Tesla Soars by 10% : More Than Just Q2 Delivery Data

Stay Connected.Stay Informed. Follow me on MooMoo!![]()

![]()

![]()

Yesterday, Tesla surged by 10%, and the reason isn't just the release of its second-quarter delivery data. Let's take a look at what other factors contributed to today's significant spike and whether this rally can be sustained.

**Delivery Data:**

First, let's examine the delivery data. The data shows that in the second quarter, Tesla delivered a total of 443,900 vehicles, exceeding the market expectation of 439,000 vehicles. This represents a 14.8% increase quarter-over-quarter but a 4.8% decrease year-over-year. Wall Street's unofficial expectations were even lower, anticipating Tesla would deliver only 420,000 vehicles this quarter, making this data appear even more optimistic.

Breaking it down, the Model 3 and Y delivered 422,000 vehicles, higher than the expected 409,000 vehicles. Other vehicles accounted for 21,500 deliveries, also exceeding the anticipated 20,900. In terms of production, Tesla produced a total of 410,000 vehicles in the second quarter, with 387,000 being Model 3 and Y, and the remaining 24,000 being other models.

**Energy Products:**

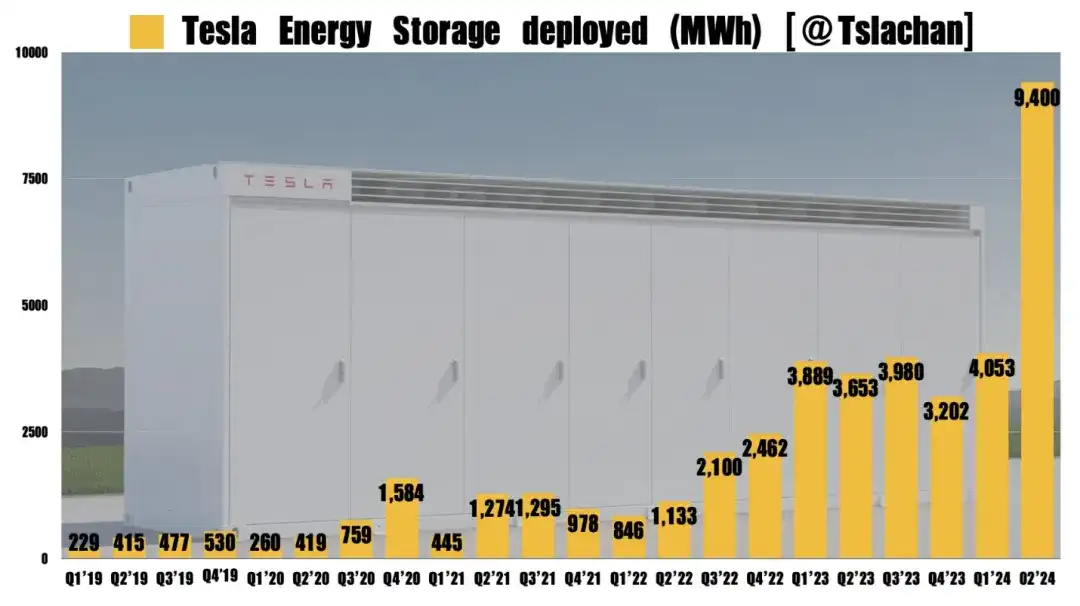

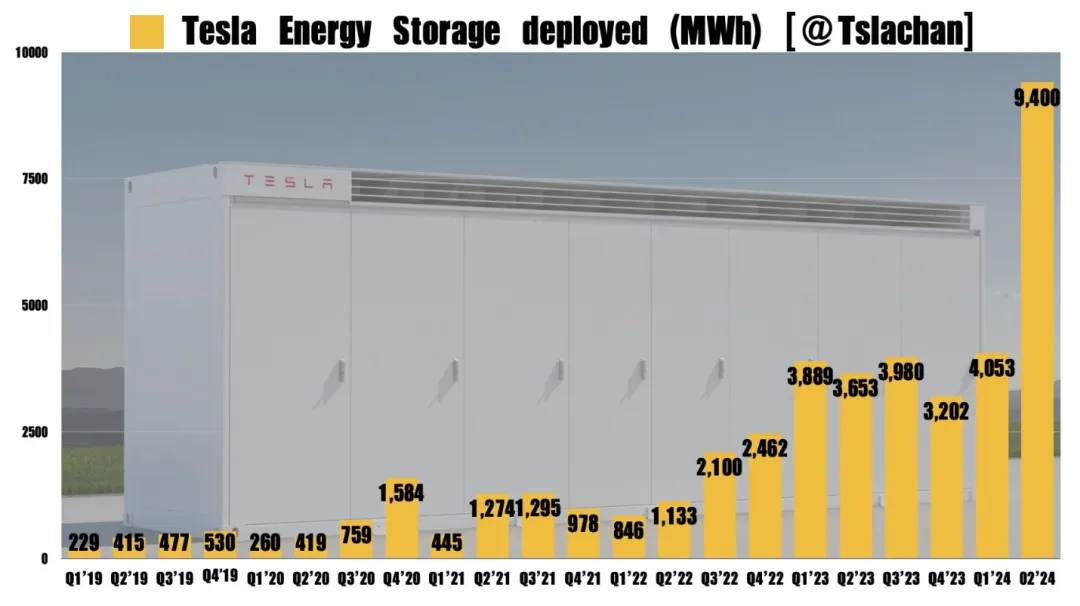

Besides the delivery data, Tesla's report also mentioned that the company deployed a total of 9.4 GWh of energy products in the second quarter, setting a new record for a single quarter. The energy storage business is actually more valuable than the automotive business due to its large market size and higher potential for profit margins. Future growth is expected to significantly outpace the automotive business. However, there were concerns about profit margins due to heavy discounting in the energy storage segment towards the end of the quarter.

It’s evident that this deployment is more than twice the previous amount. According to Tesla's last quarter financial report, the gross margin for the energy storage business was 32.7%, significantly higher than the automotive business. Also, due to economies of scale, the gross margin is growing rapidly. The first-quarter financial report stated that although revenue from the energy storage business grew by 7%, gross profit increased by 140%.

A simple calculation, based on these results, suggests that if we proportionally scale up Tesla's energy storage business revenue, it would reach $3.75 billion. Using the same 32.7% gross margin, it would bring in $1.23 billion in gross profit. Last quarter, Tesla's gross profit was $3.7 billion, meaning the energy storage business would account for roughly one-third of it.

**Options Activity:**

Aside from performance data, options trading also drove Tesla's surge yesterday. According to Bloomberg's statistics, Tesla's three-month options skew reached its highest level since February 2021. This skew describes the premium of call options relative to put options; the higher the premium, the stronger the bullish sentiment. Notably, the call option expiring this Friday with a strike price of $230 saw a trading volume of over 240,000, making it the most traded option.

**Future Growth:**

In the wake of AI-driven surges in energy stocks, Tesla's energy storage business has been one of the most overlooked segments. What does this mean for Tesla's performance?

It means certainty in future growth. Wall Street no longer needs to worry about whether autonomous driving will materialize or rely on a rebound in electric vehicle demand. The vast market space for energy storage can provide strong performance support for Tesla and improve the company's overall profit margins. During the first-quarter earnings call, Tesla's CFO stated that the energy storage business would be the main source of future profits.

Of course, autonomous driving cannot be ignored, as it has a higher ceiling and more significant profit potential. Elon Musk mentioned on X that once Tesla fully achieves autonomous driving and the Optimus robot goes into mass production, anyone shorting Tesla, even Bill Gates, will be crushed. Tesla's Robotaxi event on August 8 will continue to fuel market optimism and drive the stock price higher.

From a longer-term perspective, this performance indicates that Tesla's worst moments in this cycle are likely behind it. In the future, with the Federal Reserve's impending rate cuts, a rebound in electric vehicle demand, new car launches by the end of the year or early next year, continued advancements in autonomous driving V12, the August 8 Robotaxi event, and the explosion in the energy storage business, nearly all of Tesla's businesses are heading in a positive direction. Therefore, even though the stock price has already surged by 10% today, I remain optimistic that Tesla can continue this rally. Today's increase is likely just the beginning.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment