Control inflation well,

For decision-makers at the Federal Reserve,

It's not just as simple as raising interest rates without limits,

There is also a crucial point of controlling the expectation of interest rate hikes.

Is the Federal Reserve talking tough but having a soft heart?

Actually, as a senior official of the Federal Reserve,

Jerome Powell and his staff cannot be unaware that,

The rebound of the CPI exceeded expectations,

The main reason is the rise in energy prices,

While the rise in energy prices since mid-July,

Is basically related to the OPEC+ extension measures.

Another important set of data, Core CPI, paints a different picture,

After excluding the volatile energy and food prices,

It actually meets expectations.

Continuing to raise interest rates to curb inflation is not a very clear approach,

after all, at the current stage,

the rise in prices,

the issue is no longer primarily on the demand side,

but on the supply side.

In terms of demand,

the Fed's aggressive interest rate hikes have already had an effect,

the significant increase in housing prices has already eased significantly.

The Fed's tone is tough but its actions are gentle.

It's a sure thing.

And it will continue to be maintained like this.

Until the Consumer Price Index CPI returns to a normal range of fluctuation.

That is 2-3%.

At that time, the Fed may show a change in attitude.

Otherwise, premature change in stance will only result in the efforts and policies to control prices over the past year and a half being in vain.

It will only cause the efforts of the past year and a half to control prices to be stillborn.

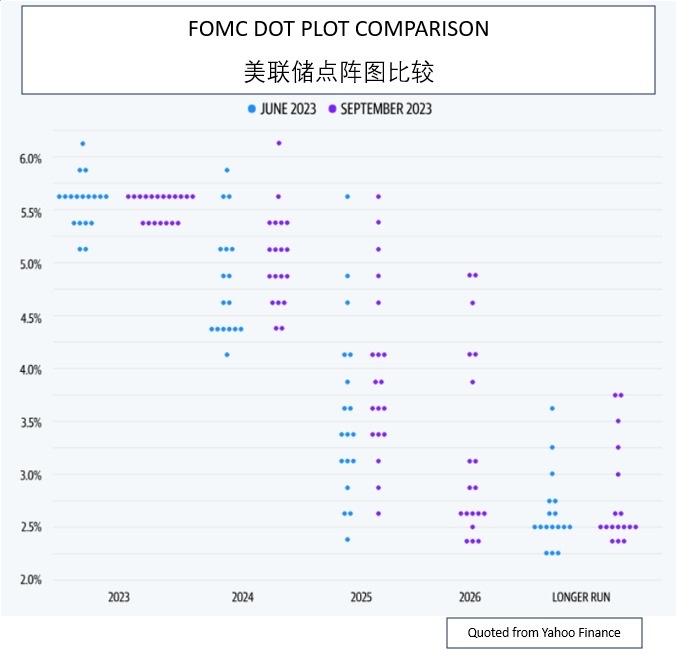

In September, the FOMC decision not to raise interest rates,

consistent with market expectations,

but the hawkish dots on the dot plot,

indicate an increased possibility of another rate hike at the end of the year,

but upon closer inspection of the dot plot,

predictions from June were already pointing in the same direction,

perhaps the market has overreacted,

after all, the stock market tends to pull back during corrections,

Any movement will be interpreted as a major event.

As for the year 2024,

In the dot plot, the expectations of interest rate cuts in terms of frequency and magnitude are indeed fading.

Possibly also due to this reason,

The market is undergoing a more profound correction.

The next FOMC announcement of interest rate hikes will fall on November 1 and December 13,

By then, the market will experience volatility once again.