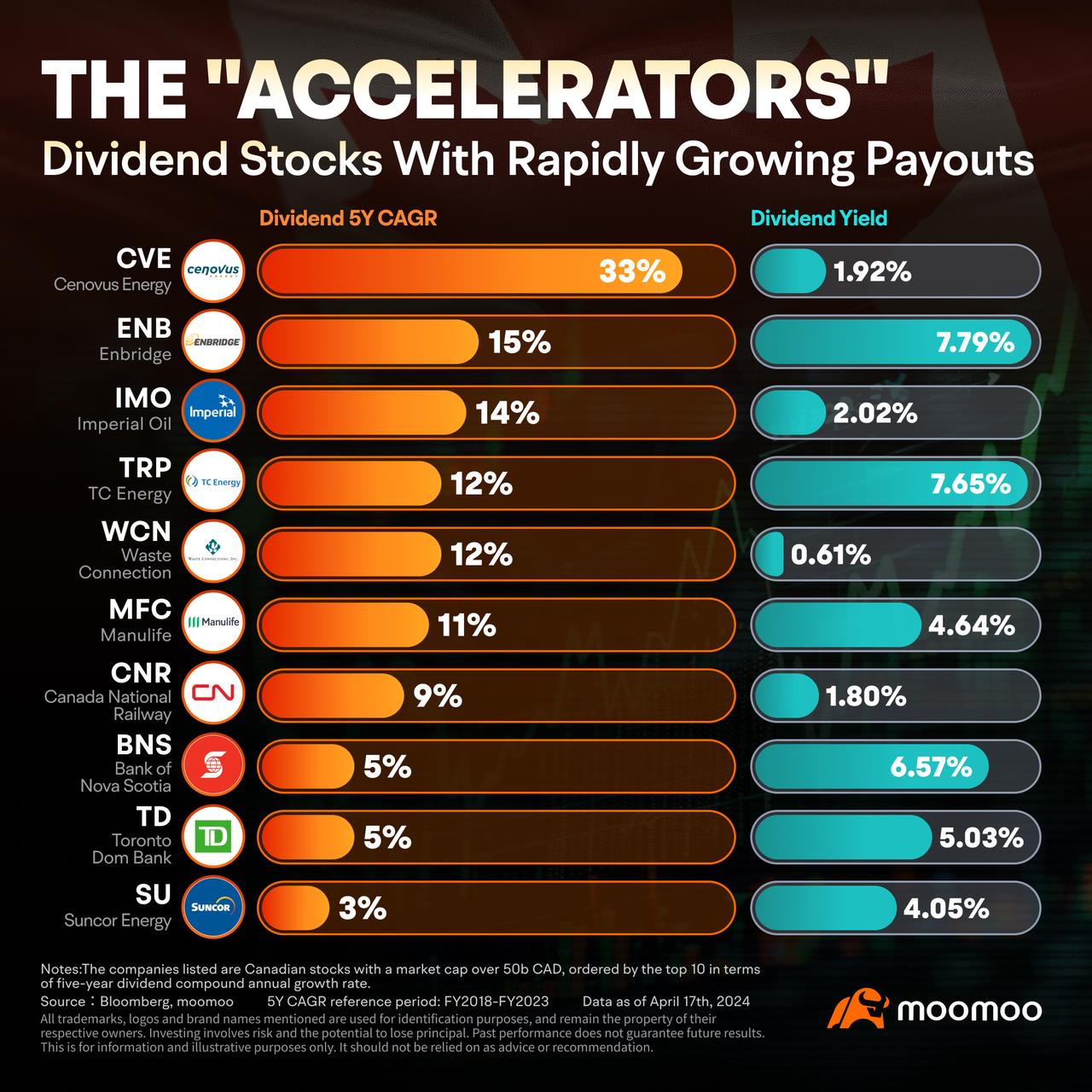

The "Accelerators": Dividend Stocks in Canada With Rapidly Growing Payouts

Dividend growth stocks are a time-honored tool for building wealth. With the right approach, these investments can offer a dual benefit of regular income and the potential for capital appreciation. The foundation of a sound dividend growth strategy rests on identifying companies that are not only well-managed but also boast solid financials and a track record of steadily climbing earnings.

A recent Nuveen report highlights the advantage of companies that have a history of boosting dividends. The study found that across the globe, businesses that regularly increased their payouts generally fared better than those that didn't, especially during market downturns. Companies adept at financial stewardship with a knack for enhancing shareholder returns stand out as potentially lucrative investments. Amidst this backdrop, we shine a spotlight on Canadian dividend stock giants in terms of the top 10 5-year dividend compound annual rates, with market caps above C$50 billion:

$Enbridge Inc (ENB.CA)$, in particular, exemplifies the dividend accelerator model. The company has maintained a 5-year compound annual growth rate (CAGR) in dividends of 15%, coupled with a dividend yield of 7.79%. Owning high-quality energy infrastructure assets, Enbridge plays a key role in the North American energy value chain. This ensures consistently high utilization of its assets, enabling the company to generate strong distributable cash flow (DCF) regardless of market conditions. Moreover, the company’s management prioritizes dividend growth as a core element of its investor value proposition. This commitment to return cash to its shareholders suggests that Enbridge could continue to increase its dividends in the upcoming years.

JP Morgan North American Equity Research extols Enbridge's cash flow stability as one of the best in their coverage. "ENB's top-tier natgas pipeline platform continues to capitalize on natgas demand-pull trends, while the Renewables and Offshore Winds businesses continue to scale up. With regulated gas distribution and power generation rounding out the asset base, ENB's risk profile appears among the lowest in our coverage."

Looking ahead, Enbridge's $25 billion secured growth backlog represents a tangible pipeline of future projects. This backlog will ensure a steady stream of revenue generation in the years ahead. Moreover, the company's strategic acquisition of three U.S. gas utilities for $19 billion enhances the company’s market presence and diversifies its revenue streams. Enbridge expects its earnings per share (EPS) and DCF per share to grow at a CAGR of 4 to 6% and 3%, respectively, through 2026, with expectations of a 5% CAGR thereafter.

In the banking sector, the $Bank of Nova Scotia (BNS.CA)$ has demonstrated a solid 5% growth in dividends, showcasing the highest yield among its Canadian Big Six peers. The bank's uninterrupted dividend payments since 1833—including during the 2008 financial crisis—speak volumes of its resilience and reliability. Under the helm of its new CEO, Scott Thomson, the bank has embarked on a strategic pivot, focusing on core markets in Canada, the U.S., and Mexico. This move signifies a departure from its previous Latin American expansion and underscores the bank's adaptability and commitment to stable, high-return markets, further cementing its status as a secure dividend investment.

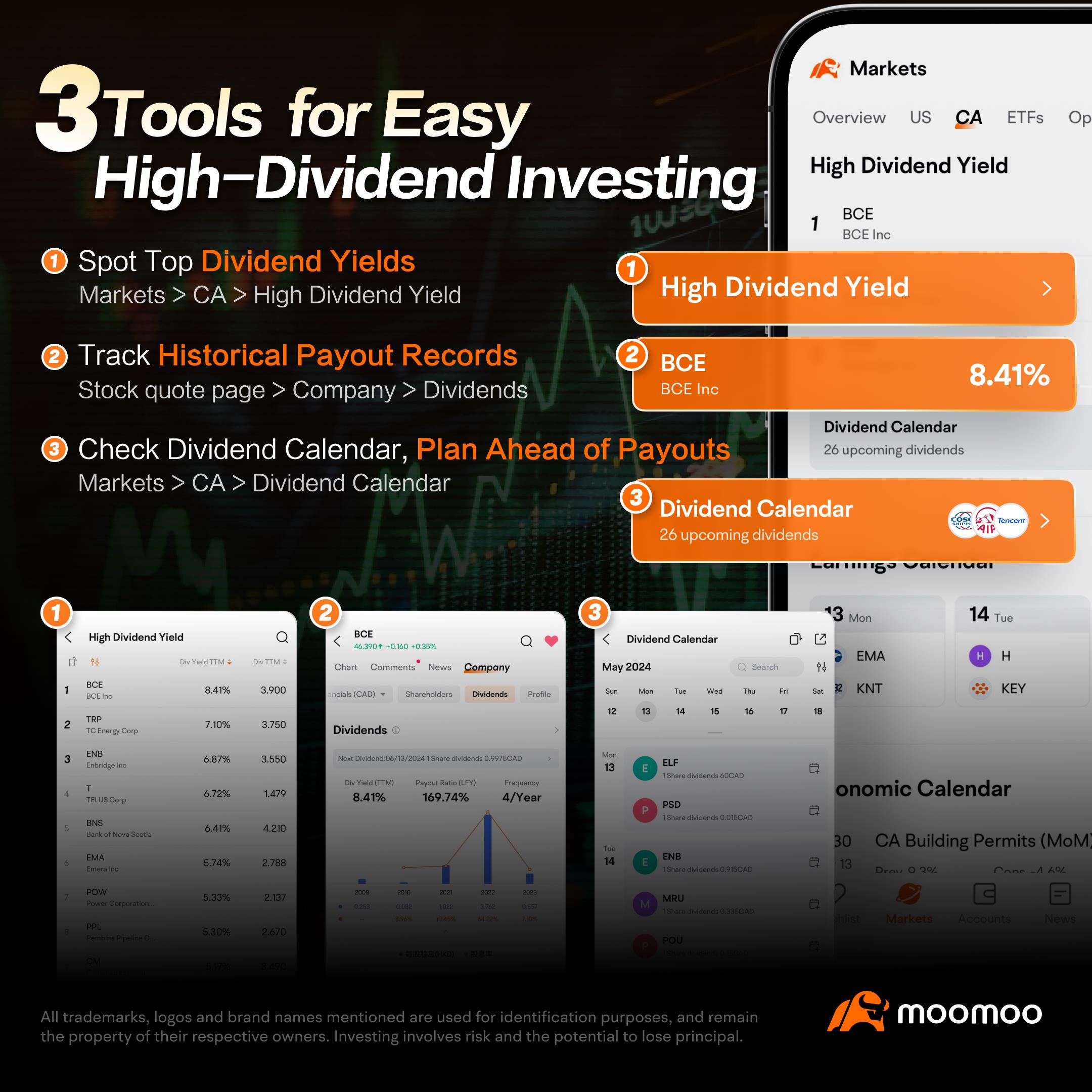

Ascend with High Dividend Strategies! 3 Key Tools From moomoo for Effortless Portfolio Deployment

By Cathie, moomoo news

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

poem_view : This is a junk stock that always invests in the interests of future shareholders. Use tomorrow's money to pay today's dividends.