The rise of generative artificial intelligence, like that used in ChatGPT, has pushed any stock vaguely related to AI up this year. The coming initial public offering of British chip designer Arm will put this market frenzy—and its parent SoftBank’s own AI ambitions—to the test.

Riding on the AI wave, Arm, which has filed to go public on the Nasdaq exchange next month, could be the largest new listing this year. The total value of IPOs in the U.S. has amounted to just $13 billion in 2023 so far, according to Dealogic. The market for new listings has only started to show signs of recovery quite recently, after a lackluster 2022.

The boom in AI stocks could certainly help Arm’s IPO. Chip stocks have rebounded strongly this year: The PHLX Semiconductor index has surged 41%. Nvidia, the undisputed leader in AI chips, led the rally. Its share price has more than tripled.

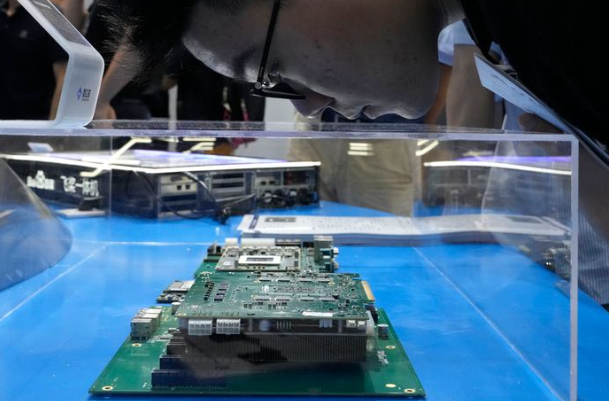

Arm’s chip architecture goes into almost every smartphone due to its low power consumption. The company charges license and royalty fees for devices that use its designs and technology. And the hope is that model will one day extend to many other markets, like for the central server processors used in AI.

There are some concrete signs those hopes might eventually be realized, too: Nvidia’s Grace server chips, for example, are based on Arm’s architecture. The two companies planned to merge in 2020, but the deal collapsed due to regulators’ cold feet.

$NVIDIA (NVDA.US)$ $Arm Holdings (ARM.US)$

MN GLOBAL INVESTMENT : to make a good fit with this stock I would just add VOX,EWY and ARM

Bertramie OP MN GLOBAL INVESTMENT : NVDA