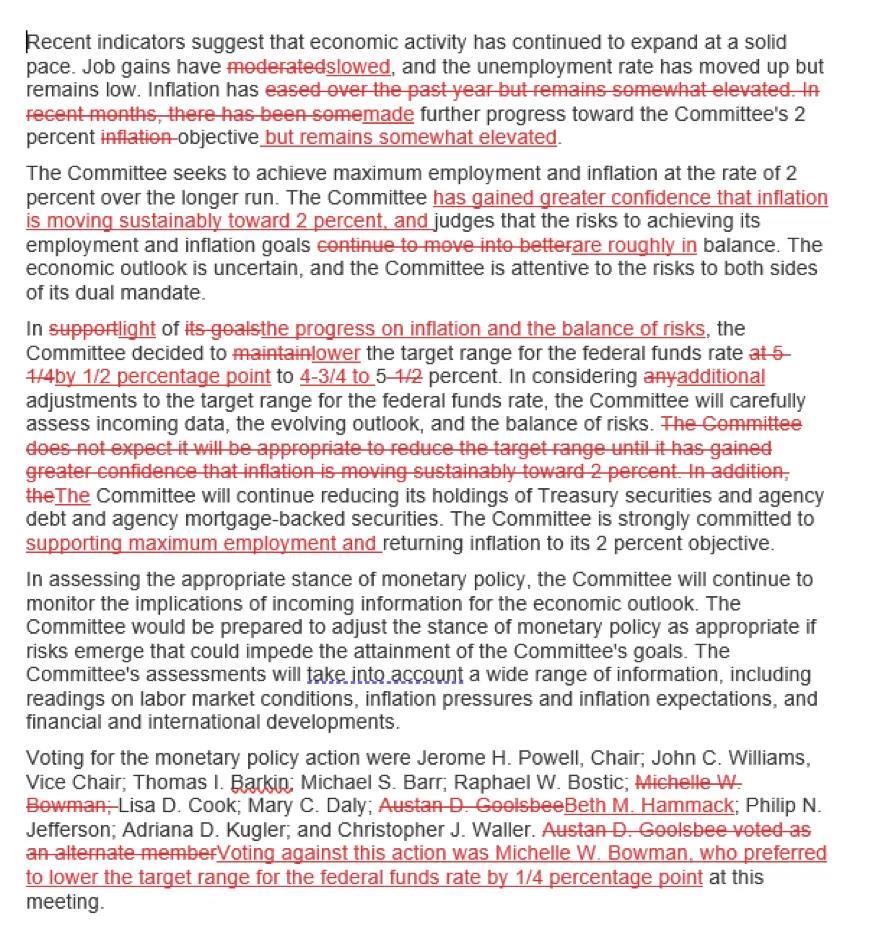

Firstly, in the opening paragraph, the Fed noted that job growth has "slowed," as opposed to the previous term "moderated." Although similar in meaning, "slowed" conveys a more definitive stance. In the second paragraph, the Fed indicated that the committee has greater confidence in inflation's sustained return to 2%, with risks to employment and inflation targets being broadly balanced. Previously, there was no such expression of confidence in inflation, and the risks were described as "tilting toward balance." This reflects a more resolute policy shift by the Fed. In the third paragraph, the Fed reiterated the progress on inflation and the two-sided risks, and in the final sentence, added that the committee would support full employment. Notably, this decision was not unanimously agreed upon; Governor Bowman cast the dissenting vote, preferring a 25 basis point cut. This marks the first disagreement in the voting on a meeting in over two years.

Gilley : a plane ticket to another country