 33% drop in Tesla's stock price.

Specifically, Tyndall believes that there are three reasons why he is bearish on Tesla :

Timing of delivery is our primary concern

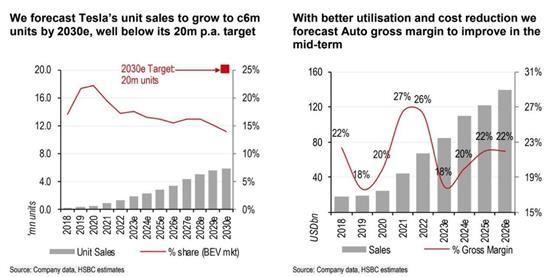

"Timing of delivery is our primary concern : we think questioning Tesla's credibility is problematic. Its ambitions may be grand (20m units by 2030), but it has a track record of generally doing what it promises. Equally, as outsiders, we struggle to challenge the feasibility of the group's ideas. So, our caution stems from the uncertainty around the timing and commercialisation of its varied ideas. We see considerable potential in Tesla's prospects and ideas, but we think the timeline is likely to be longer than the market and valuation is reflecting. Hence the Reduce rating," the note said.

Secondly, the upcoming non-car products are main headwinds

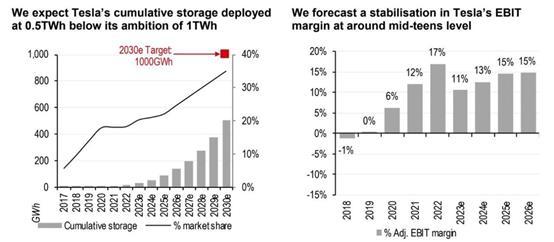

The main headwinds to the Tesla growth story, Tyndall said, are upcoming non-car products like fully autonomous software, Dojo supercomputer products and services, and robotics like the Optimus humanoids that are hard to model from a discounted, or future cash flow, perspective. Because these products and their markets are so nascent and the regulatory environment uncertain, Tyndall's model can't produce cash flow streams from those products until 2028, at the earliest.

"Our DCF valuation is generous as we assume businesses such as FSD (full-self driving), Dojo and Optimus all become successful by the end of the decade, contributing around 40% of our DCF value. We think, however, that the expected cost of capital for these businesses should be well above the group average given the regulatory and technological challenges they face," Tyndall wrote.

Finally, Tesla CEO Elon Musk is a "risk" for the company

Finally, Tyndall says Tesla CEO Elon Musk is a "risk" for the company, but not because of his controversial comments or non-Tesla pursuits such as running SpaceX and X.com (formerly Twitter).

"Musk's global fame has afforded the group a customer awareness that far outweighs the money it has spent on marketing and advertising, which is therefore a tangible benefit," Tyndall wrote. "Leaving aside the current legal issues Elon Musk faces, we think his prominence presents a considerable 'singleman' risk at the group."

Tesla Tax Credit Cut Alert

Tesla shows a disclaimer on its website warning of federal tax credit reductions on "certain vehicles." The warning was previously limited to solely its cheapest vehicle or the Model 3.

"$7,500 Federal Tax Credit for Certain Tesla Models. Reductions likely for certain vehicles in 2024," the warning on the website reads, citing pending federal guidance.

The company also urged prospective buyers to take their deliveries before the end of the quarter to guarantee a full incentive of $7,500.

Previously, the disclaimer on the website noted a "strong likelihood" for Model 3 tax credit reductions to reduce to $3,750 after Dec. 31. The Model 3 order page, meanwhile, continues to warn the customer of a potential halving in tax credit.

Tesla facing a stern challenge from Chinese EV start-ups

Tesla is currently the runaway leader in China's premium EV sector. Its made-in-Shanghai Model 3s, priced between 259,900 yuan (US$35,554) and 295,900 yuan(US$40,479), are the bestselling premium EVs on the mainland.

It is, however, facing a stern challenge from Chinese EV start-ups such as Nio, Li Auto and Xpeng, whose vehicles are viewed as having more intelligent features.

Meanwhile, Huawei and Chery Automobile EV venture Luxeed launched its first production model Zhijie S7 on Nov, 9. S7 has a total of 4 models with pre-sale prices starting at 258,000 yuan. The pricing is similar to Model 3 , but S7 'will be superior to Tesla's Model S in various aspects', Huawei executive says.

Tesla's monthly sales volume in China also showed that sales declined for two consecutive months in September and October, with 28,626 units sold in October, a 34% decrease compared to the previous month, despite Tesla's efforts to attract buyers through price cuts and other incentives.

Last but not least, media's pessimistic coverage of forthcoming Cybertruck adding to the misery for Tesla this week

Adding to the misery for Tesla this week was InsideEVs writeup on the company's forthcoming Cybertruck. The article was called: "I Saw The Tesla Cybertruck Up Close. It Still Looks Horrible" and it sports a subtitle that says "A close look reveals a lot of issues."

"Basking in the SoCal sun, this Cybertruck looked frankly horrible," the article says. "I've been around hundreds of prototype cars in my career, ranging from early test mules to near-production prototypes, and I've never seen an automaker proudly present something of this poor quality, especially not this late in development."

Daniel Golson from InsideEVs added: "It is absolutely baffling to me that Tesla's lead designer would parade around a vehicle in this condition just weeks before deliveries of production cars are allegedly commencing and even more baffling that he'd park it at such a public enthusiast event."

"Yes, this is still just a prototype at the end of the day. But at this stage of development, this close to customer deliveries starting, I couldn't help but feel something akin to second-hand embarrassment when looking at it. If Tesla feels comfortable showing this Cybertruck off, I don't think it bodes well for early customers."

Recall, Tesla shares were trounced after last quarter's earnings due to comments Musk made about the difficulties the company was having (and would be having) with producing the Cybertruck. Elon Musk said at the time:

“It's an amazing product but I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck and then in making the Cybertruck cash flow positive,” Musk said during Tesla's earnings call on Wednesday.

“While I think this is potentially our best product ever — I think it is our best product ever — it is going to require immense work to reach high-volume production and be cash flow positive at a price that people can afford.”

However, Musk claims demand for the Cybertruck is "off the charts" with more than 1 million potential buyers putting down $100 to reserve one.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

luckme : Morgan gave the buying rating on the 6th. Analysts were at least four stars, and the return rate was over 5%. Your analyst was only two stars, and sold on the 8th.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) The rate of return is negative. As you said, there is no return on trading stocks and you still lose money, and many Tesla analysts buy or hold more than four star analysts

The rate of return is negative. As you said, there is no return on trading stocks and you still lose money, and many Tesla analysts buy or hold more than four star analysts

Rexon Capital : Media will do what is popular, not always what is true. It is like watching a k drama, everything is meant for the views. Focus on what others are not focusing on. That’s where you find the edge