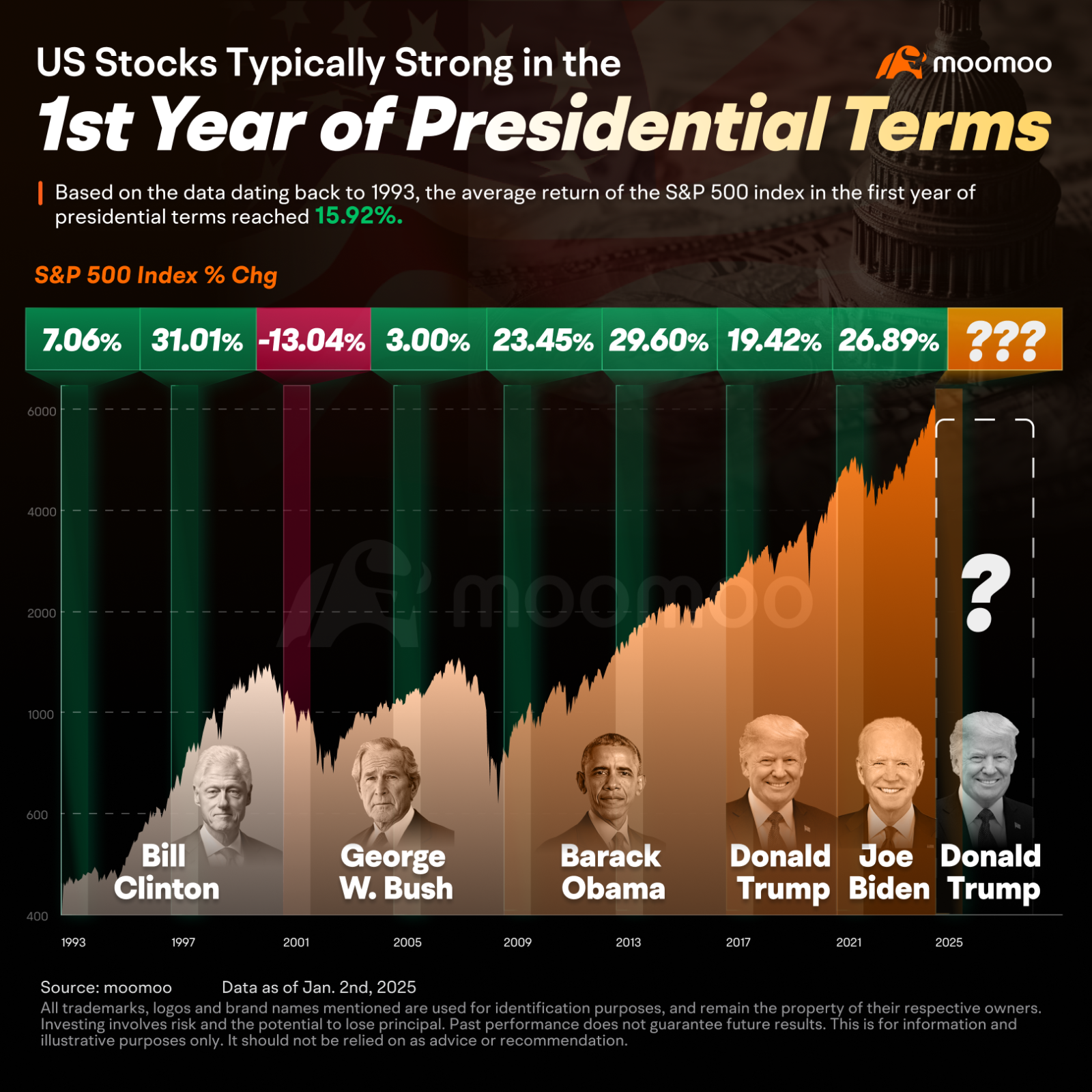

On his inauguration day, January 20th, he announced the repeal of the Affordable Care Act. On April 18th, he issued the “Buy American, Hire American” executive order, propelling domestic manufacturing stocks and sending related corporate share prices upward. On June 1st, he declared the U.S. withdrawal from the Paris Agreement, triggering an immediate rally in the share prices of traditional fossil fuel companies. For instance, Occidental Petroleum saw a 2.68% gain on that very day. On December 22nd, he signed the Tax Cuts and Jobs Act, slashing corporate income tax substantially and fueling soaring profit expectations for listed companies, igniting the enthusiasm for U.S. stocks and luring investors to flock in.

guyi : bullish...no doubt

Buy n Die Together❤ :

Daniel Jeya Raman : Donald Trump is the bullish emperor.

juliaz : good

GameOverBro : Donald Pump will make this year the year of the Rocket!

151461751 : Inflation would be a concern if the trade war starts early on his jurisdiction and it may affect everyone including corporations

104088143 : How to do

SyukurAzzaha :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)