The Case for a Bank of Canada Rate Cut Just Got Stronger

The Bank of Canada (BOC) has four more monetary policy meetings this year and the latest data strengthens the case for a rate cut from the current 4.75% level, starting with inflation.

Consumer price growth slowed more than excpected in June, to 2.7% from an unexpecteded rebound to 2.9% in May year-over-year, a reassuring development just a week before the next policy decision.

Canada's inflation drops before key rate decision

With June's CPI drop, the average for the second quarter stands at 2.8%, slightly below the BOC's projection of 2.9%. The average of the BOC's own core measures of inflation also came down to 2.6% in June from 2.7% in May, bringing the quarterly average also below 2.9%.That being said, shelter prices, up 6.2% year-ove-year, remain a source of upward pressure, as mortgage interest costs, rents and homeowners' home and mortgage insurance were among the top five upward contributors to the 12-month CPI gain.But the BOC is already looking ahead and its latest Business Outlook Survey (BOS), which is important for its monetary policy decisions, points to favorable developments in key areas of focus for the central bank:

● Inflation expectations

● Corporate pricing behaviour

● Wage growth

● The balance between demand and supply in the economy.

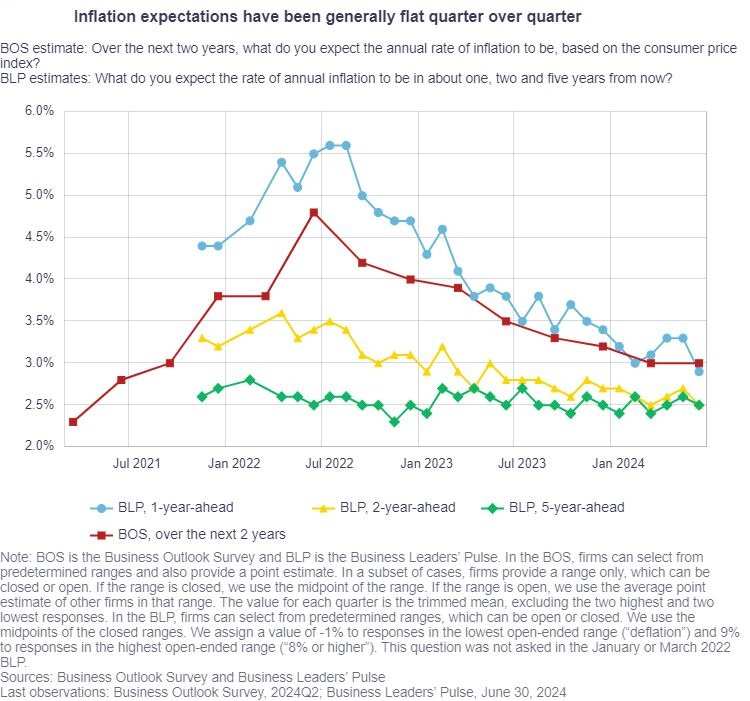

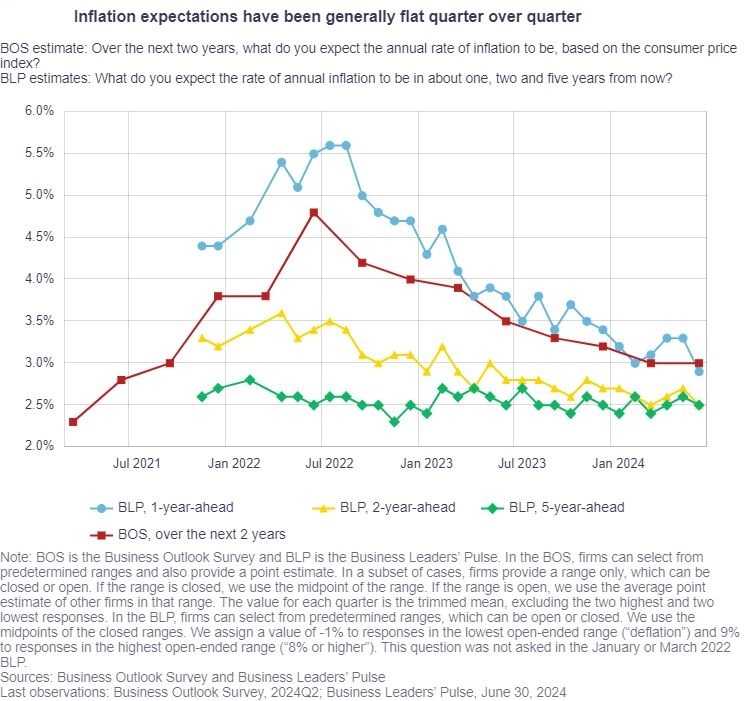

Inflation expectations cool down

Businesses' inflation expectations fell in June and are now in the central bank's operating range of 1% to 3%.

Source: Bank of Canada Business OutlookSurvey(2Q 2024)

On the consumer side, inflation expectations have also eased over a one-year horizon.

Corporate selling price gains seen slowing

Businesses surveyed by the BOC expect the growth of their selling prices to slow, a positive result for the corporate pricing behavior on the central bank's radar.

Wage growth expectations soften

Another good news for the BOC is that firms’ expectations for wage increases in the next 12 months have softened. This is consistent with reports of an ongoing easing of labor shortages.

The BOC's Canadian Survey of Consumer Expectations released with the BOS also shows that Canadians' perception of the labor market has weakened. And while their expectations for wage growth have increased, it is driven by the public sector. By contrast, confidence among private sector employees on this front is showing signs of deterioration.

Source: Bank of Canada - CanadianSurveyof Consumer Expectations (2Q 2024)

Demand and supply rebalancing

Looking at indicators of supply and demand in the economy, the BOS survey indicates a rebalancing.

Consistent with softer wage growth expectations, businesses report easing labor market conditions due to a weaker economy and rapid population growth. It is no surprise, then, that capacity pressures related to labor shortages continue to decline. So do pressures related to supply chain challenges.

At the same time, demand has become less of a concern for the first time since the beginning of 2023. Business sentiment remained relatively flat in the second quarter, partly as a result of weak demand for non-essential goods and services. That being said, less firms anticipate a recession.

The consumer survey also points to softer demand as Canadians continue to report spending cuts and persistent pessimism about the future owing to perceived high financial stress.

All in all, the data argues for further easing.

Productivity remains a challenge

A source of concern remains, however: weak productivity.

As BOC Governor Tiff Macklem puts it, Canada's Achilles heel is productivity. And the BOS survey only confirms it. Indeed, while firms’ intentions to invest in machinery and equipment increased, they remain below historical averages and focus on repairing and replacing existing capital equipment.

Without enough investments in new capacity or products, productivity will remain a challenge for Canada in the background of the BOC's analysis.

Investment themes to consider

While businesses expect moderate rate cuts and soft demand, the BOS report highlighted some pockets of strength.

Firms related to industrial and heavy civil construction expect sales to pick up. Demand is expected to come from infrastructure projects in the tech and public sectors.

Businesses related to residential real estate also expect lower interest rates to support sales. That being said, we're not talking about about any "substantial" gains in housing demand, supply and prices.

Another area to consider is consumers' essentials spending that could benefit from population growth related to immigration.You can check emerging industry trends with Moomoo's Heat Map.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment