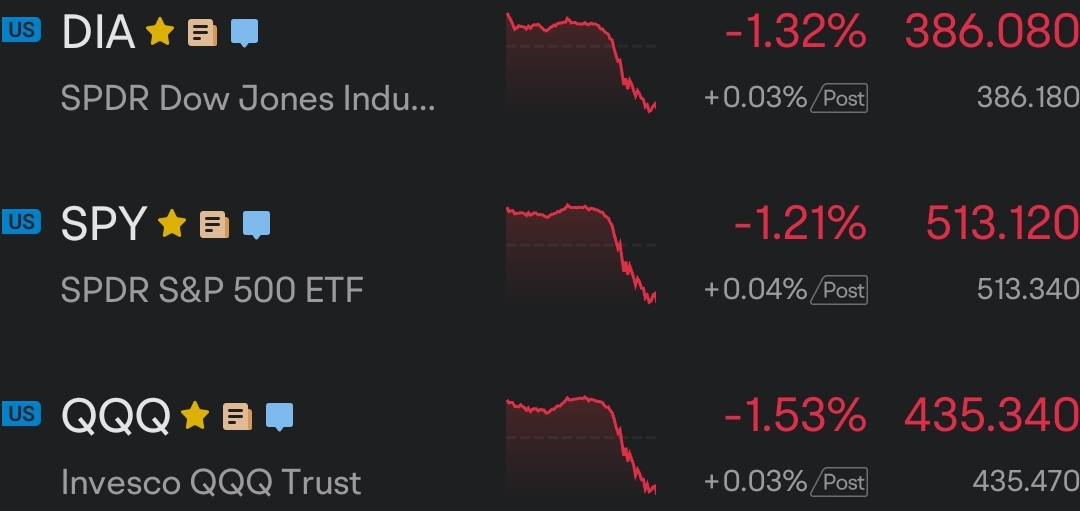

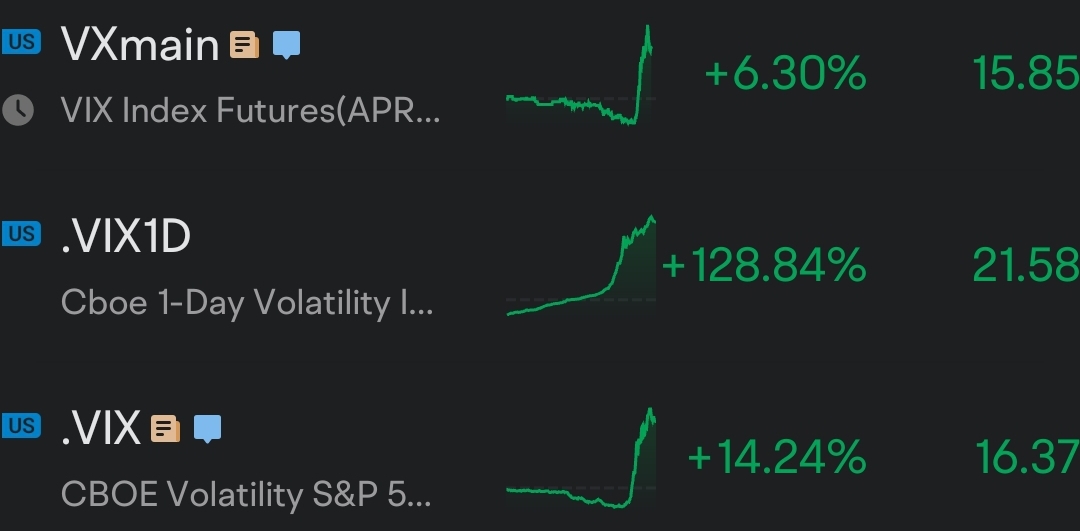

Technically speaking, RSI is not completely in bearish territory yet. But the daily RSI is at the weakest it has been since last November when the S&P 500 climbed out of the last correction. Technically, RSI is still within somewhat neutral territory. When RSI drops below its 50 value, then this usually coincides with some degree of bearishness, at least in the short-term. So watch out for that drop below 50.

RIPPER : I’m excited ……

SpyderCall OP RIPPER : Me too. I love a good dip to buy. And puts habe extremely low premiums right now. They could possibly print big time.

RIPPER : Am I the only one who saw this fall coming? I’m confused because seems like most out there were caught off guard.

All week long, I have had a gut feeling this exact fall was going to occur simply from my constant close observation of the moving averages. The patterns and overall movement of moving averages (throughout all time frames)TELL A STORY.

Only saying that because I’m not the best trader in any way, shape or form, but it seems even the pros didn’t see it coming

RIPPER SpyderCall OP : Yep, I had a couple of BIG bangers today.

It’s a good idea right now, to sort through the tickers with the most meat on the bone, lowest IV that appear to be topped out. Yes, most I’m looking at appear to be completely topped out.

If my original theory is correct, and this is the initial stage of transitioning from bull run to bear, then we are about to have some of the best opportunities of the entire quarter.

SpyderCall OP RIPPER : Good call. today was ugly. How low do you think it will go before the market buys it back up?

RIPPER SpyderCall OP : The difference between this time and other recent falls? Breaking the trendlines!

I have been watching semiconductors closely as the daily/weekly chart of semiconductor sector appears to finally be topping out. This was helpful to confirm my suspicions of AMD/ NVDA and such topping out.

To answer your question not sure if I want to take a shot at it haha …. After the initial falls I would expect a small dead cat bounce INTO A BEAR FLAG, making many think the downside was just a small pullback, only to fall further soon after.

RIPPER SpyderCall OP : Join the chat more often, we need more opinions/ ideas!

SpyderCall OP RIPPER : That sounds about right to me.

SpyderCall OP RIPPER : I'm still waiting to put myself. I want to see how the week closes out first. I might consider puts tomorrow. Not sure yet.

SpyderCall OP RIPPER : I will for sure. I have just been so busy lately. I barely have enough time to post comments in my own chat room. But I will make an effort for sure

View more comments...