The Election coverage article

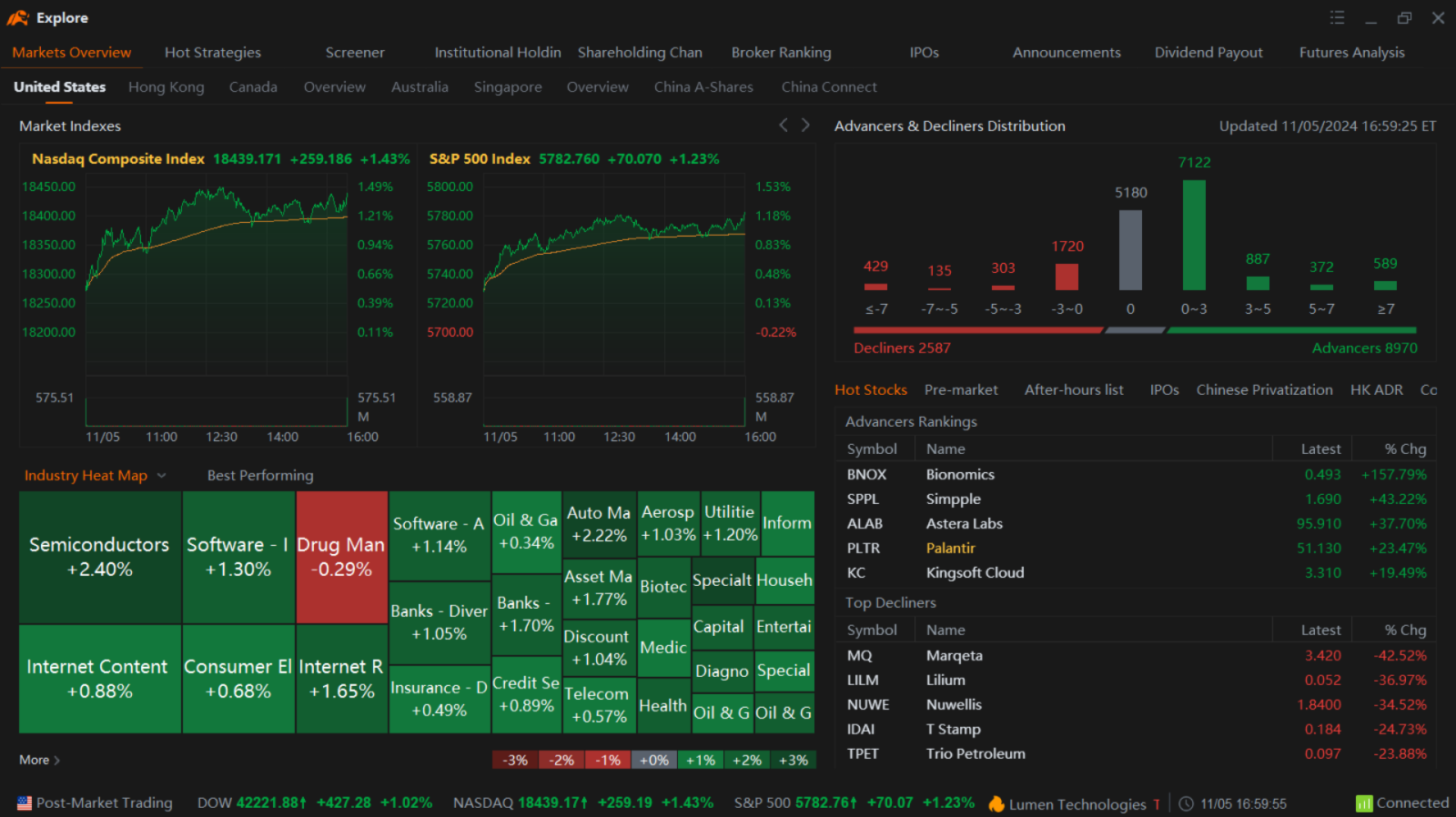

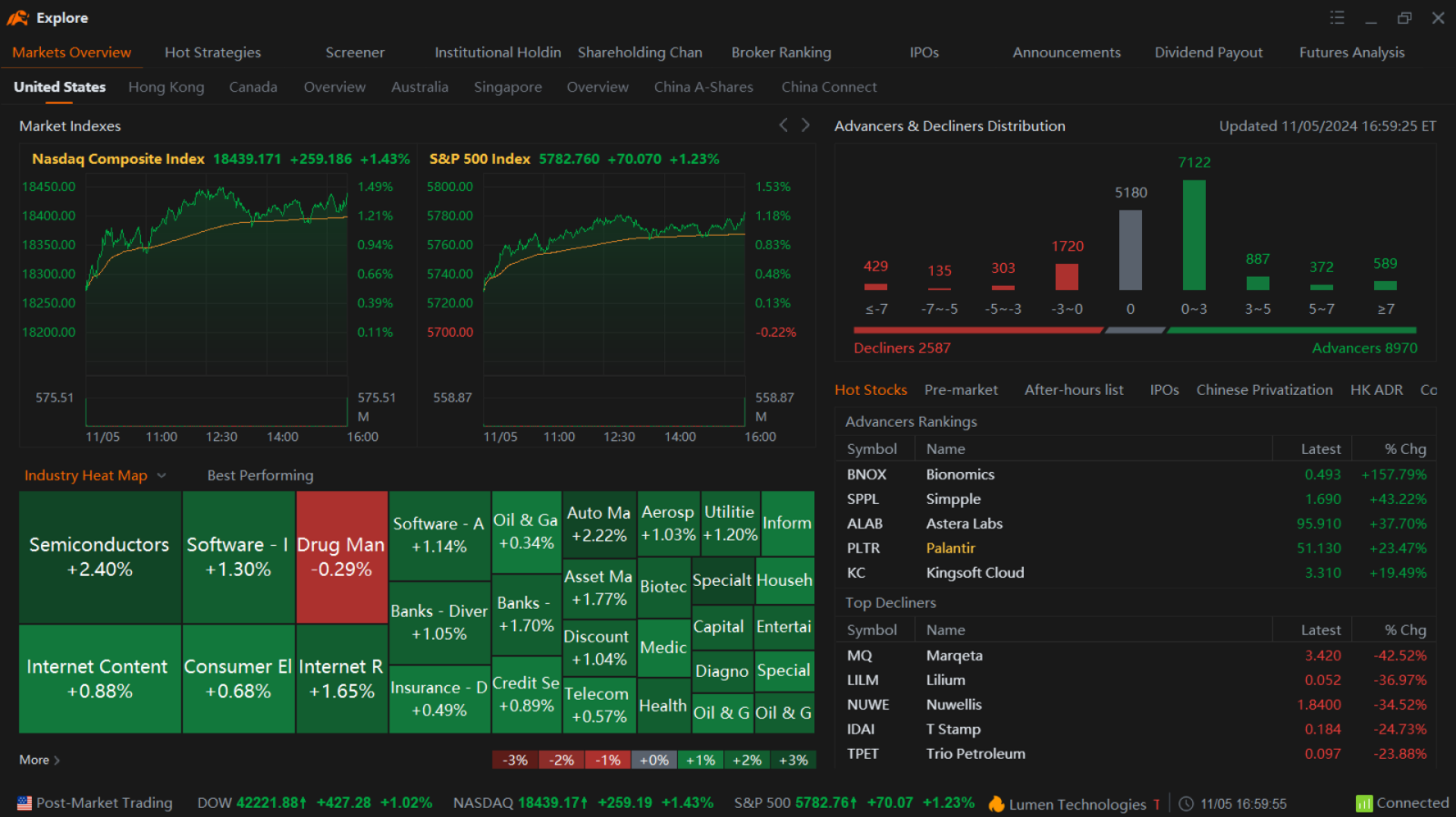

The market was speeding higher Tuesday, with all eyes on the election results. The Dow jumped more than 400 points Tuesday with the Nasdaq closing up more than 250.

After the close, the $Dow Jones Industrial Average (.DJI.US)$ was up 427 points 1.02%.). The $S&P 500 Index (.SPX.US)$ was up 1.23% and the $Nasdaq Composite Index (.IXIC.US)$ closed up 1.43%.

MACRO

The S&P PMI and ISM PMI came out Tuesday. Composite and Services PMI from S&P came in low, ISM non-manufacturing PMI came in higher, demonstrating that prices paid by services climbed less than expected, and non-manufacturing prices came in higher than expected.

The week's highlight of macro will be the Thursday FOMC rate decision. According to the FOMC's dot plot projections, investors are waiting for two more rate cuts this year. Friday, investors will see Michigan inflation expectations from a consumer survey.

Within industries tracked by moomoo, WallStreetBets-related stocks are flying with Palantir and Trump leading the way.

$Crude Oil Futures(DEC4) (CLmain.US)$ climbed again, up 0.71%.

The king of crypto has been within the 65-73 range since March, not retaking all-time highs.

But based on the crypto's volatility around elections, it might have room to grow. According to Marketwatch reporting featuring analysts at CryptoQuant

Bitcoin gained 22% and 37% in 2012 and 2016, respectively, from Election Day through the end of the year, the analysts noted. Even more significantly, it increased 98% in 2020 in the period from Election Day through year-end. In past election years the crypto has climbed-- Bitcoin gained 22% and 37% in 2012 and 2016, respectively, from Election Day through the end of the year, the analysts noted. Even more significantly, it increased 98% in 2020 from Nov to the end of the year.

$Palantir (PLTR.US)$ stock climbed 21%, the highest on the S&P 500, after the firm released earnings Monday night that showed revenue grew 30% in the past year to $726M.

$Super Micro Computer (SMCI.US)$ shares fell 13% Today after the market closed, posting a Q2 sales outlook below estimates. Super Micro said a special committee has completed its investigation based on the initial concerns raised by its auditor Ernst and Young and is "recommending a series of remedial measures for the Company to strengthen its internal governance and oversight functions."

$Trump Media & Technology (DJT.US)$ climbed 13%, but hit a volatility pause, and ended the day lower- down about 1%. It is after all the night of its Chief and main shareholder's bid to retake the Whitehouse.

In the lead-up to next week's U.S. presidential election, some high volatility was faced. Its chief and majority shareholder generates enormous media attention, especially as he runs for a comeback presidential election. Tuesday, the stock hit a local high, at one point this week, was up more than 300% since September before running into a volatility trade pause. It has since fallen and is down 20% for the week.

The stock has faced high volatility, about 30% lower than when the media company merged with SPAC to receive a listing back in May. It is down 64% from its all-time high set long before becoming DJT but up 145% from its recent low.

Last week:

The market faced the most busy week it has, with earnings results from hundreds of companies before and after the market traded. We saw results from five of the Mag Seven, and yet there is more still to come.

For the week, indexes fell, and ended out the month of October lower across the board, despite each hitting all-time highs. The $S&P 500 Index fell 1.37% for the week, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.15%, and the $Nasdaq Composite Index fell 1.50%

Last weeks Thursday Core PCE index number came in a little higher than estimated- 2.7% vs estimates of 2.6%. The regular PCE price index came in at 2.1%, the lowest year-over-year price change since 2021, and nearly on top of the Fed's 2% target.

The market climbed despite a shockingly light non-farm labor number- the U.S. added just 12,000 jobs in the past month, 100k lower than estimated. It was the lowest number in years. However, the unemployment rate did not rise, and the report mentioned the disruptions caused by hurricanes and strikes as one-time events.

Nvidia fell this week following its peer Mag Seven earnings. Nvidia is one of the largest, highest-gaining stocks this year, enjoying a bull run powered by the artificial intelligence boom, which has fueled a spike in demand for its graphics processing units.

Last week AMD shares tumbled more than 5% after reporting earnings Tuesday, which showed that the chip maker's fourth-quarter revenue outlook missed analysts' estimates. It projected revenue of about $7.5 billion, according to estimates by Bloomberg, a lower midpooint than the $7.55 billion expected by analysts. Its Q3 results, otherwise, mostly met or beat analyst estimates.

4. $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$

Alphabet reported Q3 earnings Tuesday According to the report, every segment of the search giant beat estimates. Both share classes of the stock climbed nearly 10% for the week before leveling off.

7. $Microsoft (MSFT.US)$ Wednesday reported Q1 fiscal 2025 adjusted earnings All eyes were on AI capital expenditures Wednesday, showing the firm spent $14.92B on investments like AI data centers after spending $9.92 billion last quarter. The increase in Capex hurt the company's results- it fell Thursday by up to 5%.

8. $Amazon (AMZN.US)$

Amazon shares rose after the company's earnings and revenue beat estimates Thursday. The company reported earnings that surpassed estimates. After the news, the tech and Mag 7 market climbed, the highest gainer on the Dow Friday climbing 6%.

9. $Meta Platforms (META.US)$

$Meta Platforms (META.US)$ shares slipped 3.2% in extended trading Wednesday after the company raised the low end of its capital expenditures outlook, overshadowing the earnings and revenue beat for the third quarter. The stock continued to fall Thursday.

10. $Apple (AAPL.US)$

Apple reported Q4 adjusted earnings Thursday of $1.64/share, vs estimates of $1.60/share, on revenue of $94.93 vs estimates of $94.37B. Investors watched for product revenue segments, with recent news predicting weaker demand for Apple's iPhone 16 and new Apple Intelligence services. Still, the firm said demand for December sales- holiday sales, was lower than analysts had hoped.

So let's take it back to the election, with all of that market volatility, what are we expecting from election night itself? Here is how it will break down::

What time do the polls close?

Polls will close tonight starting just now at 6:30 PM ET, and continuing every 30 minutes or so, with the largest groups of state poll closures every hour. When polls close, exit polls and vote counts come out, and sometimes the results are clear enough to indicate who won that state.

In between the polls closing, we will feature guests on our live stream. Here are when we expect states polling to close, in ET standard time.

7pm-- South Carolina, Virginia, Vermont, Georgia,

7:30pm-- North Carolina, Ohio, West Virginia

8:00 -- 13 full states Alabama, Connecticut, Delaware, Maine, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, Oklahoma, Pennsylvania, Rhode Island

8:30-- Akansas

9PM-- 10 states Arizona, Colorado, Iowa, Louisiana, Minnesota, Nebraska, New Mexico, New York, Wisconsin, Wyoming

How does the election actually work?

Every four years, Americans of voting age with citizenship and a voter registration cast their votes for the office of president of the United States. These votes are collected by the states today, and counted. Then, state electors vote for the president. Each state gets an electoral vote based on its size and is represented in Congress- two for each senator, and the rest based on the size of the state population.

The majority of states declare all of their electoral votes- an amount of votes equal to seats in the Senate and house combined- to the popular vote winner of their state. These electoral votes are cast later, in December, but the vote totals will likely not change after counts and recounts this week.

When states are called by major news organizations, in this case, AP News, New York Times, Bloomberg, and the Wall Street Journal, we will announce that information here, and fill out our map of states and electoral college total. We may use calls from CNN or NBC, CBS, or ABC, but know that we are not calling any election results- we do not have the skills or manpower or wish, we will just report what news organizations have called states when they do.

Remember, to win the presidency, a candidate needs 270 electoral votes.

Lets look at the two maps that matter tonight, the polling consensus up until the moment, and the 2020 map where Biden Beat Trump-

2020 final map

2020, during the major pandemic, it took four days for AP news to call the election after a very slow count from PA

Word from the herd: Mooers, what are you watching?

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Stock_Drift : 2024.

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

72166072 : News article say pltr is going to sell $.58 billions shares of their stock by march 2026. How is this going to affect this stock? Is this stock going down when they sell each time?

enfath2022 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101550592 :

Moon fairy 大炮仙 ❤ :