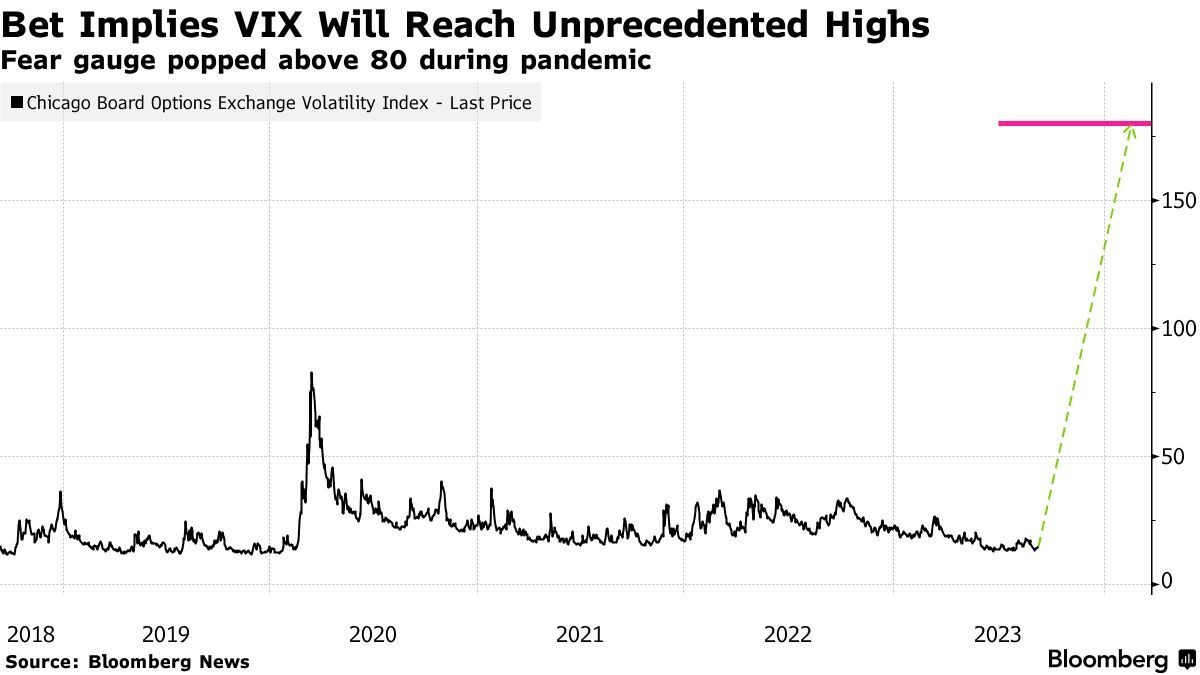

Large VIX bets often trigger market concerns. The "50 Cent" trader, who made a splash in the options market years ago, was known in the past to position themselves to make money off of market volatility by way of consistently buying VIX Index options that usually cost about 50 cents.

D Blaine : Shades of Spitnagel and Taleb. Betting on dramatic dramatic moves with cheap options.